As mentioned in an article today in the Wall Street Journal, there may be a shift taking place in the commodities markets. In simple terms, there may be more predominant shortages of commodities.

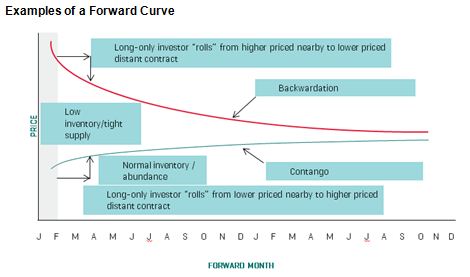

Generally as inventories are abundant, there are higher storage costs, which reduce returns from a condition called contango where the longer-dated contracts are more expensive than near contracts. As the inventories deplete, shortages may prevail, giving no value to storage for commercial consumers that need the commodities to make their goods, which is reflected in an opposite and profitable condition called backwardation. This is shown below:

From Feb 1970 through June 2013, commodities have spent 58% of the 521 months in contango, which makes sense given the long-term cycles of inventory building and depletion. Please see this illustrated in the following chart where backwardation or contango was determined by the sign of the S&P GSCI spot version subtracted from the S&P GSCI Excess Return. A positive (negative) result indicated backwardation (contango):

However, what is most interesting about this chart is the historical pattern of backwardation and contango. Notice prior to August 2004, the number of months spent in backwardation and contango were split 50%/50% and were mostly cyclical. Between Aug 2004 and May 2011, the environment was different and there were 79 of 82 months in contango, reflecting a time of excess inventory from the rush to supply closely followed by the demand destruction of the global financial crisis. Post May 2011, 1/3 of months have been in backwardation with 3 months occurring in 2011, 5 months in 2012 and 2 in 2013 (May and June).

What does it mean? If there is a shift in environment going forward towards a world driven by expansion of demand, then backwardation may be more likely with more frequent cycle switching. If this is the case, then like in 2012, the fixed forward indices such as the S&P GSCI 3-Month Forward may underperform the S&P GSCI (which holds the nearby most liquid contracts) and more dynamic indices like the S&P GSCI Dynamic Roll (which changes contracts based on term-structure) and the newly launched S&P GSCI Roll Weight Select (which changes weights based on term-structure).

The posts on this blog are opinions, not advice. Please read our Disclaimers.