“The more you look at ‘common knowledge’, the more you realise that it is more likely to be common than it is to be knowledge”

– Idries Shah, Reflections

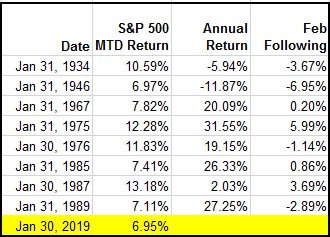

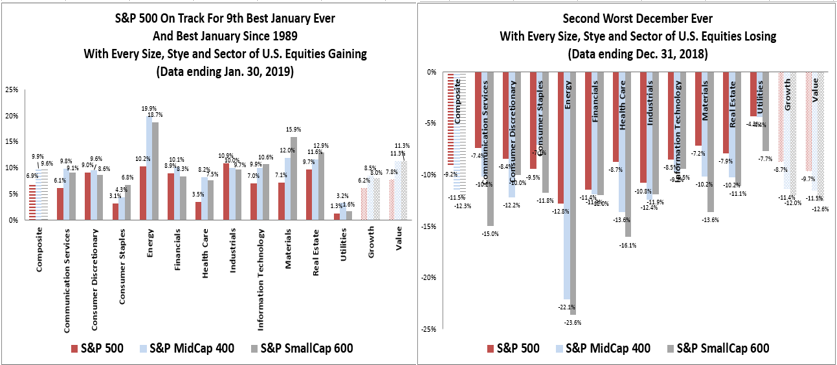

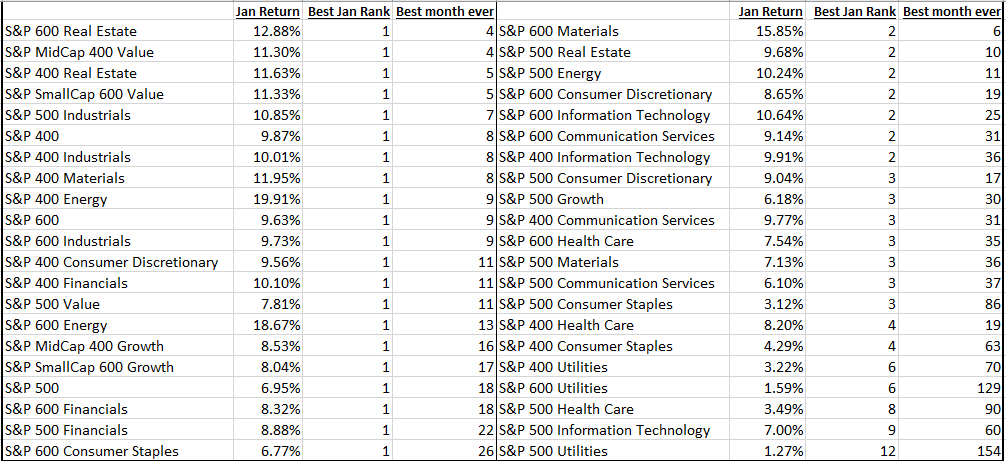

Statements such as “sell in May and go away” can become accepted wisdom without always facing proper scrutiny. Another aphorism, particularly timely at the present moment, is offered by “as goes January, so goes the year.” The idea is that January provides a roadmap for the rest of the year; it sets the tone and begins the trend. Recently, following a strong market performance in January 2019, experts have begun to assert that good times are likely ahead.

There is some historical support for the thesis that the market’s returns in the remaining eleven months of the year are predicted directionally by January’s returns. Since 1897, if the Dow Jones Industrial Average (DJIA) ended January with a positive return, the returns for the rest of the year were positive 73% of the time.

However, if the DJIA was negative in January, it offered significantly less predictive power, with the returns for the rest of the year being negative only 45% of the time, and positive 55% of the time. That is to say, the returns after a negative January had the opposite sign in a majority of cases.

So, rather than saying “as goes January so goes the year”, we ought to say, “If January goes up, the rest of the year will likely be positive. But if January is a down month, flip a coin”, which is admittedly not as pithy.

Overall, including both positive and negative starts to the year, January has matched the direction of the remaining 11 months returns 62% of the time. That doesn’t sound terrible; a .620 batting average would get you into the baseball Hall of Fame. Unfortunately, we’re not playing baseball and 62% is not far above the 50% that guessing a coin flip might get you.

But the “January Barometer” faces a tougher test than a simple coin flip. Historically, over the long-term, the Dow has gone up in more months (and more years) than it has gone down. In fact, if we simply predicted that the returns from February through December were going to be positive, no matter what happened in January, it would have been a safer bet: from February to December, returns for the Dow have been positive 66% of the time, regardless of how January performed.

So what should we take away from this? I think we can conclude that the “January Barometer” belongs in the category of misleading “truisms”. January is not a great predictor for the rest of the year, and simply predicting the market will go up has proved more prescient. Timing the market is hard, and January will not make that any easier.

The posts on this blog are opinions, not advice. Please read our Disclaimers.