It is a familiar concept that commodities have provided inflation protection as discussed in a recent post about a discussion I had with Bluford Putnam, Managing Director and Chief Economist, of our partner, CME Group, to discuss why inflation is likely to appear this year.

I have also discussed how much inflation protection has been provided in a special video on commodities and inflation from our Index Matters Series with Bob Greer of PIMCO and Boris Shrayer (formerly) from Morgan Stanley.

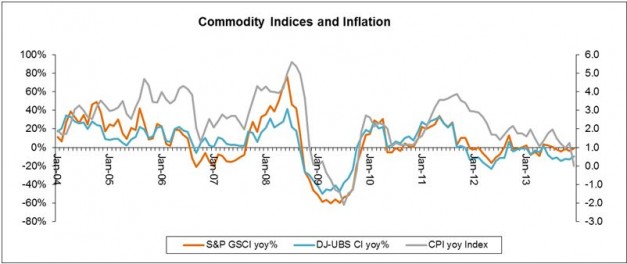

Inflation and commodities generally move together as shown in the chart below:

-

Source: S&P Dow Jones Indices and ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt

Data from Jan 2004 to Dec 2013. Past performance is not an indication of future results.

This chart reflects hypothetical historical performance. Please note that any information

prior to the launch of the index is considered hypothetical historical performance (backtesting).

Backtested performance is not actual performance and there are a number of inherent limitations

associated with backtested performance, including the fact that backtested calculations are

generally prepared with the benefit of hindsight.

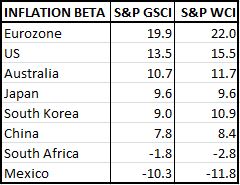

However, in light of the inflation announcement from Feb 20, 2014 that stated US inflation ticked up in January 2014, I have received some questions from investors around the world regarding whether the commodity indices protect them from local inflation. The answer is that it depends but for most of the countries in the table below, the answer is yes. As I have explained inflation beta in prior posts, the results can be interpreted as, “if there was a 1% change in CPI, then there was an x% change in the index”.

In the table below, the country CPI is compared to both a global flagship, the S&P GSCI, and an international flagship the S&P WCI. Notice generally the inflation beta is higher from the international benchmark, the S&P WCI. Also notice for some countries like South Africa and Mexico, there may not be the local inflation protection one might get from other countries. This is not completely surprising given that some countries have local price controls despite the global nature of commodities, discussed in this post including discussions with the CME Group, ICE and NYSE-LIFFE.

The posts on this blog are opinions, not advice. Please read our Disclaimers.