The big news in August was that the aging Bull market (since March 9, 2009) became the longest-running Bull market in S&P 500 history, as it posted an annualized 16.6% equity return and 19.1% with dividends, as my colleague, Howard Silverblatt pointed out. While the record-breaking Bull market for the S&P 500 is spectacular, mid-caps and small caps did even better. The S&P MidCap 400 posted an annualized 18.6% equity return and 20.5% with dividends, and the S&P SmallCap 600 posted an annualized 20.9% equity return and 22.4% with dividends.

Though large caps outperformed by the most in 2017 since 1999, small caps have made a stellar comeback, nearly doubling the large cap performance year-to-date ending Aug. 31, 2018. The S&P 600 (TR) is up 18.3% ytd, as compared with 9.9% for the S&P 500 (TR) and 8.7% for the S&P 400 (TR). The small cap outperformance was widened in Aug. with a monthly return of 4.8% versus 3.3% for large caps and 3.2% for mid-caps. It was the sixth straight positive month for small-caps delivering a total return of 20.0% over the period in the strongest run since the six months ending Mar. 2012, when the index gained of 31.2%.

While all eleven sectors are positive year-to-date for mid and small caps, some of the small cap sectors are having near record years. For example, industrials, the biggest sector in the S&P 600, is having its best year since 1997, up 17.5% ytd, and its third best on record. The smaller companies of this sector may be more insulated from U.S.-China trade tensions and also has less revenues coming from overseas so has outperformed the large-cap industrials. Also, heath care in small caps is having its second best year on record, up 47.4%, the best ytd performance since 2000. That is also driving the S&P 600 Growth (TR) that has nearly 20% in health care to have its second best ytd performance on record, up 23.5% – the most since 2003. On the other hand, small cap-energy lost more in Aug. than large caps in energy from supply disruptions that drove oil price volatility.

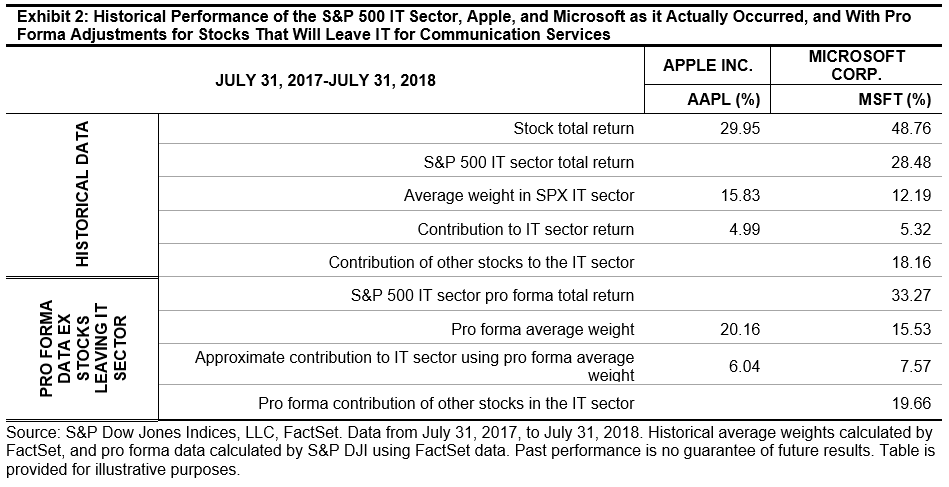

In Sept., please be reminded of the implementation of the expansion of the telecommunication services sector into the communication services sector according to Global Industry Classification Standard (GICS.) For more information, please visit our website.

The posts on this blog are opinions, not advice. Please read our Disclaimers.