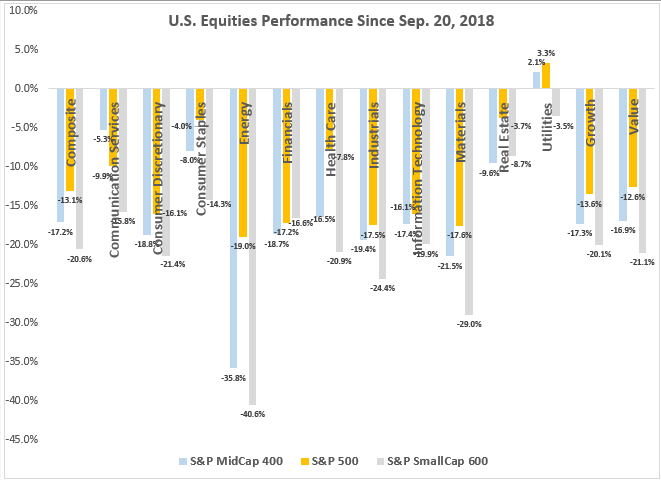

The entire U.S, equity market lost on Monday, Dec. 17, 2018, meaning every one of the 42 segments by size, sector and style finished negative for the day. This was the second day in a row with losses across the board. From Oct. 10-11, 2018 was the last time two consecutive days with all losses occurred. Now every segment of the U.S. equity market is negative in December (month-to-date through Dec. 17, 2018.) Only 9 times in history has every segment of the U.S. equity market lost in a month (with all sector data starting in 1995 and style data in 1997.) Those months were Aug. 2015, Sep. 2011, May and Jun. 2010, Jan. and Feb. 2009, Oct. 2008, and Jul. and Sep, 2002.

The only sectors that are still positive in 2018 (year-to-date ending Dec. 17, 2018) are health care and utilities, though health care has experienced some of the worst returns in the month dropping 13.1%, 11.3% and 8.4% for small-, mid- and large-caps, respectively. Volatility remains high across the sizes, though mid-cap 30-day annualized volatility has fallen below 20%, which hasn’t happened for small-caps since Oct. 24, 2018 and large-caps since Nov. 2, 2018. Many uncertainties have been driving the volatility in U.S. equities including the interest rate decision, trading tensions, Brexit, and other soft economic data like slower housing, and weaker-than-expected economic data out of China and the eurozone.

On average, S&P 500 bear markets lose 36.0%, ranging between the least severe bear market loss of 19.9% before the 1990 bull market, and the biggest decline of 60.0% before the 1942 bull market. The last two bear markets lost 56.8% in the global financial crisis and 49.1% in the tech bubble burst. While this drop since Sep. 20, 2018 may feel painful, the S&P 500 has further to fall before it reaches bear market status of a 20% drop. As of now, only the S&P SmallCap 600 has entered a bear market defined by its 20% loss.

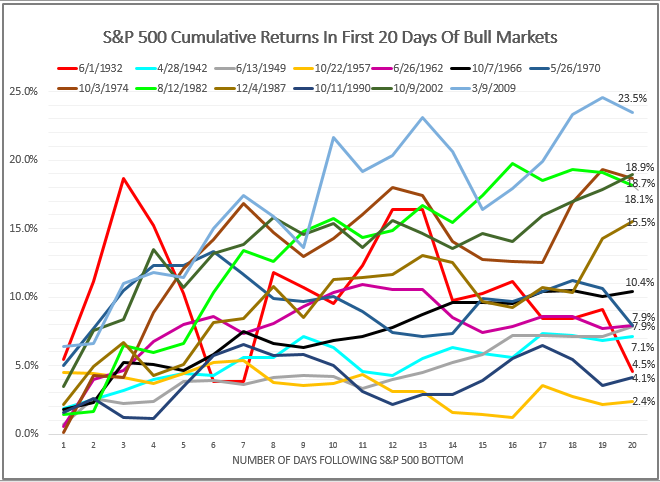

While it is possible, stocks may decline further, it is important to remember that timing the market is difficult. However, the returns in the first days of a bull market are historically big on average, so it is important to try not to miss them. After just 3 days, the S&P 500 average return was 6.6%, and after 5, 10 and 20 days, the respective returns on average were 7.5%, 10.3% and 11.3%. Also, in 5 of 13 years (1932, 1970, 1974, 2002 and 2009,) returns of 10% or more were measured after just 5 days.

