It is no surprise that now might be the perfect environment for brewing commodities.

- The S&P GSCI was up 4.5% in February and was in backwardation for the first time in February since 2004. In 2004, the S&P GSCI returned 17.3%.

- 22 of 24 commodities in the S&P GSCI were positive in February.

- All 5 sectors were positive, led by agriculture, up 9.7%, which had its best February since 2008.

- Coffee had its best month in 20 years and its second best month in history going back to Feb 1981. The S&P GSCI Coffee gained 44.0% in Feb 2014, only behind the gain of 52.1% in June 1994.

- 6 single commodities had a total return greater than 10% this month. Coffee, lean hogs, sugar, soybeans, wheat and silver gained 41.7%, 12.7%, 11.4%, 11.4%, 11.1% and 10.9%, respectively.

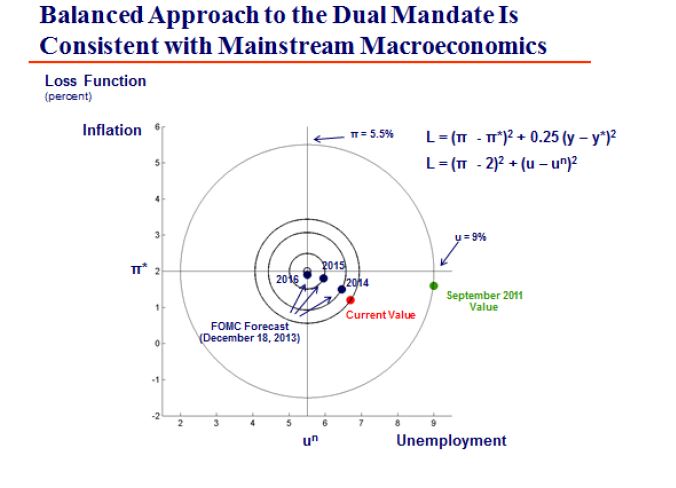

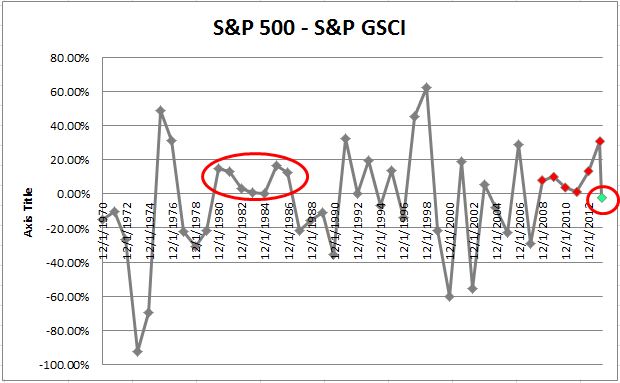

We have discussed a number of factors that may be supportive of the asset class including inflating fears of inflation, rising interest rates, falling correlations, backwardation is back and also stocks have led the stock/commodity cycle for the longest period since the 80’s.

See in the chart below that the S&P 500 has not outperformed the S&P GSCI for 6 years in a row since 1980-87. While this could last another year (or more) to match its historical streak, the tide seems to be turning. Through February this year, the S&P GSCI is now outperforming the S&P 500 for the first time since 2007.

Notice below that backwardation has been more prevalent since 2012, but mostly only in the summertime, led by droughts. This month, Feb 2014, was the first backwardated February since 2004, when the annual total return of commodities was 17.3%.

The shifting environment from a world driven by expansion of supply to a world driven by expansion of demand has resulted in lower inventories making the commodities more sensitive to supply shocks, driving a positive source of return that is less correlated with equities.

February was a month where we witnessed the positive impact of these supply shocks on commodity prices. The S&P GSCI Unleaded Gasoline gained 13.2% with a total return of 6.4% from low supplies as refineries are switching to summer blends. Also, rising tension in the Ukraine drove the S&P GSCI Energy up 3.7% while other risky assets like stocks fell.

The same rising tension that supported energy, drove the S&P GSCI Precious Metals up 7.1% to have its biggest monthly gain since August 2013. While gold can be viewed as a safe haven, the danger in gold is that as tensions ease, there may be a sharp drop in demand and performance.

The S&P GSCI Industrial Metals gained 1.3% this month with nickel and zinc up 5.3% and 5.7%, respectively. A global deficit is being driven by large mine closings as the big zinc ore bodies are tapped out and being replaced by smaller zinc operations. Also, the ban on nickel exports from Indonesia is a potential game changer for the global cost curve that can be bullish for nickel prices.

One of the major supply shocks has been the freezing cold weather, which has affected the entire supply chain of food. Livestock may have eaten more corn this winter due to frigid temperatures and the deep frost may take time to work out of soils, potentially slowing planting. Possible irreversible damage from dryness to Brazil’s coffee crop and rust fungus in Mexico has killed enough crop for coffee to have its best month in 20 years and second best month in index history since 1981.

The posts on this blog are opinions, not advice. Please read our Disclaimers.