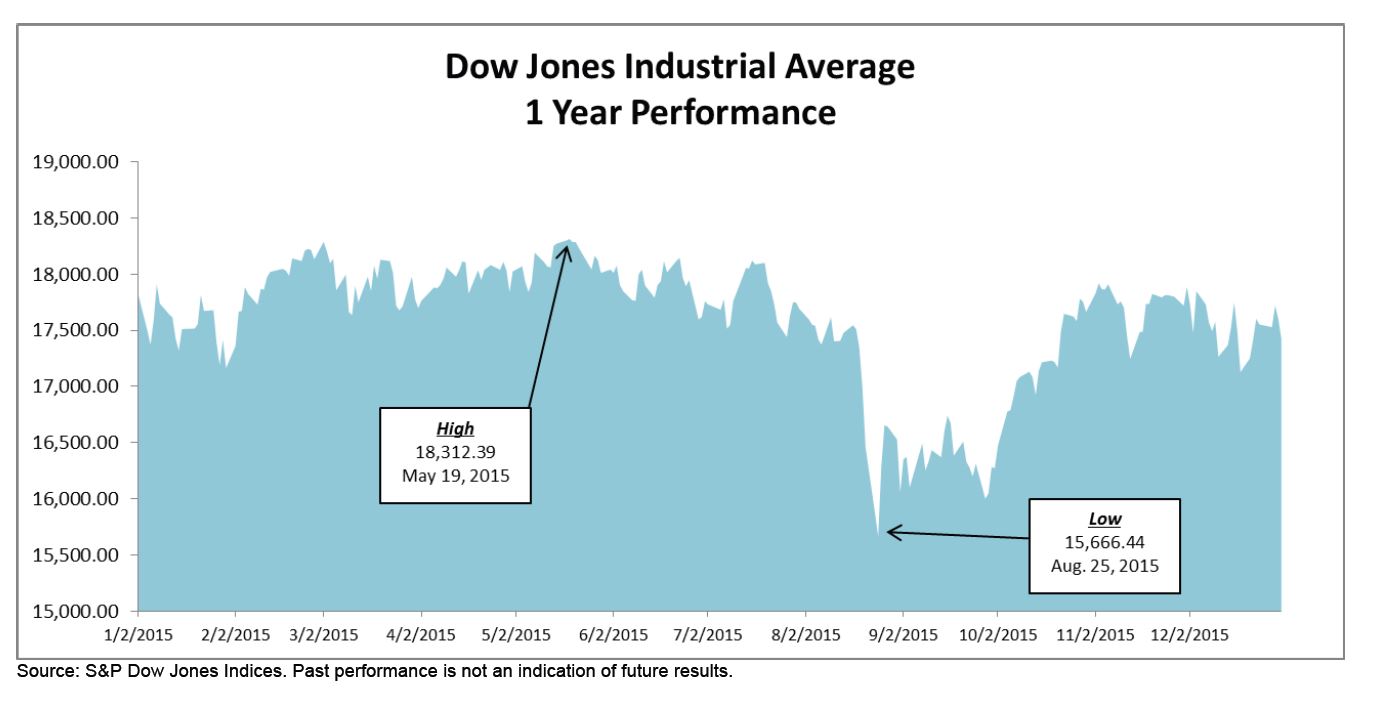

The Dow Jones Industrial Average ended 2015 at 17,425.03 – down 398.04 points on the year for a -2.23% annual return.

- Leader & Laggard – Nike (NKE) was the biggest contributor during 2015;

Walmart (WMT) was the biggest detractor. - Industry Performance – Consumer Services was the leading industry for the

year; technology the worst. - Worst Day (In Points & Percent) – down 588.40 points or -3.57% – on August

24th. While bad – the worst 1 day loss since August 2011 – it could have been

worse: the DJIA was down over 1,000 points in early trading before recovering. - Best Day (In Points & Percent) – a mere two days later, on August 26th, the DJIA

finished up 619.07 points or 3.95% as investors were drawn back to the markets

following a period of apparent panic selling. - New Highs – the second half of 2015 saw no new highs for the DJIA, the last

having been struck on May 19, 2015 when the Average closed at 18,312.39. - Changes – there was a momentous component change when Apple replaced

AT&T. Additionally, there were a few significant stock splits in 2015.