Literally – or at least mathematically – there are two equations that tell the tale of interest rate impacts on commodities.

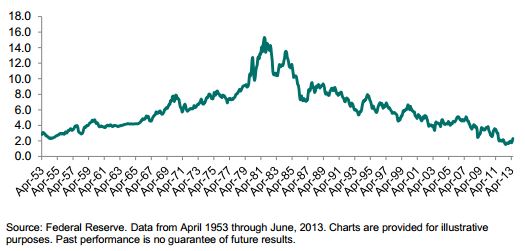

As my colleagues Fei Mei Chan and Craig Lazzara pointed out in a recent paper they authored, Much Ado About Interest Rates, “Since yields peaked in 1981, the three subsequent decades have witnessed a remarkable bull market for bonds. The yield of the 10-year Treasury bond fell from more than 15% in 1981 to its current level of less than 3%. With interest rates at historically low levels, investors might reasonably assume that it’s not a matter of if but a question of when rates will increase. ”

10-Year Treasury Yield from 1953-2013

I’m not in the position to answer the question of when interest rates will rise but can explain how rising interest rates factor into the equations of commodity pricing and index returns.

The most direct and measurable impact of interest rates on commodities can be observed from the formal relationship between spot and futures prices, as defined by the theory of storage equation which can be written as:

F0,T = S0 exp[(r+c-y)T]

Where:

F0,T= the futures price today for delivery at time T;

S0 = the spot price today;

r = the riskless interest rate, expressed in continuous time;

c = the cost of physical storage per unit time, expressed in continuous time;

y = the convenience yield, expressed in continuous time.

This equation is often used to explain the futures price in terms of the spot price, the interest rate, the cost of storage and the convenience yield as discussed by Gunzberg and Kaplan (2007).

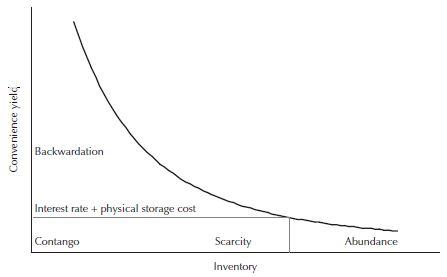

Although the interest rate and cost of storage are straightforward, the convenience yield is more complex. It’s defined by the flow of benefits to inventory holders from a marginal unit of inventory. Generally, inventory levels have an inverse relationship with convenience yield. This means that there is a low convenience yield when inventories are high. However, as inventory levels fall, the convenience yield increases at an accelerated pace as inventories are depleted.

The Demand For Storage

Simply put, there is a price consumers are willing to pay to have immediate access to a commodity during a shortage. As an example, a refiner is likely to pay a premium to have oil when there is a shortage so that its production of gas is not disrupted.

Storage can be used by both producers and consumers to fill gaps between production and sales, or between purchases and consumption. When a commodity is placed in storage to be delivered at a set time in the future at the futures price, then the opportunity to earn interest from selling the commodity in the spot market, then investing in a t-bill is lost. Also, one will pay the cost of the storage facility plus will gain (or lose) from the difference between the spot price and futures price.

Based on the above theory, two probable implications can be drawn about the effect of rising interest rates on commodities:

- Futures prices rise, and

- By storing, the opportunity cost is higher from the forgone interest so the incentive to store diminishes. Not only does the incentive to store diminish, but the rising rates may motivate investors to shift investments from commodities to yield-generating capital assets.

The second equation that demonstrates the direct impact of interest rates on commodity index returns is the total return (TR) calculation:

S&P GSCI TRd = S&P GSCI TRd-1* (1 + CDRd + TBRd)* (1 + TBRd)days

Where:

S&P GSCI TRd = the value of the S&P GSCI TR on any S&P GSCI Business Day, d

CDRd = the Contract Daily Return value represented as the percentage change in the Total Dollar Weight of the S&P GSCI on any S&P GSCI Business Day, d

TBRd= the Treasury Bill Return on any S&P GSCI Business Day, d =[1/(1-91/360*TBARd-1)1/91-1, where TBARd-1 = the 91-day discount rate for U.S. Treasury Bills, as reported by the U.S. Department of the Treasury’s Treasury Direct on the most recent of the weekly auction dates prior to such S&P GSCI Business Day, d.

days = the number of non S&P GSCI Business Days since the preceding S&P GSCI Business Day.

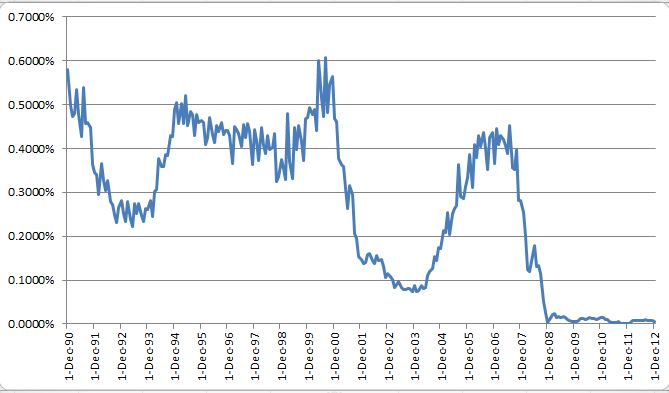

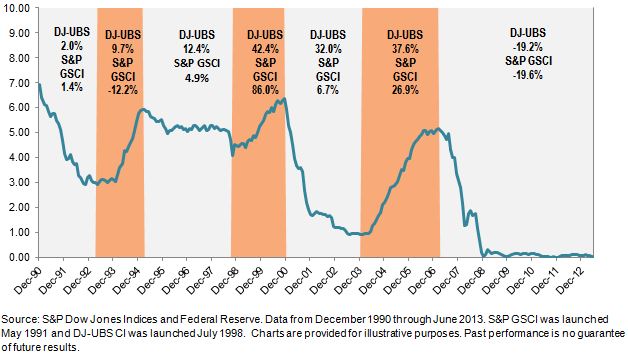

By definition, total return versions of commodity indices, such as the DJ-UBS CI and the S&P GSCI®, that incorporate the returns of the excess return (ER ) plus the Treasury Bill Return are positively impacted by rising interest rates which earn interest on the collateral of the futures contracts. Below is a chart showing the monthly return difference between the S&P GSCI TR and S&P GSCI ER:

S&P GSCI Total Return – S&P GSCI Excess Return

- Source: S&P Dow Jones Indices. Data from Dec 1990 to Dec 2012. Past performance is not an indication of future results. This chart reflects hypothetical historical performance. Please see the Performance Disclosure at the end of this document for more information regarding the inherent limitations associated with backtested performance

Since these indices are fully collateralized, this means that no leverage is used to gain exposure to the commodities through futures. As such, for every dollar of exposure, there is 100% cash in margin earning interest. The benefits are: the expected inflation plus real rate of return as well as an increase in the total return, by definition, as interest rates rise.

In isolation the relationship between interest rates and commodities is clear from the math. However in reality, there are other simultaneous factors so the results have been less obvious but there is potential for high commodity index returns in rising rate environments.

Commodity Index Performance during Periods of Rising and Falling Interest Rates

(Notice the similarity between the interest rates plotted below and the S&P GSCI TR- S&P GSCI ER in the graph above.)

Last, I would like to mention my colleagues and I are each contributing articles on impacts of rising interest rates on various asset classes in the next edition of the S&P Dow Jones Indices’ quarterly magazine called Insights, so be sure to check it out.

The posts on this blog are opinions, not advice. Please read our Disclaimers.