Home bias has been a prominent theme in India since the beginning of the mutual fund industry. Investors historically questioned why they should diversify their high GDP growth portfolio (India) with lower growth economies such as the US. This hypothesis has been tested over the last decade. India has delivered a high GDP growth but has fallen short in terms of profitability. The US has had the opposite effect. Despite low GDP growth, profitability has been better than any analyst would have predicted a decade ago.

Investors, as a result, have finally started to realize the importance of geographical diversification. It is a concept well accepted in developed parts of the world, such as the US and Europe, where most investors tend to have globally diversified portfolios.

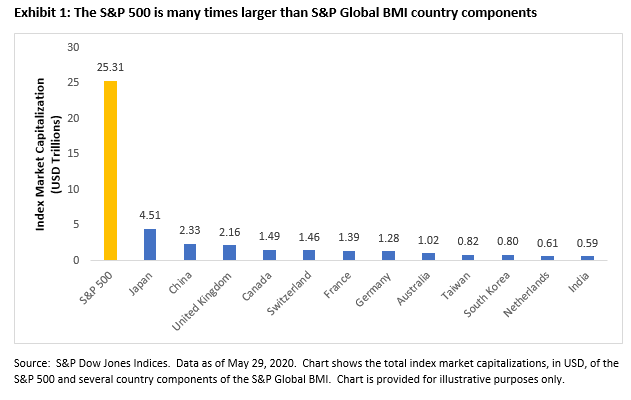

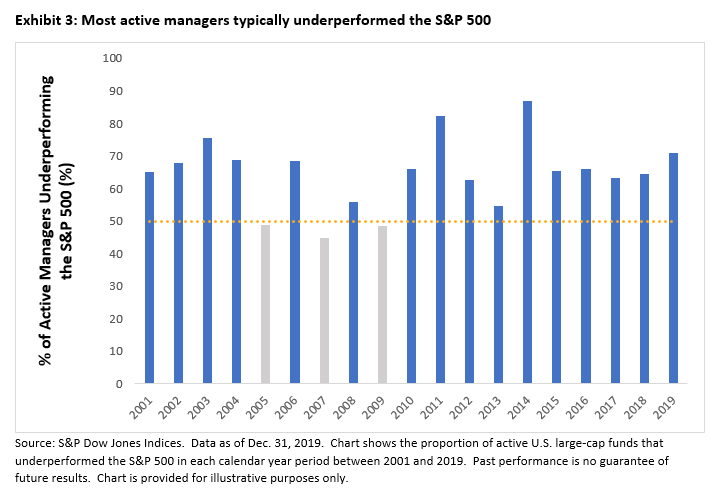

So global investments have delivered good returns over long-term horizons. What else is there for Indian investors?

Low Correlation with Indian Equities

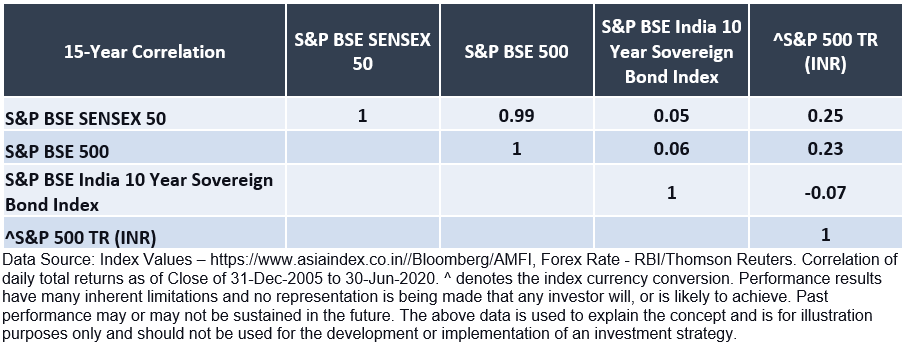

Commonly, investors have invested in multiple equity mutual funds with the hope of diversification. Historically, domestic mutual funds have tended to move in the same direction. Most Indian mutual funds have a correlation of 90%+, giving very little diversification to the investor. Investors in India who are looking to diversify their domestic portfolio tend to accept asset classes with traditionally lower yields such as debt, gold, and real estate.

