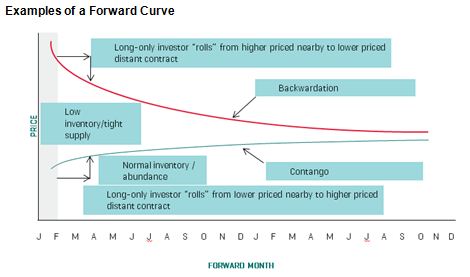

2013 is the first year commodities have been in backwardation since 2003. For those of you who need a refresher on the definition of backwardation, you are not alone, so here it is: “When a near-month futures contract is trading at a premium to more distant contracts, we say that a commodity futures curve is in “backwardation” or that the commodity is “backwardated.” This occurs when inventories of commodities are tight so market participants are willing to pay a premium to buy the immediate deliverable commodity. Theoretically there is no value to carrying costs such as storage, insurance and interest costs since there is a scarcity of the commodities.”

Also, for illustrative purposes, this graph may help:

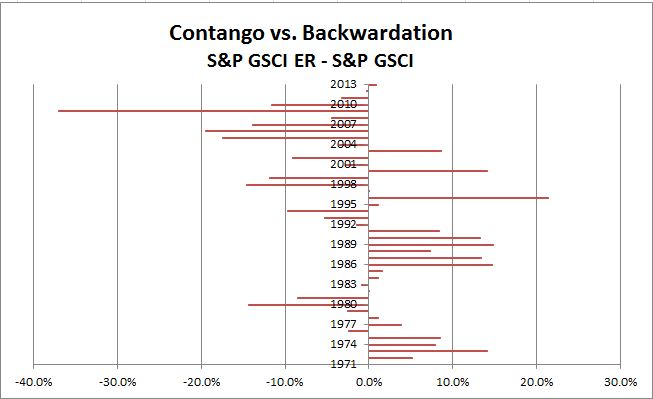

The measurement of the historical backwardation (and contango, which is the converse of backwardation) shown in the chart below calculates the annual roll yield by taking the annual return of the S&P GSCI Excess Return (which measures the price return plus the roll return) less the annual returns of the S&P GSCI Spot Return (which measures the price return only). Backwardation was implied by a positive result, whereas contango was implied by a negative result. Notice 2013 had the first positive result since 2003.

The implication of this, as mentioned in a paper titled “Identifying Return Opportunities In A Demand-Driven World Economy” published by Marya Alsati-Morad, Peter Tsui and me, is that when commodities are backwardated, indices like the S&P GSCI and DJ-UBS that hold the near-month commodity futures contracts may earn a positive return from rolling into a cheaper contract before expiry.

For extra valuable insight on the impacts of contango and backwardation, please watch this special interview with Bob Greer, Executive Vice President & Manager of Real Return Products, PIMCO and Boris Shrayer, (former) Managing Director & Global Head of Commodities Marketing, Morgan Stanley.

For more on the environment and the index development and rolling versus weighting please see the links aforementioned.

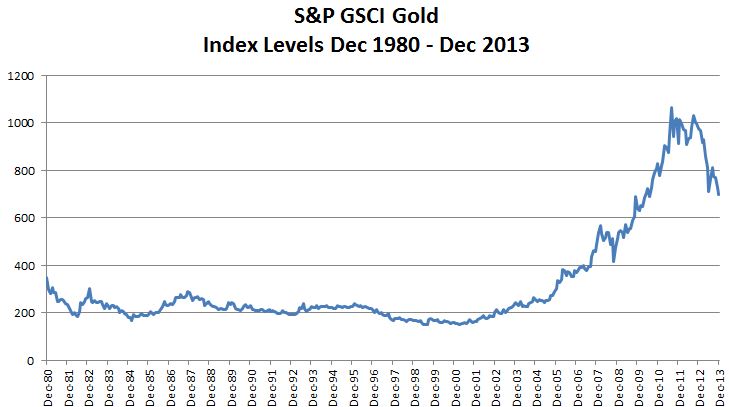

Last but not least, something that is particularly interesting is that the last long streak of backwardation happened in 1984-1991, following a precipitous drop in gold of 48% from 1980-84. During this the time of backwardation, the S&P GSCI returned positive every year between 1984-1990 for a total of 221%.