In a previous blog, we discussed the U.S. Federal Reserve’s initial responses to the current market volatility and resultant dislocations. In short, dropping rates to 0% and adding over USD 1 trillion to the funding markets did little to abate the severity of the situation. In an effort to prevent a liquidity crisis from turning into a solvency crisis, the Federal Open Market Committee (FOMC), in combination with the Department of Treasury, has rolled out the following measures.

- Quantitative Easing (QE): QE is back and bigger than ever: The FOMC will purchase at least USD 500 billion of Treasury securities and at least USD 200 billion of mortgage-backed securities.

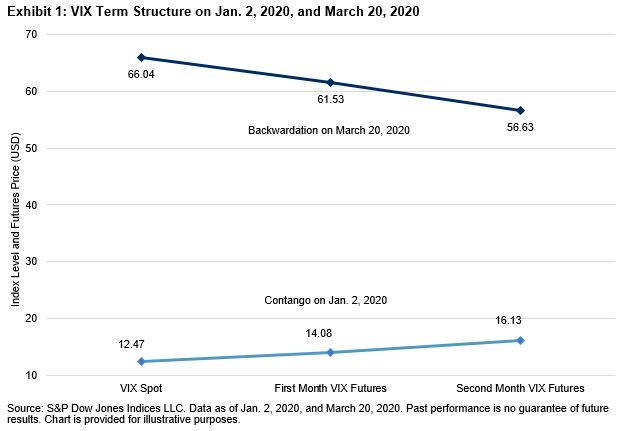

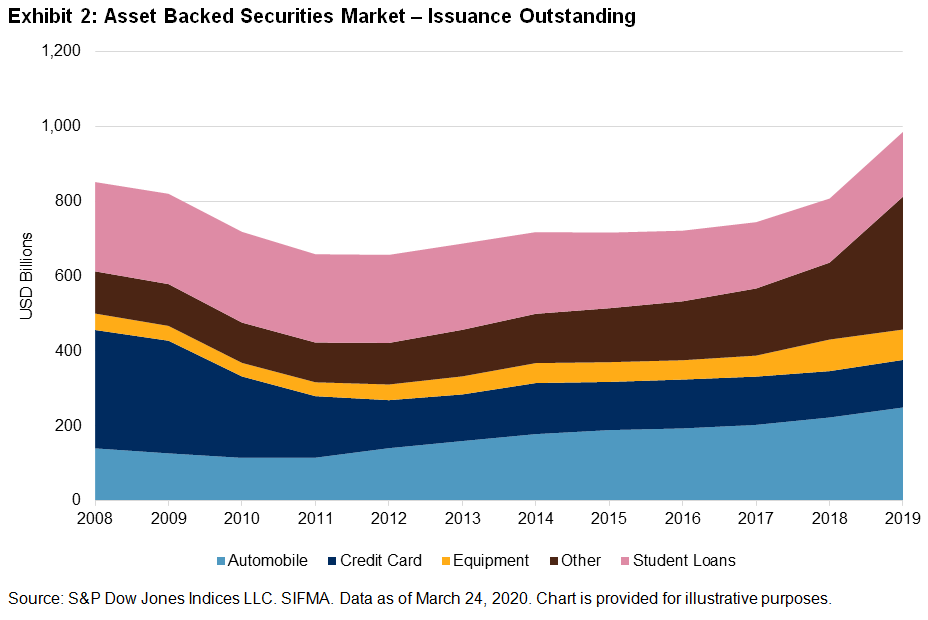

There’s no telling exactly what this amount could climb to, given that the objective is to purchase “amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy.”1 Exhibit 1 shows the securities held on the Fed’s balance sheet since 2008 through prior QE phases and the 17-month period of quantitative tightening that began in 2017. The red line shows the rapid expansion taking place the week of March 23.

- Term Asset-Backed Securities Loan Facility (TALF): USD 10 billion funded by the Department of Treasury.

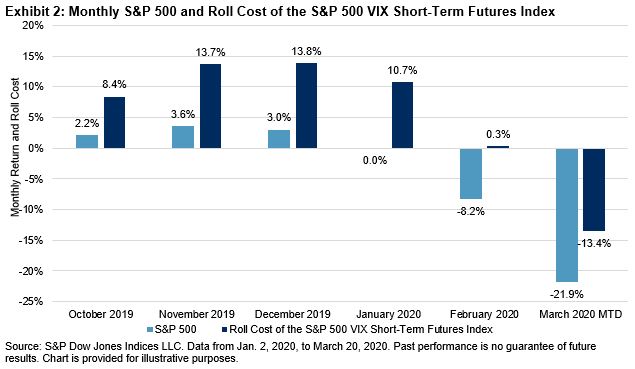

Another tool from the GFC, the TALF will “enable the issuance of asset-backed securities (ABS) backed by student loans, auto loans, credit card loans, loans guaranteed by the Small Business Administration(SBA), and certain other assets.”1 Exhibit 2 shows the current composition of the asset-backed securities market and its growth following the GFC.

