I don’t believe what the gas experts say, “that there is nowhere for gas prices to go but down.”

After another bloodshed month for crude oil as evidenced by the S&P GSCI Crude Oil return of -10.9% in Oct, bringing it down 24.6% off its high on June 20, one might get excited about further savings at the pump. Save that excitement.

The gas retailers are not looking to save any money for anyone but themselves. At least this is the story using data going back to 1991 from the EIA (U.S. Energy Information Administration) for U.S. Regular Conventional Retail Gasoline Prices (Dollars per Gallon) and S&P GSCI Crude Oil levels.

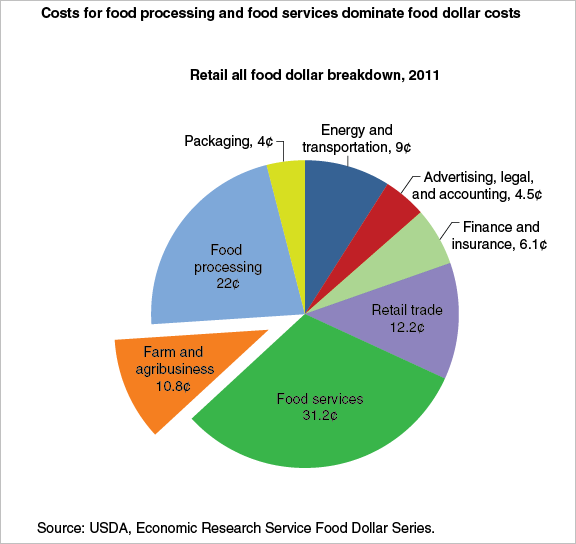

According to the EIA, what we pay at the pump is split into a chart with the following breakdown:

This might be true but only on average. In the total sample of 251 months, gas prices rose during 196 months where oil prices fell. In only 55 months was the reverse true. Further when oil fell and rose, it was pretty symmetrical, falling on average 6.6% and rising 6.9%; however, when gas prices fell, they only shaved off 3.8% on average compared with an increase of 4.9% when they rose. The picture becomes even clearer and more biased when observing the gas price change with the oil price change. When oil prices fell, on average gas prices only fell 2.1% but when oil prices rose, gas prices rose 2.7% – in other words, when oil rose and fell, it moved roughly at a 1:1 ratio; but the amount gas rose was 30% more than the fall. If we put this in terms of a beta, or sensitivity, similar to how we calculate a stock beta or inflation beta, the gas beta (to oil) is only 0.41, showing that it doesn’t fully swing up AND DOWN with the underlying oil.

According the IEA (International Energy Agency), it turns out that macroeconomic factors may have a greater impact on (oil) demand than oil prices. Their demand model therefore gives macroeconomic factors a higher weighting than crude oil price assumptions, which do not directly feed‐through to retail product prices, as taxes and subsidies blunt the impact of crude price changes, and are deemed to play a less significant role than economic growth in terms of influencing demand. These two exogenous variables are however, interrelated: lower prices, for most countries, reduce the cost of doing business and support economic growth, the converse being true for net oil exporters. At this point, the only conclusion is that lower prices offer a cushion of sorts against an otherwise vulnerable macroeconomic backdrop.

Gas retailers aren’t the only retailers trying to profit from the everyday consumer like you and me. This is true for food as well. Although grains had a nice rebound in October, with the DJCI Grains gaining 14.5% this month, the DJCI Softs didn’t fare so well and lost 1.6% driven down by all the treats we love like coffee (-2.8%), sugar (-2.5%) and cocoa (-12.2%). So let’s get excited about cheaper Christmas treats than Halloween treats, right?! WRONG!!!

According to the USDA (U.S. Department of Agriculture,) the farm to table expenses flow much like the pipe to the pump.

The USDA also reports, one reason for the relative stability in retail prices in relation to commodity prices is that these prices reflect the cost of processing and marketing inputs in addition to commodity costs. ERS’s 2011 Food Dollar Series reports just 10.8 cents of every food dollar goes toward farm commodities and agribusiness expenses. The remainder is allotted to food processing, food service, and other administrative, transportation, and retailing costs, categories which are less volatile due to fixed machinery expenses, multi-year contracts for supplies, and small year-to-year changes in wages. Since 1990, grocery store wages—which make up over 50% of retailing costs—have increased an average of 2.2% per year.

Moreover, the USDA says retailers and restaurateurs are sometimes slow to pass input costs along to consumers through higher prices, which can cause margins to narrow during times of higher commodity price inflation. Delayed price transmission in grocery stores can occur for a variety of reasons, including re-pricing costs (such as printing new shelf price labels) and concerns that input price changes are only temporary. A 2011 ERS study found that retail prices for bread and beef generally respond to changing commodity prices within 1 to 6 months. However, lags for some foods such as eggs and milk are at the upper end—5 to 6 months.

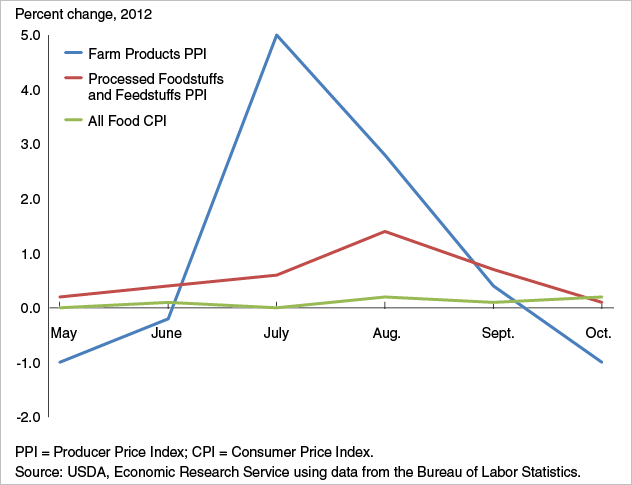

Notice in the chart below how the All Food CPI (green line) actually rises as the Farm Products PPI (blue line) is falling from Sept to Oct.

Too bad, you might go broke eating the chocolate to fix your depression from the artificially elevated gas price.

The posts on this blog are opinions, not advice. Please read our Disclaimers.