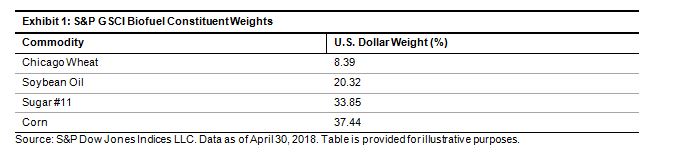

On July 9, 2007, S&P Dow Jones Indices launched the S&P GSCI Biofuel, which aims to provide market participants with a reliable and publicly available benchmark for investment performance in the feedstock commodities used in the production of biofuels. The index includes Chicago wheat, corn, soybean oil, and sugar.

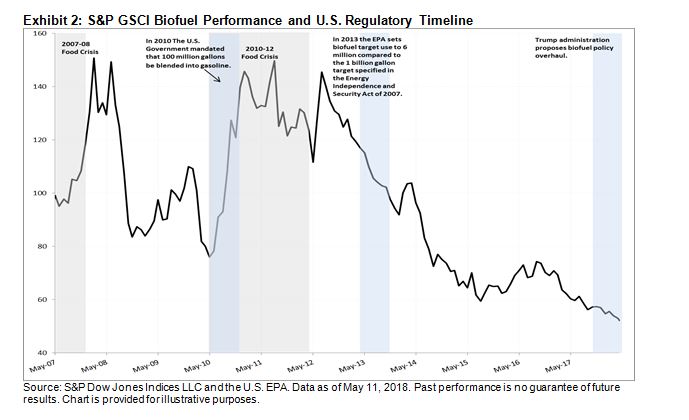

Biofuels are produced utilizing biological processes, are renewable, and are intended to replace fossil fuels such as gasoline for transportation, which is not renewable. Biofuel was first used as fuel in a diesel engine in 1898. In 1918, blended gasoline was first invented and was used extensively during World Wars I and II due to oil shortages. The Clean Air Act was signed by Nixon in 1970, and in 1992, the Common Agricultural Policy allowed land to be designated for the planting of crops for biofuel production. In 2001, E15 (or 15% ethanol/85% oil fuel) was officially allowed in the U.S., and in 2007, President Bush signed the Energy Independence and Security Act, which mandated the increase of ethanol usage in the U.S. Exhibit 2 depicts the subsequent U.S. regulatory implementations as they related to the performance of the S&P GSCI Biofuel.

As seen in Exhibit 2, the S&P GSCI Biofuel tended to perform better during and subsequent to the implementation of new regulatory environments that supported the production and utilization of biofuel.

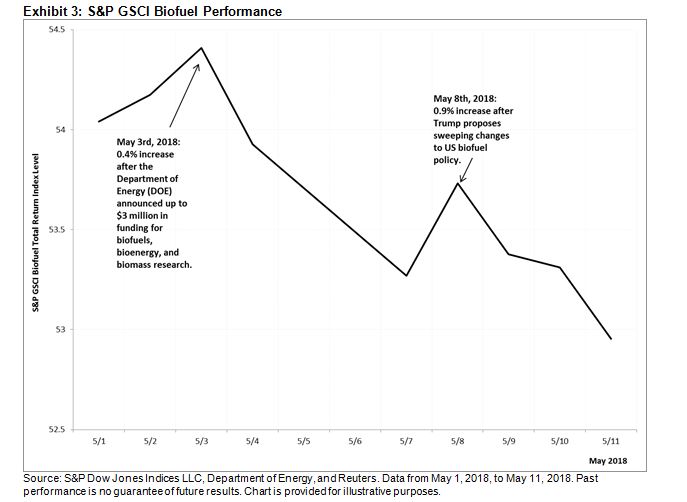

Exhibit 3 drills into the performance of the index during the month of May 2018, when U.S. President Donald Trump announced that he was considering allowing exported ethanol to count toward the volumes mandated under the nation’s biofuels law, a move that could benefit both the oil and corn industries in the U.S.[i]

The S&P GSCI Biofuel increased 0.9% on the day of the announcement (May 8, 2018), while the S&P GSCI Unleaded Gasoline declined by 1.1%.

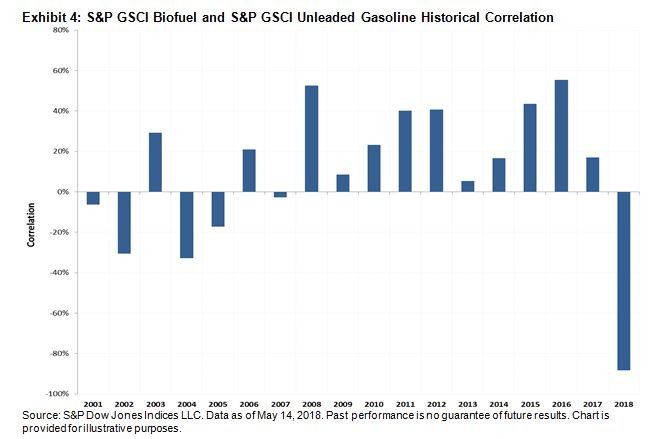

Exhibit 4 depicts the annual correlation between the S&P GSCI Biofuel and the S&P GSCI Unleaded Gasoline. While the indices had a correlation of 0.2 for the entire period evaluated, the annual correlation levels fluctuated.

It can be seen that the correlation between the two indices was low or reflective of the entire period correlation during the “regulatory years” (2007, 2010, 2011, and 2018). The highest correlation levels were during 2008, when all commodity prices experienced a sharp downturn as a result of the credit crunch and sovereign debt crisis, and in 2016, when petroleum prices benefited from robust demand and biofuels strengthened as a result of increasing the Renewable Fuel Standard targets.[i]

[i] Source: https://www.eia.gov/todayinenergy/detail.php?id=29132

[i] Source: https://www.reuters.com/article/us-usa-trump-biofuels/trump-to-soon-propose-sweeping-changes-to-biofuel-laws-source-idUSKBN1IC263

The posts on this blog are opinions, not advice. Please read our Disclaimers.