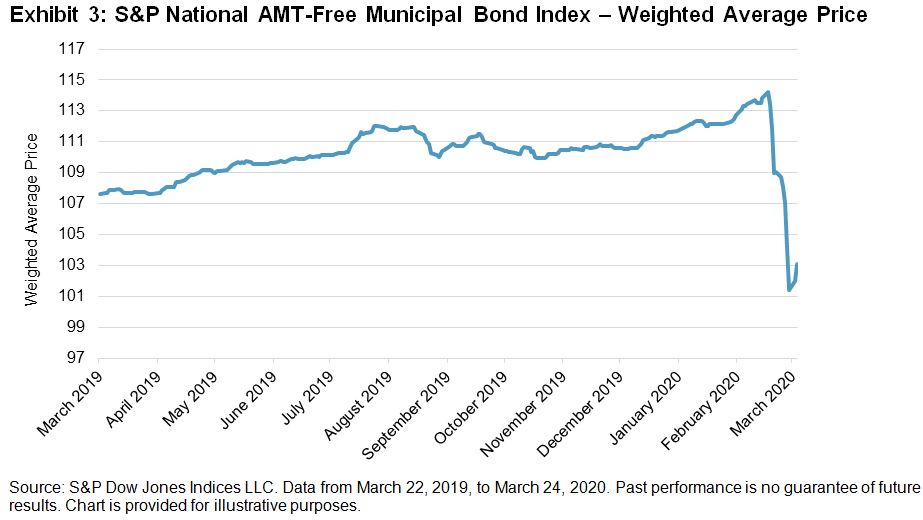

- Expansions to the Money Market Mutual Fund Liquidity Facility (MMLF) and the Commercial Paper Funding Facility (CPFF): In an effort to facilitate the flow of credit to municipalities, the Federal Reserve is expanding the MMLF and the CPFF to include high-quality, tax-exempt issues as eligible securities.

This will have a greater impact on money markets than on municipalities, as state and local governments will most likely require more direct intervention. However, Exhibit 3 shows that the announcement encouraged some price support in the broad municipal bond market.

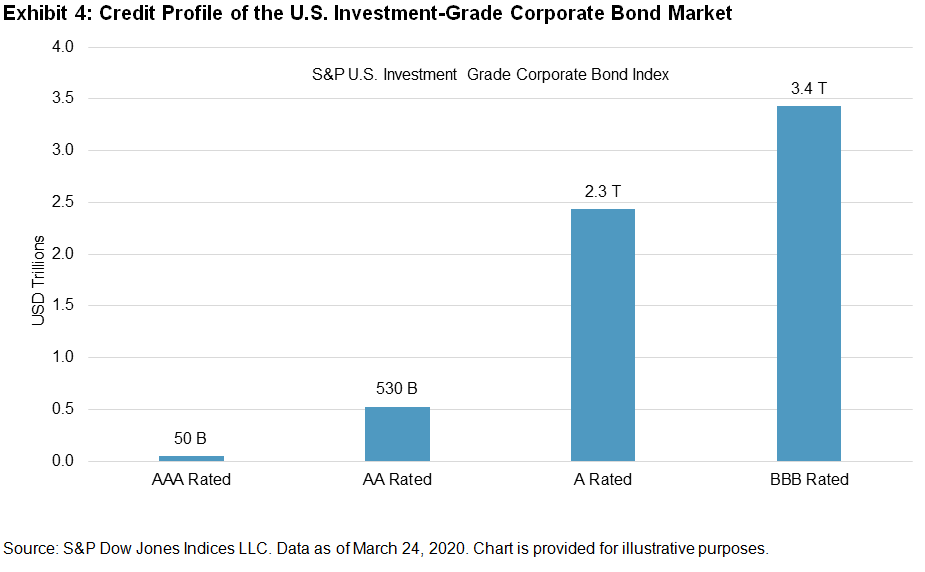

- Establishment of Two New Facilities: In an effort to support credit to large employers, the FOMC established the Primary Market Corporate Credit Facility (PMCCF) for new bond and loan issuance and the Secondary Market Corporate Credit Facility (SMCCF) to provide liquidity for outstanding corporate bonds; each facility will begin with USD 10 billion funded by the Department of the Treasury.

This is, perhaps, the most drastic measure the FOMC is taking in an effort to support funding for large corporations. The PMCCF will allow investment-grade companies access to credit and will provide bridge financing of four years. The SMCCF will purchase corporate bonds in the secondary market issued by investment-grade U.S. companies and U.S.-listed exchange-traded funds whose investment objective is to “provide broad exposure to the market for U.S. investment-grade corporate bonds.”1

The FOMC is prohibited from selecting specific corporate issuers, and they can only purchase bonds with a rating of BBB- or higher. Exhibit 4 shows the current credit profile of the U.S. investment-grade corporate bond market. Of the USD 6.3 trillion of corporate bonds, more than 55% are rated BBB. While both facilities will surely grow in size to support the market need, the greater risk is the further degradation of credit quality of the USD 3.4 trillion of corporate bonds outstanding.

While the measures outlined in this post are intended to provide support to corporate and municipal debt markets, monetary policy (no matter how extreme) may not be enough to prevent further repricing. More than likely, the highly anticipated fiscal response is what will ultimately determine how soon stability returns to financial markets.

- Board of Governors of the Federal Reserve System; federalreserve.gov.