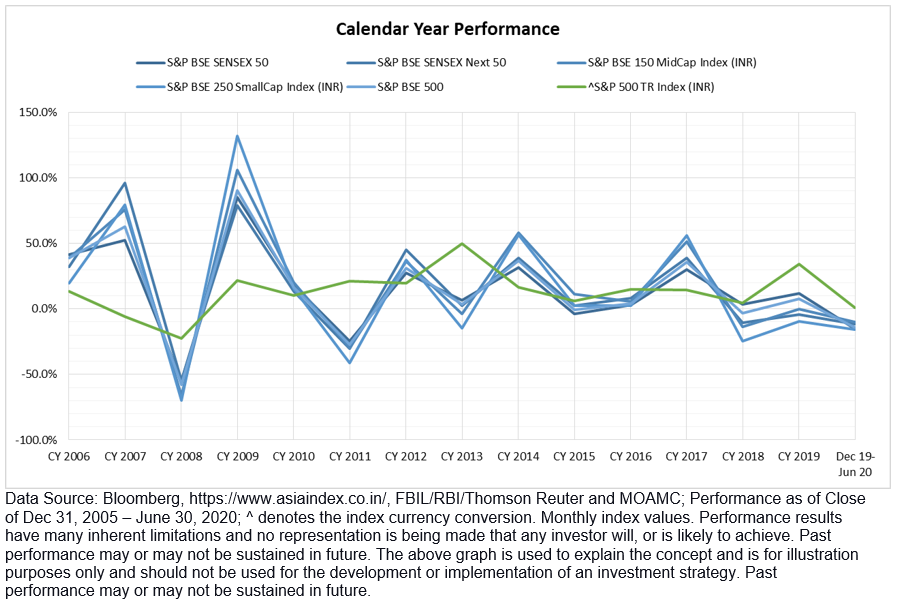

However, international equity is an asset class where investors have experienced equity-like returns and lower volatility due to diversification. The following chart shows calendar returns of the S&P 500 vs. broad-based index funds across categories.

With a lower correlation, investors have seen India and the US deliver good yield returns when combined with lower volatility.

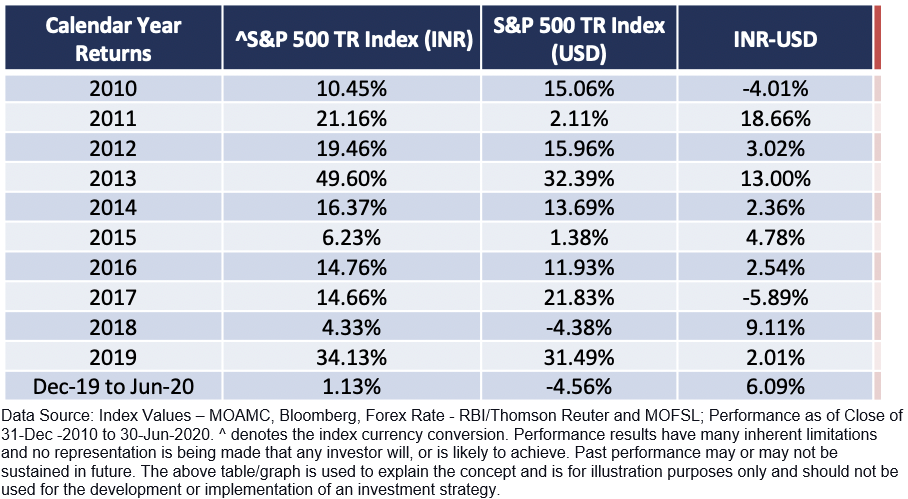

Currency as an Asset Class

The S&P 500 offers Indian investors two asset classes: US Stocks + USD as a currency. With the rupee falling most years (~5% CAGR) over the last ten years, international diversification can potentially give added protection over a falling currency. With investors increasing their spend in USD terms (foreign trips, education, electronics, etc.), it has become attractive to have some wealth invested in dollar-based assets such as the S&P 500.

Higher Dividends and Stock-Level Diversification

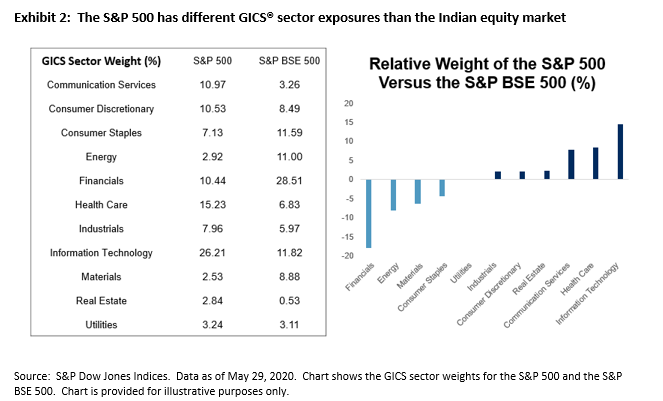

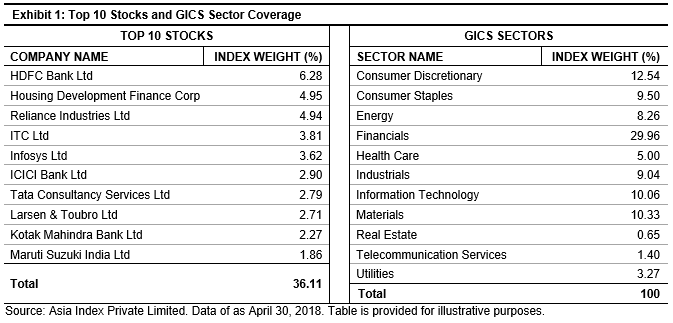

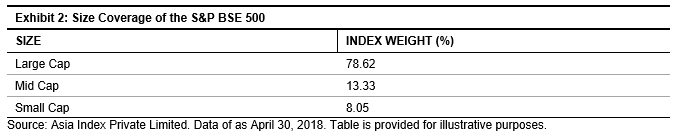

The S&P 500 provides higher dividends in addition to sector-based diversification to Indian investors. India tends to be heavy on financial services, whereby the US tends to have a higher allocation towards Technology and Telecommunications. Access to some of the leading companies with globally diversified revenue streams adds well to the mix of stocks in an Indian investor’s portfolio.

In conclusion, international diversification has taken off partly due to high historical returns over the last decade and partly due to the disappointment in domestic markets. However, diversification is key when considering international investments.