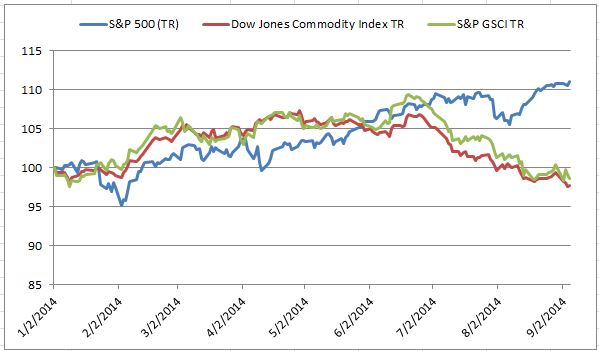

What a difference a summer makes. While many of us enjoy perfect weather, it is a nightmare for a long-only investor in agricultural commodities. Further, the drop in energy from easing supply disruptions in the middle east and slowing demand from China and the Eurozone have caused the Dow Jones Commodity Index (DJCI) to lose 7.3% in the third quarter and the S&P GSCI to lose 8.5%. This is a stark contrast from the first half of the year where the DJCI gained 5.4% and the S&P GSCI gained 7.7%. From the peaks on June 19, the indices are down 9.9% and 8.5% for DJCI and S&P GSCI, respectively.

The DJCI is halfway to the bear market, but this may not be the worst news for investors. As mentioned in the comments of a prior post, I have discussed in two book chapters, Absolute Returns in Commodity (Natural Resource) Futures Investments in Hedge Fund & Investment Management (Edited by Izzy Nelken) and also in The Long and Short of Commodity Futures Index Investing in Intelligent Commodity Investing (Edited by Hilary Till and Joseph Eagleye,) there are two major opportunities to capture returns in commodities, which are cyclical opportunities and systematic opportunities. Trend following systems can capture cyclical opportunities in commodities because only price can respond to balance supply and demand. This is since commodities in the short-run cannot be drilled, mined and grown causing relatively slow cycles of inventory building, which in-turn drives patterns of commodity prices to trend up and down. So, when there is a supply/usage imbalance in a commodity market, its price trend may be persistent, which may be captured by trend-following programs.

Trend following is strong historically in times of persistent shortages (backwardation) since the replenishing of inventories of commodities in shortage may be time consuming. Trend following may also work in times of persistent excess (contango) However, the run of contango commodities experienced from 2005-2012, seems to have ended and commodities are currently hovering at the line near equilibrium where short term disruptions swing the pendulum quickly.

It is debatable whether the shortages that appeared in 2013 and the first half of 2014 are gone for good. The inventory buildup may be temporary based on weather and geopolitics. However, one must keep focus on longer term factors like the strength of the dollar (which is historically inverse to commodity prices), rising inflation, rising interest rates and demand forces coming from China and other parts of the world.

Please join us along with +2,200 investment professionals for our S&P Dow Jones 8th Annual Commodity Seminar featuring Rob Arnott, Bob Greer and Kevin Norrish to find out answers to the following questions:

- Why do you think investors are continuing to withdraw money from commodity index investments despite recent improvements in the performance of the asset class?

- What is the likelihood of another sustained period of above average commodity index returns anytime soon?

- To what extent is the withdrawal of investment money, itself responsible for poor return performance of commodity indices?

- What commodity investment strategies are likely to perform best over the next year or so?

- Are we ever likely to see a return to the huge commodity investment inflows of the mid-2000s or was that a one-off?

- How large of an allocation to commodities, if any, belongs in the typical policy portfolio?

- During the financial crisis commodities suffered big losses. Shouldn’t they provide diversification?

- Some investors argue that deflation is a bigger threat than inflation right now. Should we still be worried about inflation?

- If investors don’t actually buy commodities, how can they hedge against inflation?

- If futures markets are efficient, is there an inherent return to commodity indexes?

- In your description of “supra asset classes”, where does gold fit?

The posts on this blog are opinions, not advice. Please read our Disclaimers.