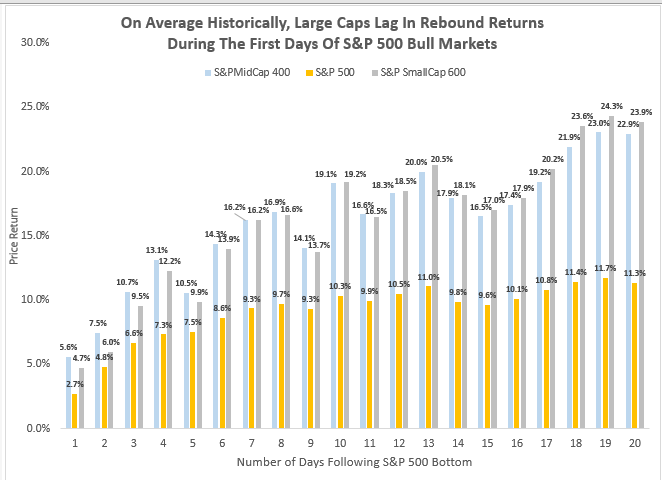

Within the U.S. equity complex, the positioning matters to capture the upside in those first few days of a rebound. Notice in just the first four days, both the mid- and small-caps returned double digits on average. Historically, in the first nine days of an S&P 500 bull market, the S&P MidCap 400 has returned the most on average, though the S&P SmallCap 600 pulled ahead after the 10th day. More importantly, the large caps, represented by the S&P 500 distinctly lag. After 20 days, the S&P 500 has returned on average just 11.3% versus 22.9% and 23.9% for mid- and large- caps, respectively. Possible reasons can be how sensitive mid- and small-caps are to growth, the dollar, inflation or interest rates. Moreover, mid-caps may do well in these first bull-market days since they are generally not as risky as smaller companies, yet have solid infrastructure but are nimble enough to take advantage of opportunities, especially overseas if the dollar drops.

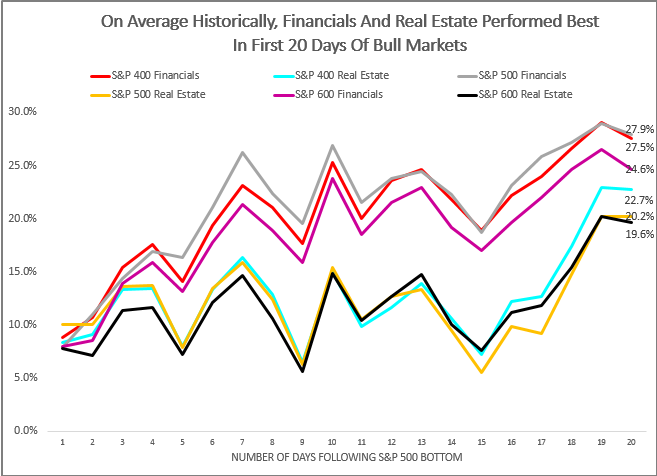

Further, regardless of size, the financial and real estate sectors have done best on average in the first days of a new bull. Every size of these sectors develop into a bull market in the first 20 days on average after S&P 500 bottoms with large- and mid-cap financials returning nearly 28%. Even in just the first 3 days, the average returns of these segments were between 11.3% and 15.4%.

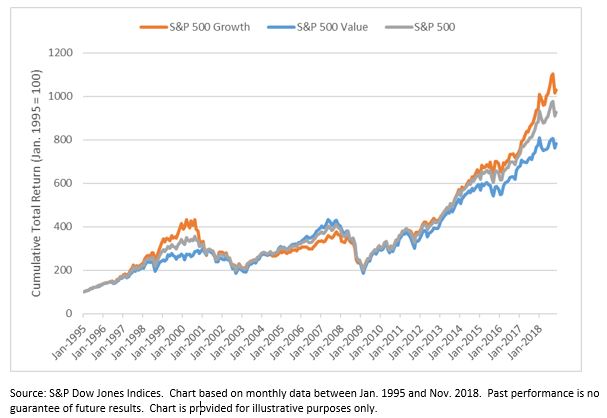

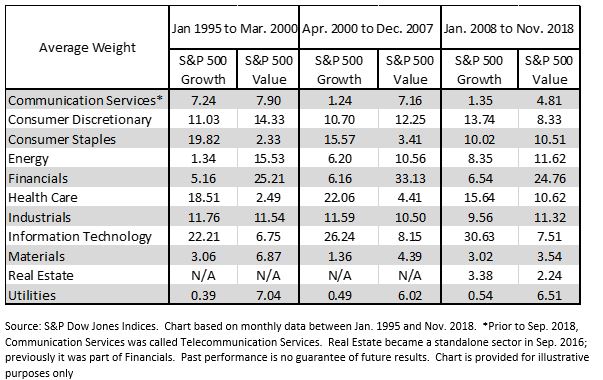

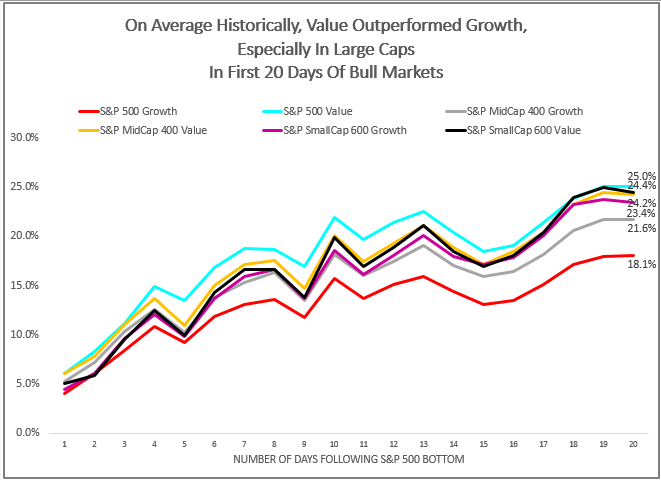

Lastly, if large caps are the size of choice, the value style helped, but style really only mattered for large caps with the S&P 500 Value posting a 25.0% average return versus 18.1% for the S&P 500 Growth.

Again, with the high levels of volatility in the market today as a result of several unknown events, there is a possibility of a further decline but the bottom will likely be difficult to time. Given the risk, the only way to be certain of earning the potentially big returns in the rebound is to be invested. Throughout the U.S. equity market, the returns in early bull market days have been significant, but historically, the mid- and small-caps have done better.

The posts on this blog are opinions, not advice. Please read our Disclaimers.