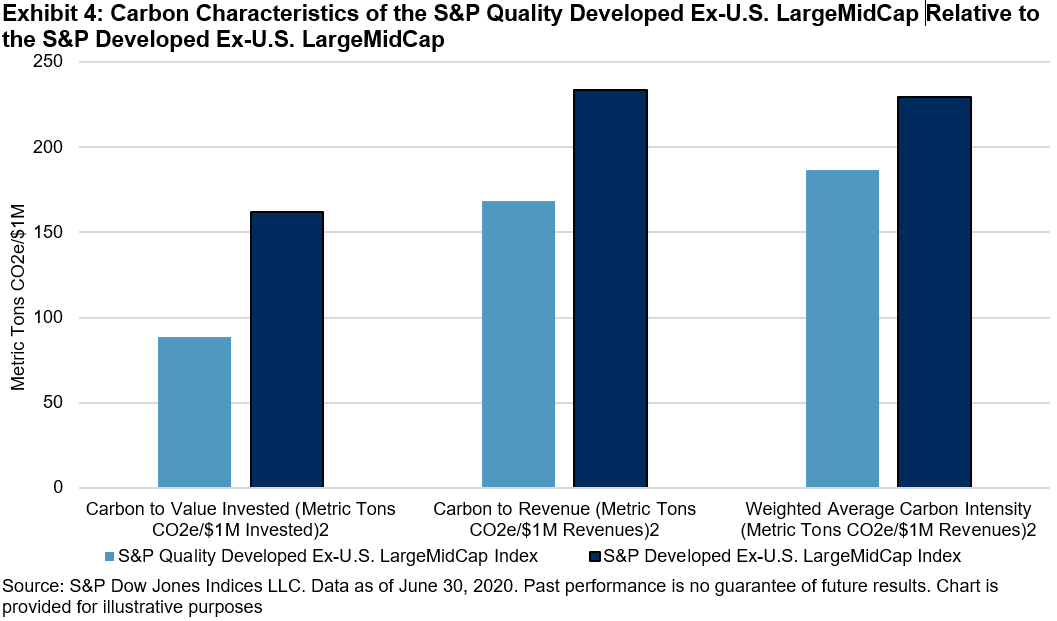

After a volatile start to 2020, many investors were looking at double digit declines and were probably re-evaluating their 2020 expected returns. But while COVID-19 continued to determine market sentiment, Q2 hosted a remarkable recovery. The S&P 500 (+20.54%) and the S&P MidCap 400 (+24.07%) posted their highest quarterly total returns since 1998, while the S&P SmallCap 600 (+21.94%) recorded its largest ever quarterly gain.

More broadly, the overwhelming majority of sector and style indices across the market capitalization spectrum also recovered in Q2: 14 posted their best quarterly total return ever as stimulus packages and tentative indications of a reopening U.S. economy offered tailwinds. Energy led the way, helped by gains in commodity markets, followed by Consumer Discretionary and Information Technology.

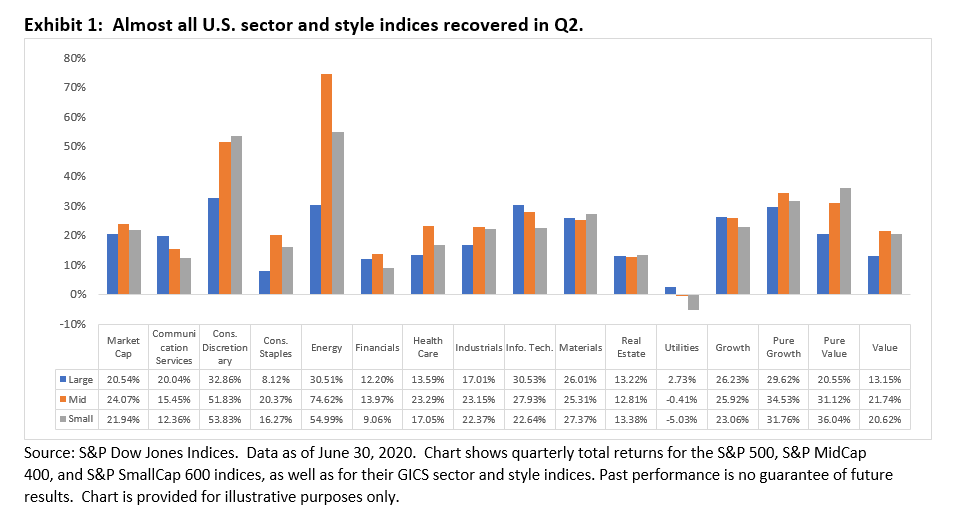

Although a move from spring to summer usually causes a shift in style – at least on the clothing front – there was little change from an investment perspective: growth continued to outperform value, as it has done for most of the last decade. However, the magnitude of growth’s outperformance during the first half of 2020 was unprecedented: we saw the highest spread in growth and value YTD total returns compared to the first six months of any other year since 1998. Declining U.S. Treasury yields, and the impact on valuations of growth-oriented companies likely helped.

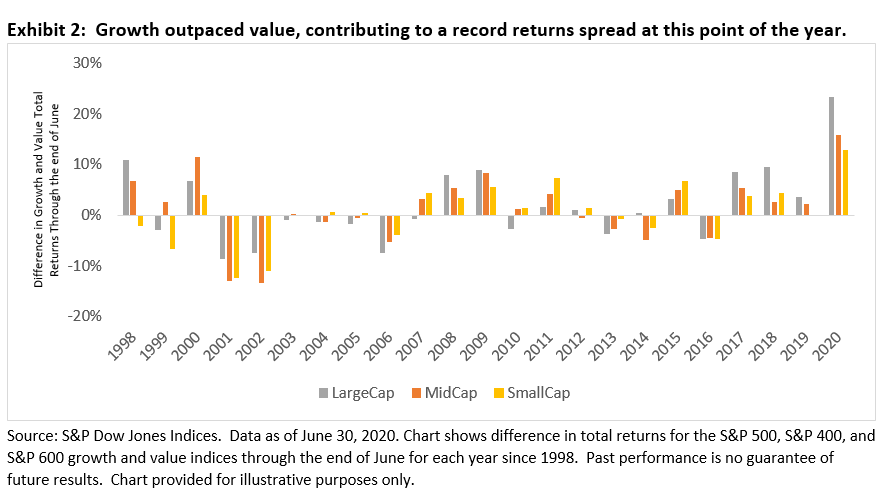

The strong gains observed in Q2 and a mostly positive start to this month have brought certain indices to within striking distance of their 2020 highs: the S&P 500 Information Technology sector needs another 1% in gains, while the Tech-heavy S&P 500 Growth (0.9%) needs slightly less. In contrast, large gains are still needed in the Energy sectors to recover recent highs: the asymmetric impact of drawdowns meant Q2’s gains were not enough to overcome the precipitous declines from the first quarter.

So where does that leave us? Timing the market is challenging and has arguably been made harder by how unusual 2020 has been so far. While it’s anyone’s guess what might happen during the rest of the year, the first half of 2020 suggests it may be memorable and interesting to watch.

The posts on this blog are opinions, not advice. Please read our Disclaimers.