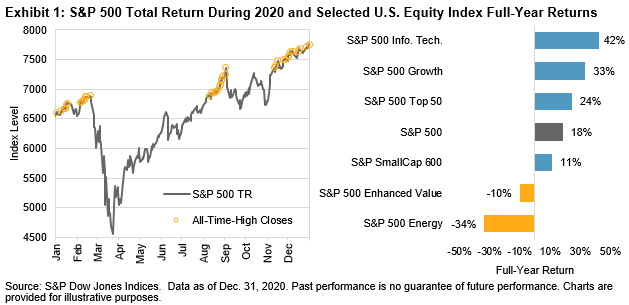

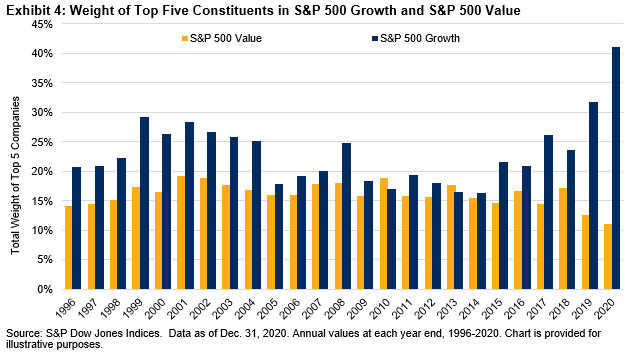

One of the major trends in the last few years has been the outperformance of large, growth-oriented stocks and, at first glance, 2020 represented a continuation of this trend. For example, the S&P 500® Growth (33.5%) outperformed the S&P 500 Value (1.4%) by 32.1% last year, the largest difference in calendar year total returns between the two indices, ever.

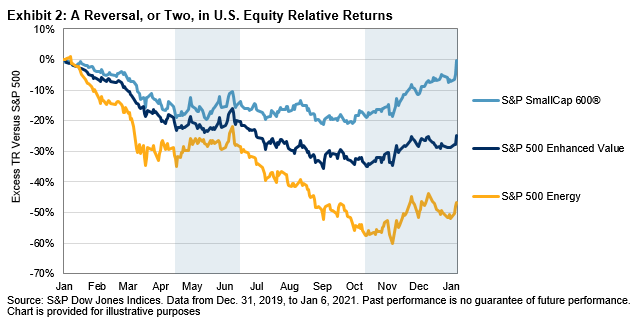

However, focusing on the overall picture for 2020 ignores a recent reversal in fortunes—Value outperformed Growth by 3.8% between the end of September and latest annual S&P U.S. Style Indices reconstitution (Dec. 18, 2020), contributing to Value’s second-largest quarterly outperformance since 2009 (Value beat Growth by 6.9% in Q4 2016).

Much of the outperformance in Q4 2020 can be attributed to the beginning of the COVID-19 vaccine rollout, which fueled expectations of an economic recovery and lifted many value-oriented stocks that were particularly impacted by the COVID-19 correction. Overall, S&P 500 Value constituents posted higher returns than their Growth counterparts in 7 of the 11 GICS® sectors leading up to the December 2020 style reconstitution.

More recently, Value has outperformed by around 2% since the results from the latest reconstitution went into effect (prior to the open on Dec. 21, 2020). Value-oriented Financials provided tailwinds, lifted by increased investor speculation that interest rates will rise in 2021 in response to higher U.S. inflation expectations.

While it remains to be seen which news stories will dominate headlines this year, georevenue exposure may offer insights into the relative fortunes of Value and Growth. For example, Exhibit 3 shows that value-oriented companies are typically more domestically focused than their growth counterparts: the sales-weighted average U.S. revenue exposure is greater for many sectors in the Value index compared to the Growth index. This suggests that news that causes investors to change their U.S. economic outlook and/or expectations for domestic consumers’ spending—such as the vaccine rollout late last year—may have an outsized impact on Value’s returns. Similarly, Growth’s fortunes may be more sensitive to global narratives, especially as they relate to some of the largest market constituents.

As a result, the recent reversal in Value’s fortunes has led some investors and commentators to suggest that we may be witnessing a long-anticipated rotation away from Growth and into Value. Although we shall see whether there is growth in value or value in growth, differences in georevenue exposure may be a useful way to understand movements across style indices.

The posts on this blog are opinions, not advice. Please read our Disclaimers.