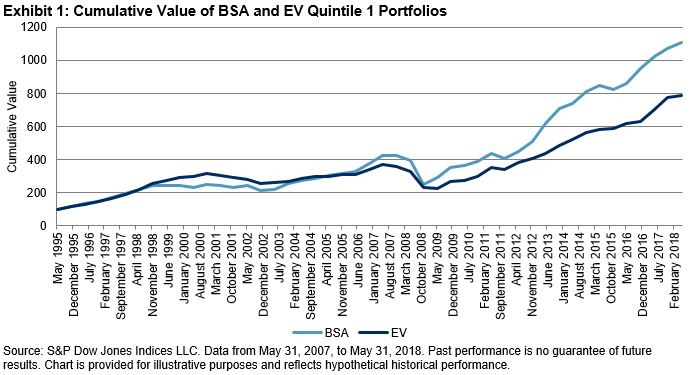

Despite escalating trading tensions between U.S. and China that built through Sep., large caps were largely unaffected. The aging Bull market (since March 9, 2009) showed no signs of stopping, as the S&P 500 posted new highs and posted an annualized 16.51% equity return and 18.91% with dividends, as mentioned by Howard Silverblatt in Market Attributes. However, also noted by Silverblatt, Q4 appears to be full of politics and turmoil. Based on the monthly performance measurement of the small cap premium, perhaps the market is showing at least one sign of fear.

The S&P 500 gained 0.43% in Sep., reaching a new high, while the S&P SmallCap 600 failed to keep pace and lost 3.32%. This formed the biggest monthly large cap outperformance over small caps in 4 years, measuring 3.75%. Back in Sep. 2014, when the spread was 3.94%, though the magnitude of the large cap outperformance was impressive, it was less meaningful since both large caps and small caps fell together. During 78% of months when the S&P 500 is negative, the S&P SmallCap 600 is negative too, and on average when both indices fall together, the S&P 500 loses 5.09% versus the average S&P Small Cap 600 loss of 4.10%

What is far more interesting is what happens after the S&P 500 reaches a new high while the S&P SmallCap 600 falters. In only 24 of 297 months, or in 8.1% of months, has the S&P SmallCap 600 lost while the S&P 500 gained. Not only is this the current scenario but the bearish divergence has only been bigger 7 times in history where 2 of those times preceded major stock market drops. The S&P 500 reached new highs while the S&P SmallCap 600 fell prior to the declines in 2000-2002 and in 2007-2009.

In Jul. 2006, the S&P 500 gained 0.51% while the S&P SmallCap 600 lost 3.50%, resulting in a small cap premium of -4.01%. The S&P 500 did not reach its high until Oct. 2007 but subsequently lost 52.6% through Feb. 2009. While there were 15 months from the Jul. 2006 bearish diversion date until the top, the S&P 500 still declined 42.2% from that time of large cap outperformance. Moreover, the other bearish diversion (bigger than the current amount with the S&P 500 at a new high despite the S&P SmallCap 600 loss) measured -13.4% in Mar. 2000. This was just 5 months ahead of the high in Aug. 2000 when the market began its 46.3% decline, ending in Sep. 2002. From the bearish diversion date in Mar. 2000, the market declined 45.6%. Even if the large cap outperformance does not happen exactly on the market high, or if the bearish diversion signal is just the first of many, it seems there may be a bearish signal from the inability of small caps to keep up with the large cap momentum.

Going into Q4, there may be politics and turmoil, but if there is growth, rising interest rates, inflation or a rising dollar, those conditions are historically supportive of small caps.

The posts on this blog are opinions, not advice. Please read our Disclaimers.