Headline news on Friday was that oil dropped below $40 per barrel, the lowest since March 3, 2009. It’s bad news for an oil investor to learn 6 1/2 years are wiped out – that is no gain since the bottom of the financial crisis.

Unfortunately, the reality is so much worse than that. The price per barrel of oil is an unrealistic measure for most investors since the oil needs to be stored and that can be costly. Futures contracts are priced to include the storage costs, so according to the theory of storage equation, one is indifferent between buying an oil futures contract or buying physical oil and storing it until the time of expiration of the contract. Needless to say, storing at least 1000 barrels of oil is inconvenient, so most investors prefer futures. Sometimes, returns of futures contracts are more profitable than the spot returns and at other times futures lose more than the spot market. Inventories drive the difference where excess inventory that is expensive to store is losing to a futures investor from a curve condition called contango. The opposite condition, called backwardation, is profitable and happens when there is a shortage so there is no value to storage, and a premium, called convenience yield, is put on owning the commodity immediately.

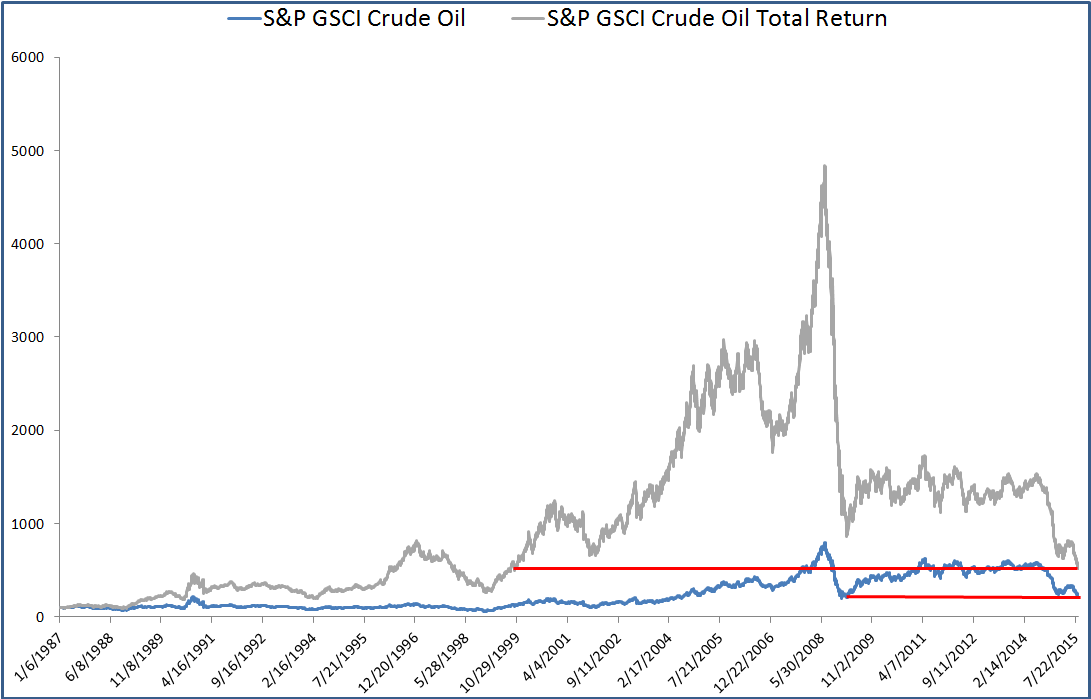

Obviously right now there is excess oil inventory, but how much is being lost from the term structure of futures as described by the theory of storage equation? It might be more than you think. The answer is shown graphically below where the S&P GSCI Crude Oil Total Return includes the term structure costs from rolling but the S&P GSCI Crude Oil does not. With a quick glance, it is clear that 10 additional years of returns are wiped out from these costs.

