A large number of emerging markets currencies declined en masse during the period from 30 April 2013 through 31 January 2014, with many observers applying the moniker of contagion. Over the whole period many emerging market currencies were clustered in the range of losing between 9% and 22% of their value against the US dollar, with a few remaining stable, and some losing much more.

Our research argues that the emerging market contagion was driven by asset allocation shifts. That is, expectations for relative risk-adjusted returns went dramatically against the emerging markets, and the Fed’s QE tapering had nothing to do with the FX activity.

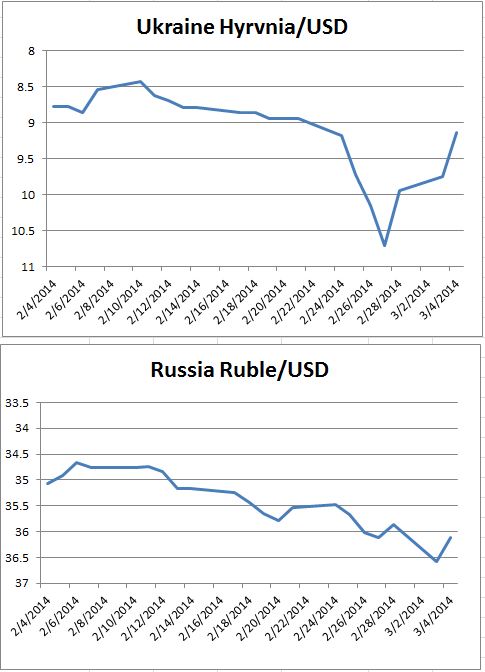

Starting with risks in the political arena from the spring of 2013 onward, developments went against emerging market. The Syrian Civil War was complicated by the nerve gas attacks and related US-Russian diplomacy. There were demonstrations in the plazas of Turkey over development plans as well as a scandal reaching high into the Government. Middle class residents were taking to the streets of Brazil to demand improved government services, even as the Government was spending generously on the infrastructure for the upcoming World Cup in 2014 and Olympic Games in 2016. In Thailand, political unrest was threatening the electoral process. India’s election campaign was heating up, with the possibility of a major change in political power. Argentina experienced significant inflation, a currency devaluation and overall political confusion. Ukrainian political tensions became violent. Some of these tensions eased while others gained momentum over the year, but they all combined to create the impression that the riskiness in many emerging market countries was rising, and that spillover effects in various regions were not only possible, but likely.

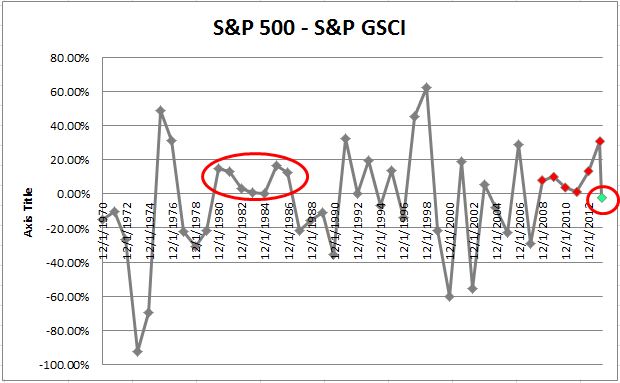

From a performance perspective, the interesting development was in the US. US equities rallied almost 30% in 2013 even as the US 10-Year Treasury yield went from less than 1.7% at the end of April 2013 to a new range, 2.7% to 3.0%, a full 100 basis points higher than before the “Taper Talk”. The ability of US equities in 2013 effectively to ignore the coming policy change at the Fed to taper QE while US bonds were selling-off aggressively strongly suggests to us that QE was not responsible for the emerging market contagion.

The relative equity out-performance of the US was a two-way street and had at least a part of its roots in the deceleration of economic growth in many emerging market countries. For example, economic growth in the four largest emerging market countries of Brazil, Russia, India, and China has been slowing with weighted average real GDP growth of 8.2% in 2010 declining to an estimated 5.5% in 2013 and a forecasted 5.1% for 2014. (See “Decelerating BRICs Face Structural Challenges”, by Samantha Azzarello, December 9th 2013, http://www.cmegroup.com/education/featured-reports/decelerating-brics-face-structural-challenges.html). The growth slowdown was accompanies by equity declines in many countries, with the MSCI Emerging Market Index losing 5% of its value over 2013.

The juxtaposition of a powerful rally in US equities set against decelerating economic growth and rising political risks in many emerging market countries, we would argue, provided the foundation and incentives for many global asset allocators, such as pensions, endowments, sovereign wealth funds, etc., to shift their asset allocation policies in the direction of US equities and other mature industrial markets, and away from emerging market countries. This asset allocation shift hit both emerging market equities and currencies. We are definitely not in the camp that thinks the Fed’s QE tapering debate and decision was a primary cause of the contagion.