Questions and some answers on issues facing, or created at, the Fed

Raise Rates?

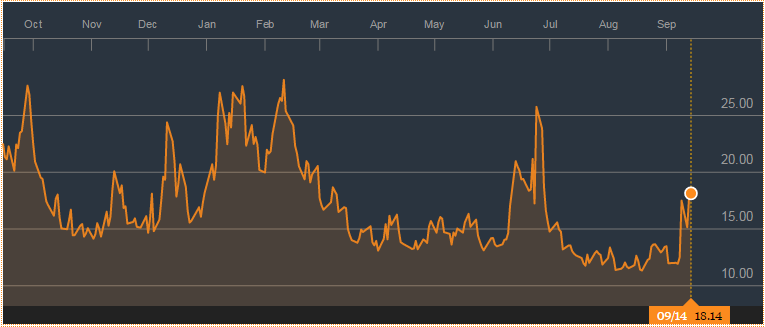

Not very likely next week at the September 21st FOMC meeting. Recent data including August jobs report, declines in Industrial Production and Retail Sales and comments from FOMC members argue against a move now. The November 2nd meeting is just days before the election so attention will be the December 14th FOMC session. As of now the probability appear to be close to, but a bit below, 50%.

Policy Puzzles – The last eight years have seen more changes in the Fed’s policy making and operations than any time since 1979. Some comments on the innovations:

Quantitative Easing (QE) raised the price and lowered the yields on intermediate and long term bonds in an effort to spur business investment and encourage consumer spending on big ticket items. Lower long term interest rates increased the prices of houses and stocks, adding to household net worth. The same low interest rates raised havoc for pensions and insurance companies facing long term liabilities. Business investment gains were harder to identify.

Negative Interest Rates were the next step when the combination of QE and near-zero central bank policy rates didn’t provide sufficient stimulus. In Switzerland, but not in Japan, negative interest rates weakened the currency. They did manage to push real interest rates farther into negative territory despite extremely low inflation. However, negative interest rates damage consumer confidence and encourage saving more than spending. They also distort normal relations among different debt instruments and the yield curve.

Raising the Fed’s inflation target maybe one way to raise interest rates and give the Fed more room to lower rates when the next recession appears. The arithmetic works but pushing the inflation target to 4% would add to fears that past QE is setting us up for much higher inflation. Given the difficulty the Fed and other central banks have in even getting inflation up to 2%, everyone may doubt that a 4% inflation target could be achieved.

The Phillips curve seems to have disappeared. A building block of monetary policy is the inverse relation and trade-off between inflation and unemployment usually referred as the Phillips curve. A basic tenet of monetary theory is that raising the policy interest rate – the Fed funds rate in the US – will raise unemployment and lead to lower inflation. This worked until recently. Then after the 2007-9 recession ended, unemployment came down from 10% to 5% but inflation remained a bit under 2%. Although current data suggest this theory isn’t valid now, it is still being cited in arguments for and against higher interest rates.

One counter to policy built on the Phillips curve is called Neo-Fisherism, named after economist Irving Fisher. Fisher is known for two things: predicting that stocks had reached a permanently higher valuation level just before the 1929 crash and explaining that the nominal interest rate is the sum of inflation and the real interest rate. (Most economists prefer to remember Fisher for the second item.) Traditionally Fisher’s interest rate rule is understood to mean that causation runs from inflation to the nominal rate. Borrowers and lenders focus on the real rate and nominal rates adjust to compensate for inflation. Neo-Fisherism turns this upside-down: The central bank sets the nominal interest rate. The real (or natural) rate of interest is determined by economic conditions – it may vary in the short term but not in the long term. Inflation then adjusts to re-establish the proper relation between the nominal and real interest rates. In this world, the Fed would raise interest rates if it wanted to raise inflation. Moreover, the same logic argues that if the Fed keeps interest rates low, it will not be able to raise inflation.

Another alternative to traditional monetary thinking is the Fiscal Theory of the Price Level (FTLP) which also attempts to explain why QE and low interest rates haven’t succeeded in raising inflation. Under QE, the central bank buys bonds and increases the money supply by raising the cash banks have on hand or on deposit at the Fed. Traditionally this increase in the money supply should have raised inflation – more money chasing fewer goods means higher prices. A simplified version of FLTP says all QE did was swap bonds and money – in a modern market economy with rock bottom interest rates bonds and money are both liquid ways to hold cash. Since they are almost equivalent, QE doesn’t affect the supply of liquidity and can’t effect inflation. If the central bank really wants to increase liquidity, it must turn to the fiscal authority – the Treasury – for expanded fiscal spending. Without the credibility of increased debt-financed government spending, liquidity won’t increase and inflation won’t move.

As the Fed and others debate all these theories, interest rates are likely to stay low for a while longer. If the economy picks up in the third quarter, the Fed may deliver a rate hike as an early Christmas present.

The posts on this blog are opinions, not advice. Please read our Disclaimers.