There may be a legitimate concern about rising inflation since inflation has been under the Fed’s target for years and there is now very low unemployment with signs of accelerating economic growth. The low unemployment rate and strong growth are probably positive for the stock market and the tax cuts may provide even more upside. However, if inflation upticks and the Fed raises rates to slow it, the increased cost of capital and likely drop in consumer spending may put pressure on stocks.

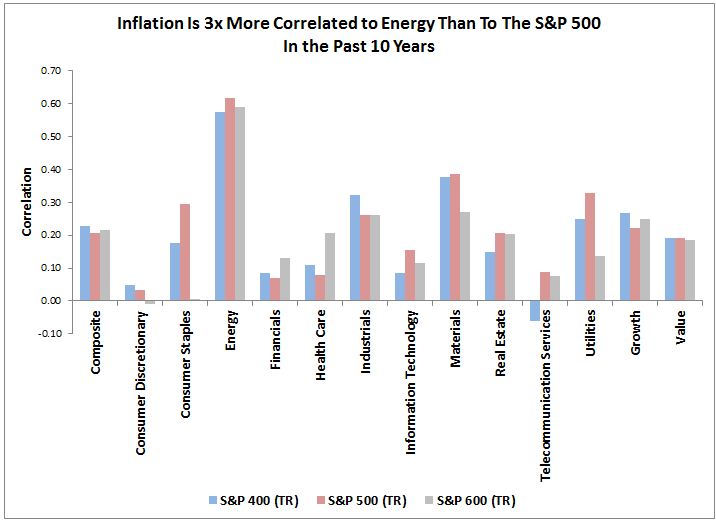

Understanding more about how to position equities in the event of rising inflation may be useful in this uncertain time. In conjunction with the impacts on stocks from accelerating growth and the falling dollar, a more complete picture of investment strategy inside an equity allocation can be formed. Small-caps benefit most from accelerating growth, mid-caps do best from a falling dollar, and what will be shown in this analysis is that mid-caps are most sensitive to inflation, and energy is by far the most sensitive sector. Also what is interesting is that though crude oil itself is more sensitive to inflation than the energy equities, once the roll yield of the futures contracts is considered, all the benefit is lost.

Let’s start with the 10 year correlation using monthly year-over-year data of index levels and CPI (Consumer Price Index.) Overall, equities are not that correlated with inflation at just over 0.2. However, the energy sector correlation to inflation of 0.6 is triple the correlation of the broad equities to inflation. The crude oil futures are even more correlated to inflation, measuring over 0.8, that is considered highly correlated. This is because energy is the most volatile component of CPI, essentially driving it.

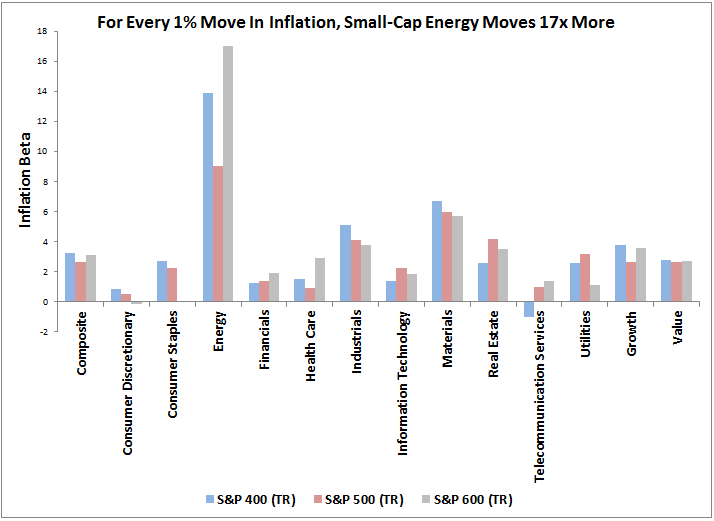

Another common measure used to evaluate the sensitivity of assets to inflation is called inflation beta. It means, “if there was a 1% change in CPI, then there was an x% change in the index.” For example, in the chart below, for every 1% rise in inflation there was a 17% increase on average for small-cap energy stocks. The S&P MidCap 400 is the most sensitive broad-based index, with an inflation beta of 3.3, only slightly higher than the 3.1 inflation beta of the S&P 600, but markedly higher than the 2.6 inflation beta of the S&P 500. Again, the crude oil futures have an even higher inflation beta than the equities at about 20. Since the small-caps are least likely to hedge, they may benefit most with rising oil and inflation.

One might conclude that for inflation protection, crude oil is the best bet. Though the problem with getting inflation protection with crude oil futures is that market participants need to pay storage costs, reflected through the roll yield when there is excess inventory. In a decade plagued with high inventory, this has cost crude oil futures investors an additional 48% beyond the -37% lost in the spot market. The result has been a negative up market capture ratio of -109.7, meaning for every 1% rise in inflation, the S&P GSCI Crude Oil Excess Return actually fell by 1.1% on average in the past 10 years.

Given equities are better than futures for inflation protection, after the roll yield is included, and that small-caps and mid-caps have done best with accelerating growth, the falling dollar and rising inflation, perhaps the strategy might be to underweight large caps.

The posts on this blog are opinions, not advice. Please read our Disclaimers.