Over the past 10 years, the highest overnight reference rate from the Brazilian Central Bank has been 14.25% from July 2015 through September 2016. In an attempt to hold back the depreciation of the Brazilian real and to keep inflation within the target range, the reference rate dropped 775 bps to 6.50% at the end of August 2018, which is a record low. In addition, of the USD 1.8 trillion in outstanding debt, almost 60% are sovereign bonds. Because of these factors, a new surge of income has been necessary over the past couple of years.

One way to get exposure to fixed income other than typical bonds are derivatives, and S&P Dow Jones Indices, in partnership with B3, has created the S&P/BM&F One-Day Interbank Deposit 3Y Futures Index. The index is designed to measure the performance of a hypothetical portfolio holding a three-year One-Day Interbank Deposit (DI) Futures Contract. The DI contract is on the Brazilian one-day interbank rate, which is used by Brazilian banks to lend and borrow from each other. The contract provides a way to hedge for or speculate on short-term Brazilian interest rates.

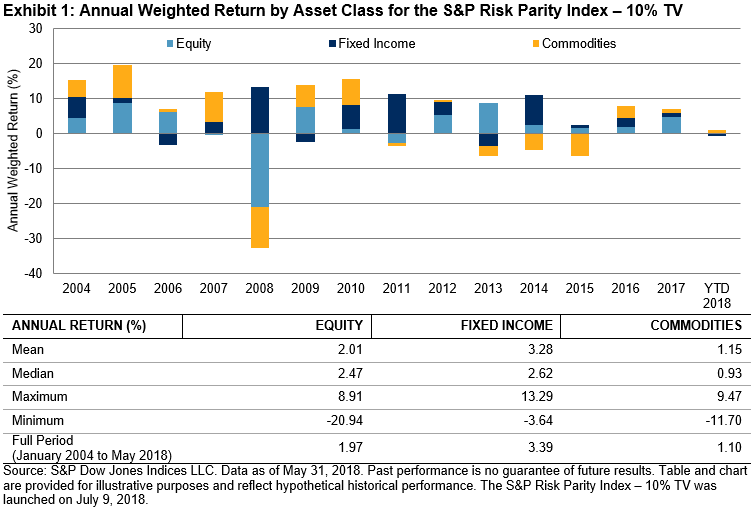

The index offers a benchmark for financial institutions to measure the return on their holdings and can serve as the base of an investment vehicle, as the index is easy to replicate and was created with potential tax benefits in mind. It is also calculated in U.S. dollars, which makes it accessible to investors outside of Brazil. Exhibit 1 shows the performance of the indices calculated as excess return and total return.

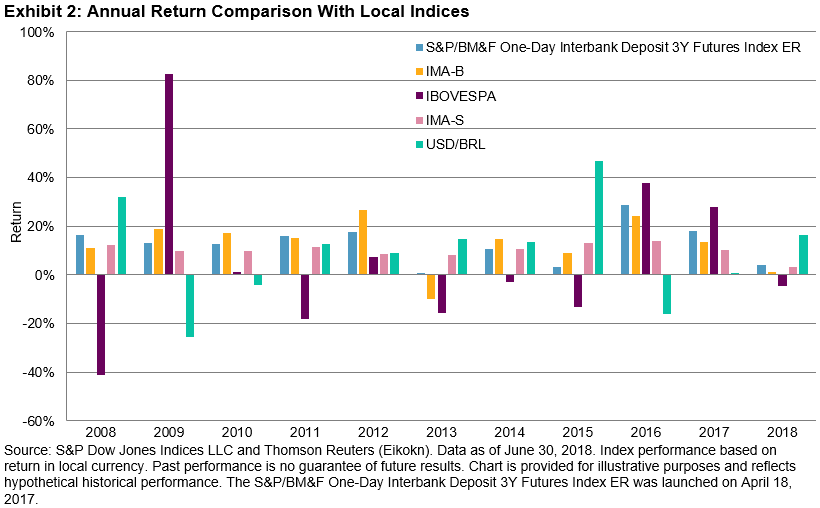

For the first time, this index provides the opportunity for a local fixed income investment vehicle in the Brazilian market that would provide diversification and could be used to gain core fixed income exposure or to hedge current positions. Exhibit 2 shows the comparison of annual returns with other local indices. In the past 10 years, none of the local indices outperformed in particular, but kept steady. However, when comparing the risk/return profiles, the S&P/BM&F One-Day Interbank Deposit 3Y Futures Index significantly outperformed, meaning that it could help in the reduction of risk in a portfolio (see Exhibit 3).