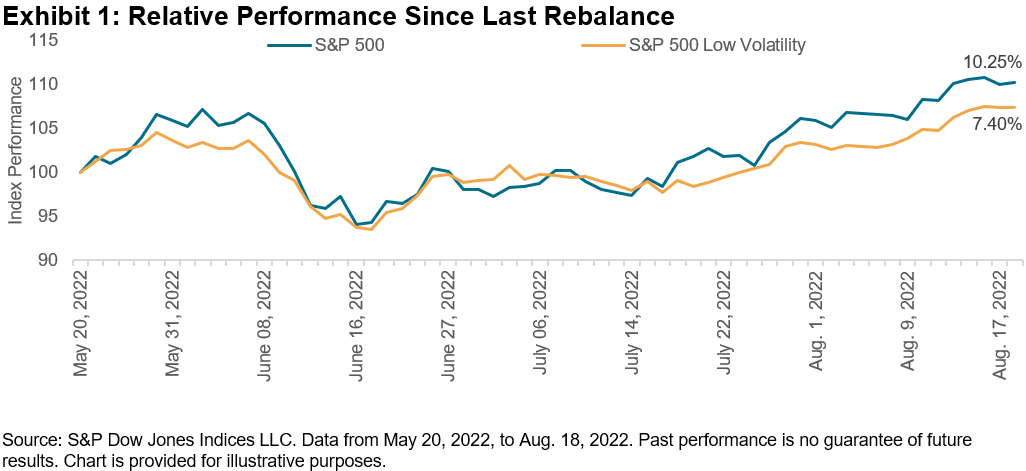

If the first six months of 2022 were defined by the woes of equities, the year’s second half has been defined (so far!) by a comeback. Since hitting a low in mid-June, the S&P 500® has gained an impressive 17.1% through Aug. 18, 2022. In such an environment, low volatility strategies are expected to underperform, and, reliably, the S&P 500 Low Volatility Index (which has historically tempered the performance of the benchmark) gained “just” 14.5%, underperforming 2.6% in the same period. This reflects an upside capture of 85%. (Historically, the low volatility index’s upside capture has averaged 72%.)

Volatility has generally risen since the low volatility index’s last rebalance, with the biggest increase in the Consumer Discretionary and Energy sectors.

The latest rebalance for the S&P 500 Low Volatility Index shifted an additional 3% weight to the Health Care sector. Consumer Discretionary, despite notching the highest volatility increase, also added weight to the portfolio, pointing to pockets of relative stability within the sector. Information Technology, which in recent years has had a higher allocation relative to its presence historically, has been paring back its allocation in the past three rebalances. It now takes up just 3% of the low volatility index. Energy’s weight remains at 0%. The latest rebalance is effective after the market close on Aug. 19, 2022.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

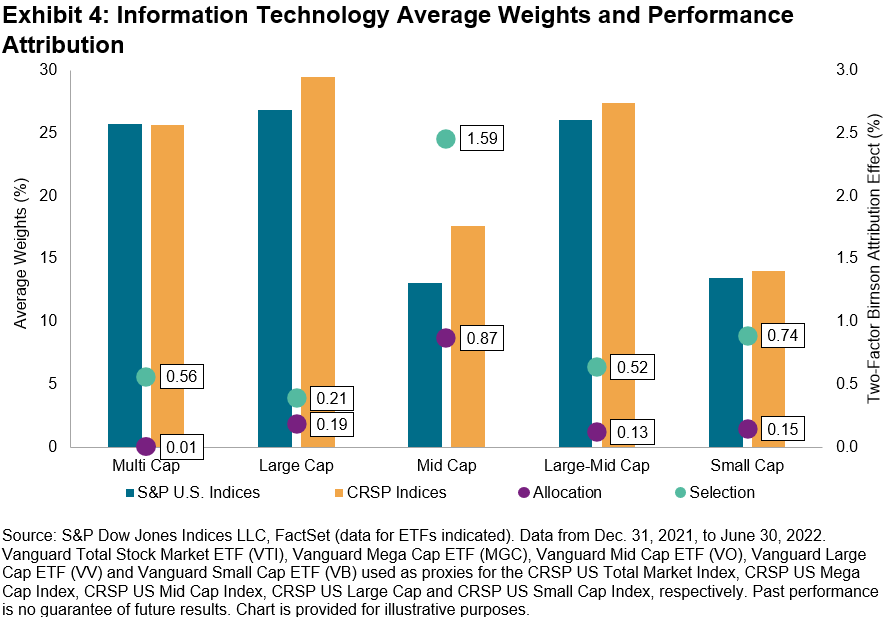

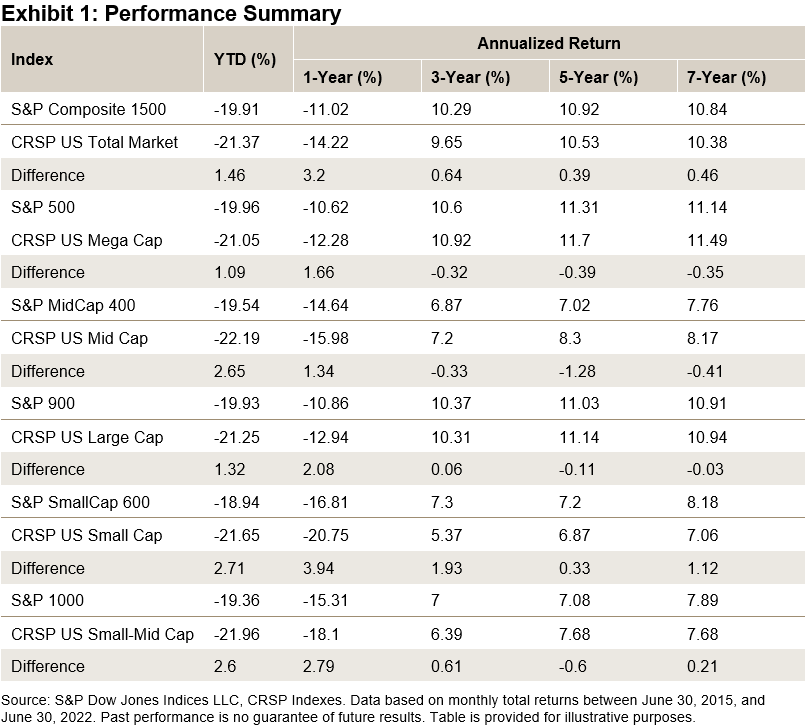

Differences in index construction can help us to understand these performance differentials. Exhibit 2 summarizes the methodologies underlying the S&P DJI U.S. equity indices and their CRSP counterparts. One of the biggest differences between the methodologies is that, unlike the CRSP indices, the S&P 1500 and its component indices use an earning screen: new index additions must have a history of positive earnings.

Differences in index construction can help us to understand these performance differentials. Exhibit 2 summarizes the methodologies underlying the S&P DJI U.S. equity indices and their CRSP counterparts. One of the biggest differences between the methodologies is that, unlike the CRSP indices, the S&P 1500 and its component indices use an earning screen: new index additions must have a history of positive earnings.