The author would like to thank Clara Arganaraz, Index Manager of the S&P 500® Net Zero 2050 Paris-Aligned Sustainability Screened Index, for her contributions to this post.

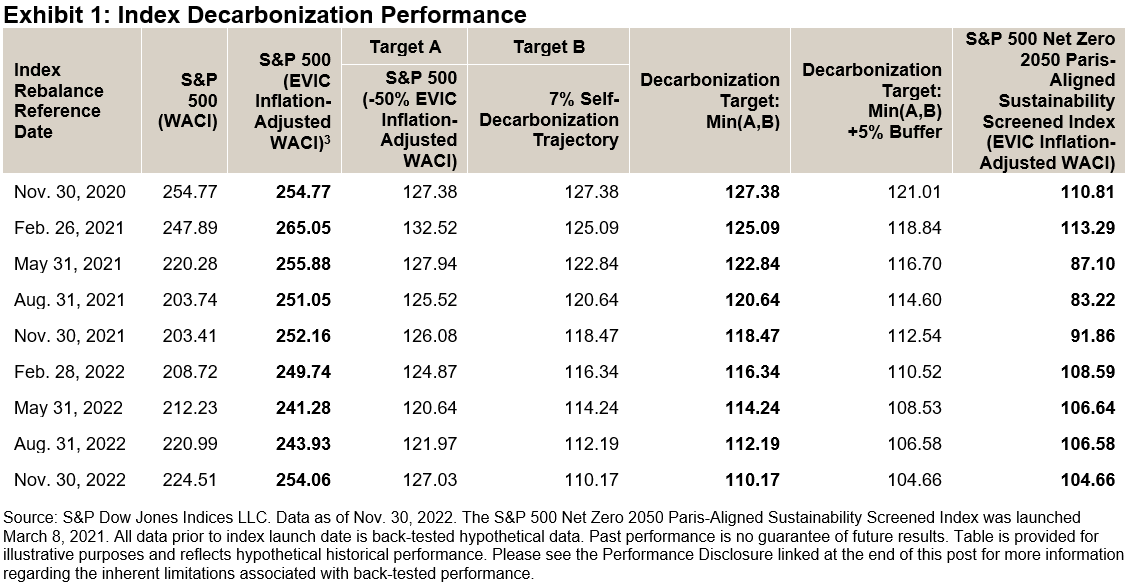

S&P Dow Jones Indices recently completed the rebalancing of all indices that aim to meet the minimum requirements for EU Climate Transition and EU Paris-Aligned Benchmarks.1 This includes the rebalancing of the S&P 500 Net Zero 2050 Paris-Aligned Sustainability Screened Index, which is designed to measure the performance of eligible equity securities from the S&P 500, selected and weighted to be collectively compatible with a 1.5ºC global warming climate scenario at the index level, among other climate, environmental and sustainability objectives.

The index is designed to achieve a variety of ESG objectives through the use of sustainability screening in its eligibility criteria and an optimization process in constituent selection and weighting, including a reduced overall greenhouse gas (GHG; expressed in CO2 equivalents) emissions intensity compared to its underlying index (the S&P 500) by at least 50%. The index also includes a minimum self-decarbonization rate of GHG emissions intensity in accordance with the associated trajectory implied by the Intergovernmental Panel on Climate Change’s (IPCC) most ambitious 1.5ºC scenario, equating to at least a 7% GHG intensity reduction on average per year.

As of the index’s Nov. 30, 2022, rebalancing reference date (and all previous rebalances), the index’s enterprise value including cash (EVIC) inflation-adjusted weighted-average carbon intensity (WACI)2 achieved its required level of decarbonization—the minimum of either half the S&P 500 WACI or its 7% self-decarbonization trajectory WACI as at the rebalance reference date. The index achieved a relative decarbonization to the underlying index of 58.80% at an EVIC inflation-adjusted WACI at the required level (104.66).

The index seeks to achieve a variety of other objectives simultaneously, and once more, was able to achieve them successfully at the recent rebalance.

- The index’s weighted-average 1.5˚C Climate Transition Pathway Budget Alignment4 was marginally below zero, implying the index is 1.5˚C Climate Scenario-aligned at the index level.5

- The index’s weighted-average S&P DJI Environmental Score achieved the minimum level required at this rebalance (72.45) based on this constraint in the methodology, also exceeding the score of the underlying index (65.65).

- The index’s high climate impact sectors revenues exposure was at least as high as in the underlying index, as required by the minimum standards for EU Climate Transition Benchmarks and EU Paris-aligned Benchmarks.

- The index had a lower exposure to companies deemed to insufficiently disclose their GHG emissions, at a level well below its maximum exposure permitted by the methodology.

- The index did not have any exposure to companies with fossil fuel reserves, despite the methodology permitting a maximum of 20% of the exposure of the underlying universe.

- The index-level physical risk score (31.74) was at the required level as of the rebalance, as defined by the methodology, and it was lower than the underlying index’s score (35.27).6

The index’s ratio of green revenues to brown revenues was four times higher than in the underlying index, as required by the methodology.

The S&P 500 Net Zero 2050 Paris-Aligned Sustainability Screened Index seeks to achieve a range of climate change, environmental and sustainability objectives, and again the index has met these ambitions.

1 Commission Delegated Regulation (EU) 2020/1818 of 17 July 2020 supplementing Regulation (EU) 2016/1011 of the European Parliament and of the Council as regards minimum standards for EU Climate Transition Benchmarks and EU Paris-aligned Benchmarks. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32020R1818&from=EN

2 Measures are calculated in metric tons of carbon dioxide-equivalent emissions per USD 1 million of EVIC (tCO2e/USDmn). For more information on how this metric is calculated, see “Weighted-Average Carbon Intensity (WACI)” in the Constraint-related Definitions section of the S&P 500 Net Zero 2050 Paris-Aligned Sustainability Screened Index Methodology.

3 For more information on how the WACI is adjusted for EVIC inflation, see ‘Inflation Adjustment’ in Section 3, Part 4 of the EU Required ESG Disclosures Appendix in the S&P Paris-Aligned & Climate Transition Index Family Benchmark Statement.

4 For more information on how this metric is calculated, see the Constraint-related Definitions and Optimization Constraints sections of the S&P 500 Net Zero 2050 Paris-Aligned Sustainability Screened Index Methodology, and the S&P Dow Jones Indices: ESG Metrics Reference Guide.

5 A measure at or below zero means the index is 1.5˚C Climate Scenario-aligned at the index level.

6 A lower score is associated with less physical risk exposure at the index level.

The posts on this blog are opinions, not advice. Please read our Disclaimers.