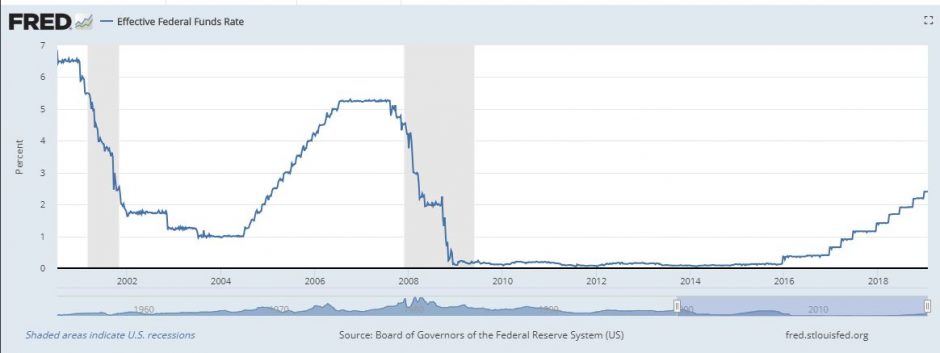

Today’s Fed announcement keeping the Fed funds target range at 2.25% to 2.5% was more than simply leaving rates unchanged for the moment. Behind the headlines are changes in their expectations for inflation and the economy and adjustments in their operating procedures:

- The FOMC will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate.

- The Fed expects overall inflation and inflation for items other than food and energy to remain near 2%.

- The FOMC views sustained economic expansion, strong labor markets and inflation near 2% as the most likely outcome.

Given this view of the economy and inflation, there is no need to raise rates unless conditions change. The Fed is dropping its plan for gradual rate increases. It will be closely watching the incoming data, but it won’t rush to judgment.

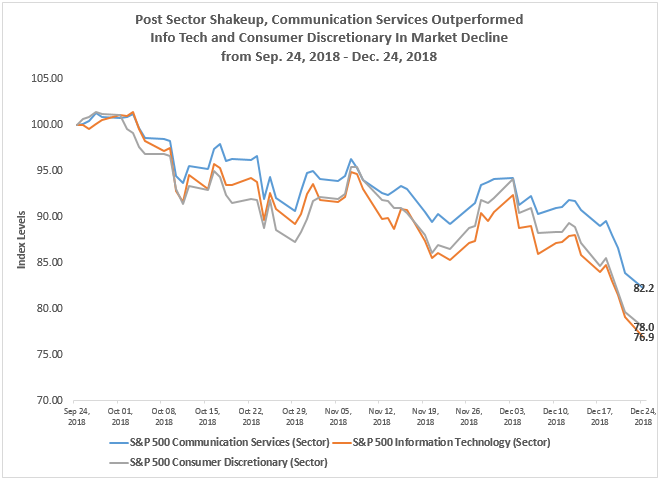

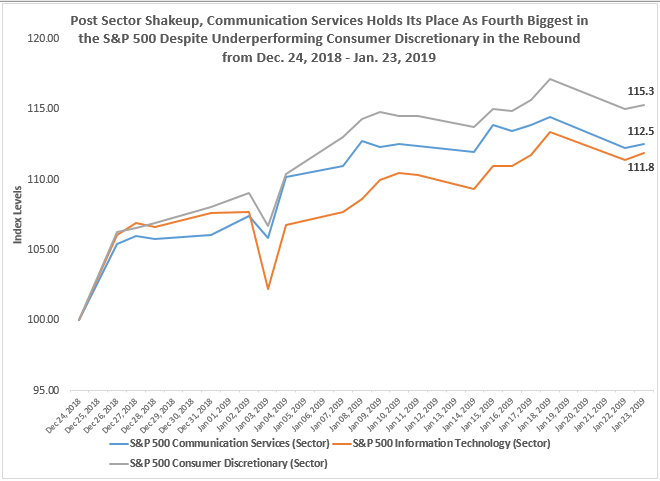

Supporting this change are continued and gradual reductions in the still overly large Fed balance sheet combined with ample bank reserves that should help curtail any market volatility. The Fed manages the Fed funds rate by adjusting the level of excess bank reserves – the extent by which bank reserves exceed reserves required by regulations and deposit levels – and by setting the interest rate it pays on excess reserves held by banks. By assuring ample reserves, the Fed will be limiting the risk of the kind of market gyrations seen at the end of 2018.

Market expectations align with the Fed’s stance. The CME’s Fed Watch Tool calculates the probability of a rate increase at each FOMC meeting through January 2020. Through the end of 2019, the probability that the Fed holds the rate at its current target is 80% or more. Even in early 2020, the probability of keeping the rate only dips slightly to 73%.

Needless to say, there are no guarantees in anything financial. However, for the moment interest rates seem likely to stay close to where they are.