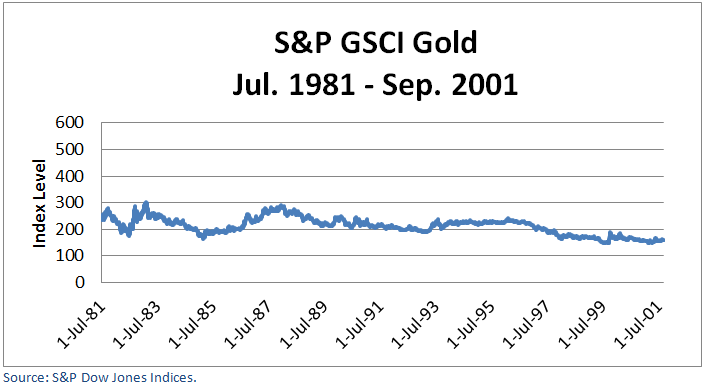

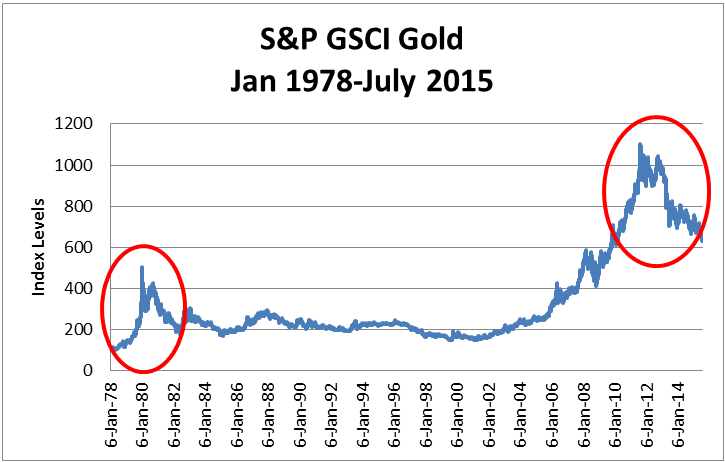

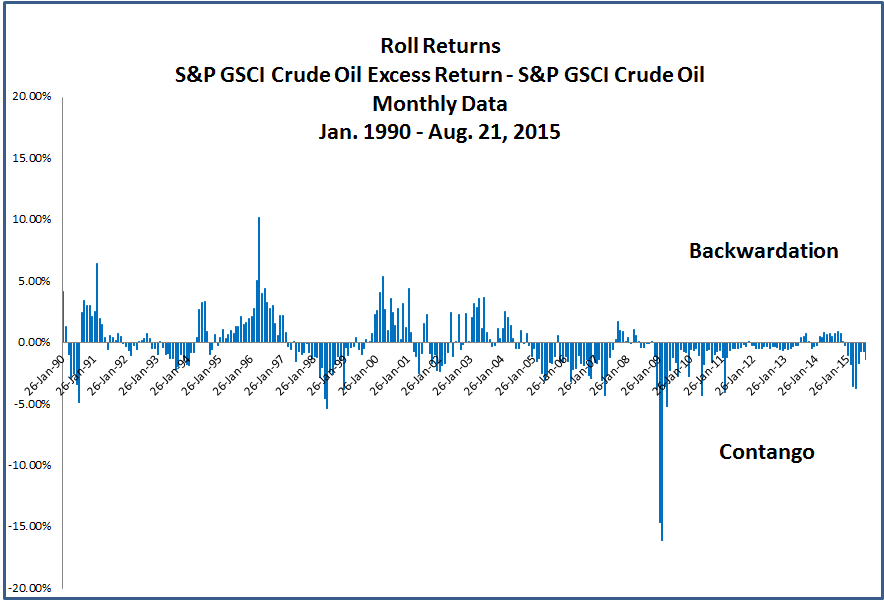

At Friday’s close, the S&P GSCI Crude Oil index was at 221.69, the lowest since 3/2/2009 when the level was at 220.05, and it fell 62.1% since its high on June 20, 2014. However, the S&P GSCI Crude Oil Total Return fell 66.3% from its June high to a level of 516.55, its lowest since Oct. 11, 1999 when the index was 508.38. Four percent may not seem like much, and although the difference is small from the backwardation that was present through Nov, 2014 (as shown in the chart below,) again, it is enough to erase an additional 10 years of returns.

Two things are interesting. One is that the current rolling costs are currently only about half of what was observed in the drawdown from July 14, 2008 to Feb. 18, 2009. The other interesting observation is that the huge negative rolling costs don’t exactly correlate with the timing of the drawdowns. It was really in Jan and Feb of 2009, that the roll cost spiked with a 33.5% loss in the total return versus a 10.0% loss in the spot return. It took the inventories over 4 years to deplete with no significant shortage for roughly 6 years as shown in the chart below:

It is difficult to predict how long this glut will last. However, It may be longer than expected if China decides to use some oil from its (unkown) strategic petroleum reserve as prices rise, and its devalued yuan makes it more expensive to import the oil.

To add to the turmoil, on average when oil is down, it drops 6.9% in a negative month. Historically, gas falls about the same amount, losing 7.0% in a negative oil month. This time unleaded gasoline has held its value relatively well, only dropping about 1/4 of the drop in oil, reducing the benefit to consumers.

From processing issues to labor costs, despite commodity drops, prices seem to be rising for consumers. Check out announcements from: Starbucks about raising prices despite a near 25% drop in coffee this year; the USDA announced rising beef and pork prices despite S&P GSCI Feeder Cattle, Live Cattle and Lean Hogs losing 8.2%, 12.1% and 22.6%, respectively; some are even reporting bread price increases despite a drop of 14.5% and 21.4% in Chicago and Kansas Wheat. At least chocolate prices are increasing with a the rise in the cocoa commodity price – that is up 5.6% year-to-date. Maybe a little extra serotonin is helping the demand in this otherwise stressful market.

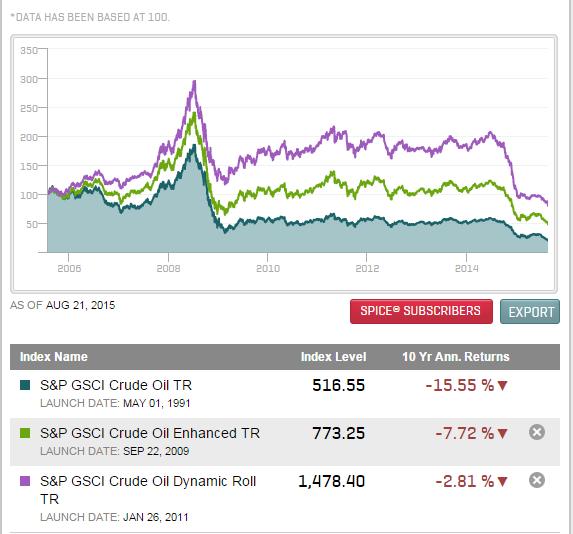

To end this on a sweeter note, many index innovations have been developed to better manage rolling costs from contango. The chart below shows an annualized 10-year comparison of an enhanced rolling strategy that is relatively simple but reduced the loss by half. It also compares a more sophisticated dynamic roll that has lost less than 3%. If diversification and inflation protection are goals, a smarter rolling strategy may be useful for a potentially prolonged term structure in contango.

The posts on this blog are opinions, not advice. Please read our Disclaimers.