Psychologists have studied feelings of Olympic medalists for decades to find: “If you set aside the happy people who win gold and look only at the people who come in second and third, it’s the men and women with bronze medals who invariably look happier than the athletes who won silver.”

To investors who have studied behavioral finance, it is no surprise that the silver winners feel like gold losers. In economics, we call this framework loss aversion and it implies that one will feel more pain from a loss than happiness from a gain.

Whether a transaction is framed as a loss or as a gain is very important. For example, would you rather get a $5 discount, or avoid a $5 surcharge? The same change in price framed differently has a significant effect on consumer behavior. Though traditional economists consider this “endowment effect” and all other effects of loss aversion to be completely irrational, that is why it is so important to the fields of marketing and behavioral finance.

The concept of loss aversion was first demonstrated by Amos Tversky and Daniel Kahneman. Later, in a publication by John Dawes, (Price changes and defection levels in a subscription-type market: can an estimation model really predict defection levels ?” Journal of Services Marketing Vol 18 No. 1 2004.), the effect of loss aversion in a marketing setting was demonstrated in a study of consumer reaction to price changes to insurance policies. The study found price increases had twice the effect on customer switching, compared to price decreases.

Silver’s performance, up 14.5% MTD and 13.0% YTD through Feb 18, 2014, may be causing the same feelings of anxiety, depending on how it’s framed. Suppose an investor picked silver as the commodity of choice in February, it seems like a winning choice. However, it is only the second best performing commodity in the S&P GSCI, behind coffee, which gained a whopping 21.7% this month. The chance this investor is happy to have picked the second best commodity might not be so high since the mind frame may be a loss of 7.2%.

Another irrational behavior in finance is called anchoring. Anchoring which was also described by Tversky and Kahneman, occurs when people make estimates by starting from an initial value. For example, in the Olympics, if two athletes competed in the 2010 games and one won a gold and the other won a bronze, then they both won silvers in 2014, the athlete who dropped from gold to silver might be more unhappy than the athlete who improved from bronze to silver.

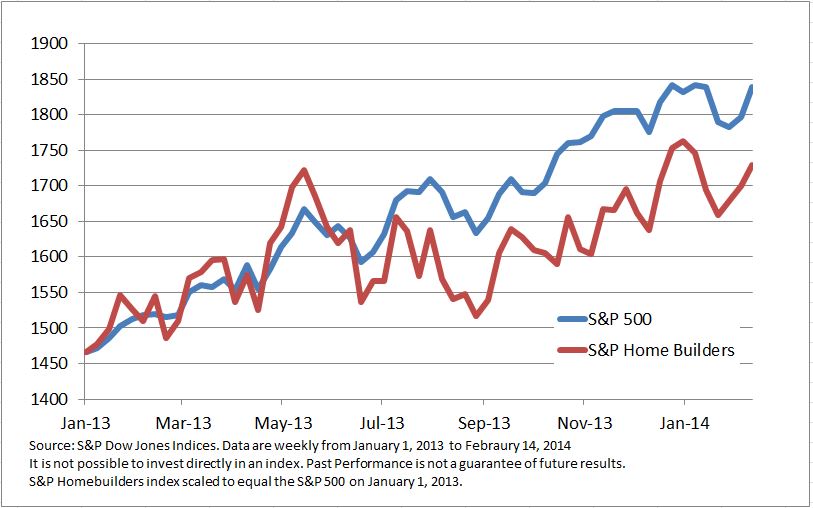

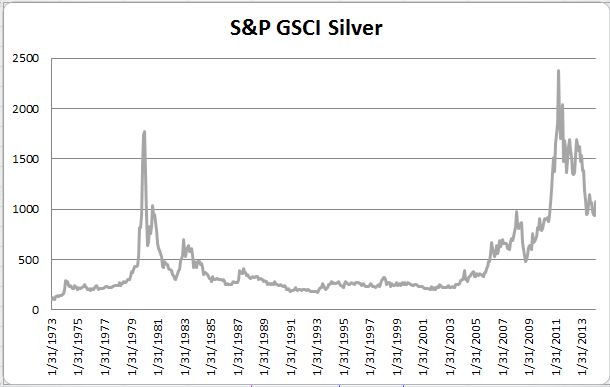

Notice in the the chart below, there may be different feelings about holding or selling silver today based upon the price of purchase. However, the irrational behavior is that it shouldn’t matter what the purchase price was considering the decision going forward to buy, hold or sell should be based on today’s price in relation to the future and not the past. An investor that bought silver in Oct 2008 may be feeling regret that s/he did not sell at the high in April 2011, and rather than being happy over a 125% gain is feeling upset over a 55% loss. On the other hand, if an investor bought at the beginning of 2014 and has gained 13%, s/he may be feeling elated, and that of course is only if s/he is not sorry to have missed out on coffee.

The posts on this blog are opinions, not advice. Please read our Disclaimers.