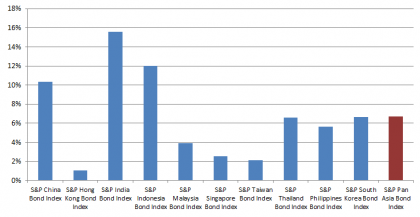

As the global yields remain low, many yield-hungry investors have turned to Asia for yield pickup and portfolio diversification. Exhibit 1 lists the yield-to-worst of the ten local currency bond markets tracked by the S&P Pan Asia Bond Index.

Exhibit 1: The Yield-to-Worst of the Pan Asian Bond Indices

Reflecting the strong demand and continuous development, the size of the Asian local currency bond markets, measured by the S&P Pan Asia Bond Index, expanded by more than 9% to USD 6.94 trillion in 2014. And noticeably, the market value tracked by the S&P China Bond Index rose 16% to RMB 26 trillion, fueled by the strong issuance in the corporate market.

In terms of the index performance, despite the losses seen in December, the S&P Pan Asia Bond Index delivered a total return of 6.7% in 2014. The index’s yield-to-worst has tightened from 89bps to 4.34% in the same period.

Among the ten countries, the top three outperformers are China, India and Indonesia, which all recorded double-digit growth, please see Exhibit 2. China, in particular, continued to receive strong demand from global investors regarding the RQFII opportunities, please visit here for my last post on China – What’s More than Yields?. The total return of the S&P China Bond Index gained 10.3% YTD while its yield-to-worst tightened by 128bps to 4.29%.

Exhibit 2: Total Return Performance in 2014

*All data are as of December 31, 2014.

The posts on this blog are opinions, not advice. Please read our Disclaimers.