Now approaching its fourth anniversary since launch, the S&P 500® ESG Index seeks to reflect many of the attributes of the S&P 500 itself, while providing an improved sustainability profile as a result of an updated ESG score.1 With live performance data covering an extraordinary period—including two bear markets on either side of a growth boom—we are presented with a real-world performance test for the index’s improved sustainability profile.

From its launch date until the end of 2022, the ESG index outperformed its benchmark, the S&P 500, by a cumulative 9.16% (impressive in the context of a benchmark that is notoriously hard to beat). But how important were higher or lower ESG-scoring constituents in generating this excess return?

To measure this, we created hypothetical ESG “quintile portfolios,” reconstituted annually by ranking the S&P 500’s constituents by their ESG score and assigning each to one of five portfolios, from highest to lowest ESG-scoring. The hypothetical cap-weighted performance of these portfolios was then calculated and used to create a Brinson-like2 “ESG attribution,” teasing out the importance of ESG exposures in the returns in the S&P 500 ESG Index.

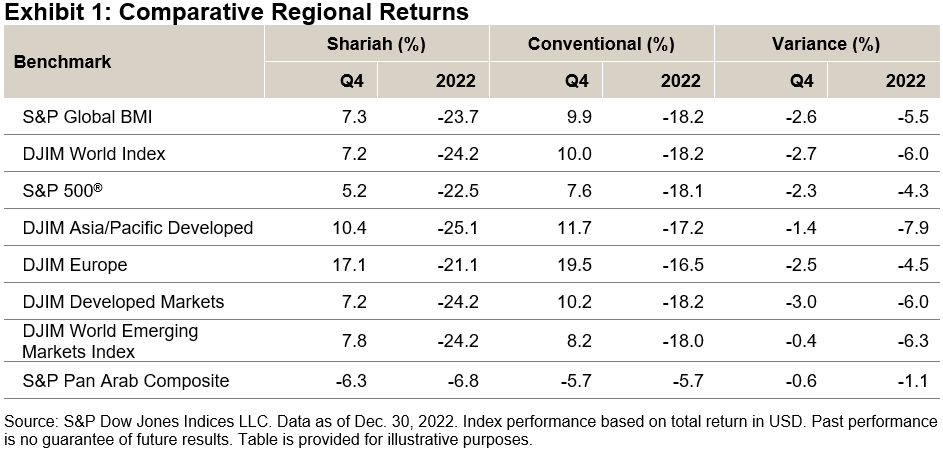

Exhibit 1 summarizes the results of this analysis, including the average weights of the S&P 500 ESG Index and the S&P 500 in each ESG quintile (from high to low scoring), the corresponding portfolio and index returns, as well as a summary of the corresponding allocation and selection effects over the full period.3

Although an overweight in the High ESG Quintile 1 detracted from returns, the total effect from over- and underweighting across and within the ESG quintiles was positive in every other quintile. Most strikingly, underweighting the lowest ESG-scoring constituents contributed the most to the S&P 500 ESG Index’s outperformance. Specifically, the Low ESG Quintile 5 underperformed S&P 500 by -16.9%, the S&P 500 ESG Index underweighted this quintile by an average of 10.2%, and the combined effect was to generate 4.18% in excess return for the S&P 500 ESG Index.

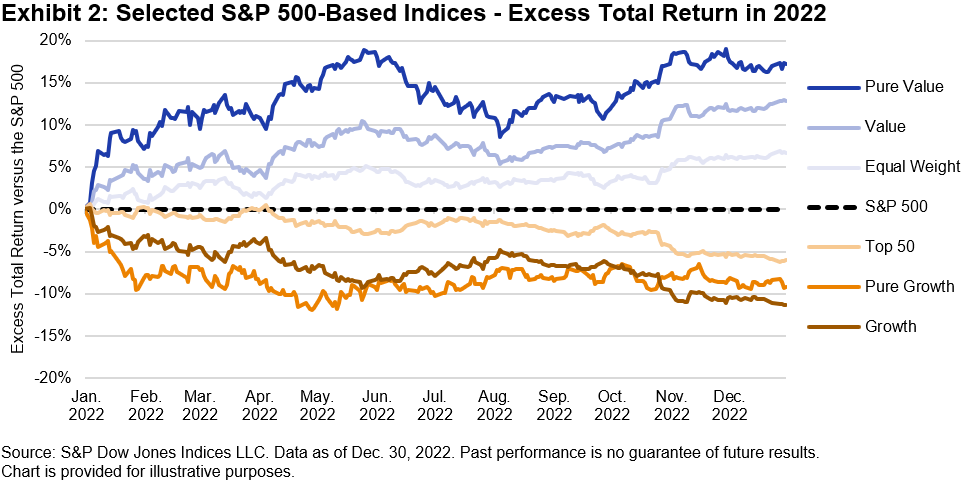

Drilling down, Exhibit 2 compares the performance of the Lowest ESG Quintile to the S&P 500 in each calendar year included in the sample: it underperformed in three of the four calendar years represented. Exhibits 1 and 2 together show that, in short: the S&P 500 ESG Index consistently benefited from avoiding the worst-scoring constituents.

Of course, performance drivers can (and do) change over time. ESG-based attribution analysis such as these can offer insight and perspective as markets and conditions evolve. Investors seeking similar attributions for a range of our flagship indices are now able to find them—updated as of the most recent quarter-end—in S&P DJI’s recently launched Climate & ESG Index Dashboard.

Register here to receive quarterly insights and performance attributions for our range of flagship ESG and climate indices.

1 The index methodology is available at: www.spglobal.com/spdji/en/documents/methodologies/methodology-sp-esg-index-series.pdf.

2 Similar to our previous analysis with Carbon Quintiles, the quintile portfolios are each assigned an equal number of benchmark constituents, and the impact of weighting to stocks with higher- or lower ESG scores is measured analogously to the way sector or country effects are measured by a traditional Brinson attribution.

3 Analysis carried out using S&P Capital IQ Pro.

The posts on this blog are opinions, not advice. Please read our Disclaimers.