The Global Industry Classification Standard (GICS) was first developed in 1999 as a four-tiered, hierarchical industry classification system. It is managed jointly by S&P Dow Jones Indices and MSCI to serve as the major global industry framework for investment research, portfolio management, and asset allocation. Each company is assigned a single GICS classification at the sub-industry level according to its principal business activity using quantitative and qualitative factors including revenues, earnings and market perception. Annual reviews are conducted to ensure that the structure remains fully representative of the current global market.

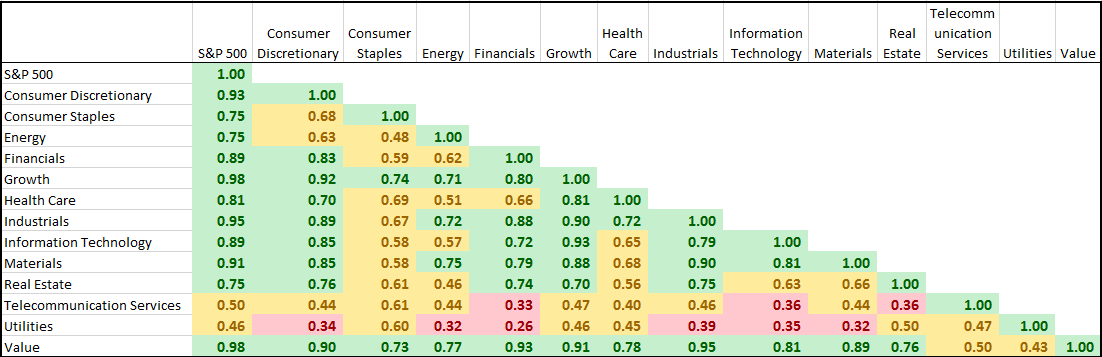

While the GICS assignment doesn’t change constituents and weights in composite indices like the S&P 500, the classifications are important for attribution and understanding the economic impacts on sectors and industries. Further, with the increasing popularity of sector products, the changes are vital to know for making investment decisions and measuring managers who are sector specialists. Market participants may use the sectors consisting of related companies that tend to perform similarly and display strong correlation in rotation strategies, for focused diversification in lieu of single stocks or for different growth and value characteristics. Note the wide range of performance and relatively low correlation between certain sectors. For example, the 10-year annualized return of consumer discretionary was 14.5% as compared with the -0.2% delivered by energy, and the two sectors have a moderate correlation of 0.63 that can provide both opportunities and diversification.

Note the high correlation, 0.93, of consumer discretionary to the S&P 500 that shows how much the U.S. economy is driven by consumer spending. There are also sectors like utilities and telecommunication services that have shown much lower correlation the the S&P 500 and to other sectors. Sometimes sector fundamentals drive performance differently as observed between energy and consumer staples with a correlation of 0.48. Regardless of whether oil is rising or falling, basic goods are still needed.

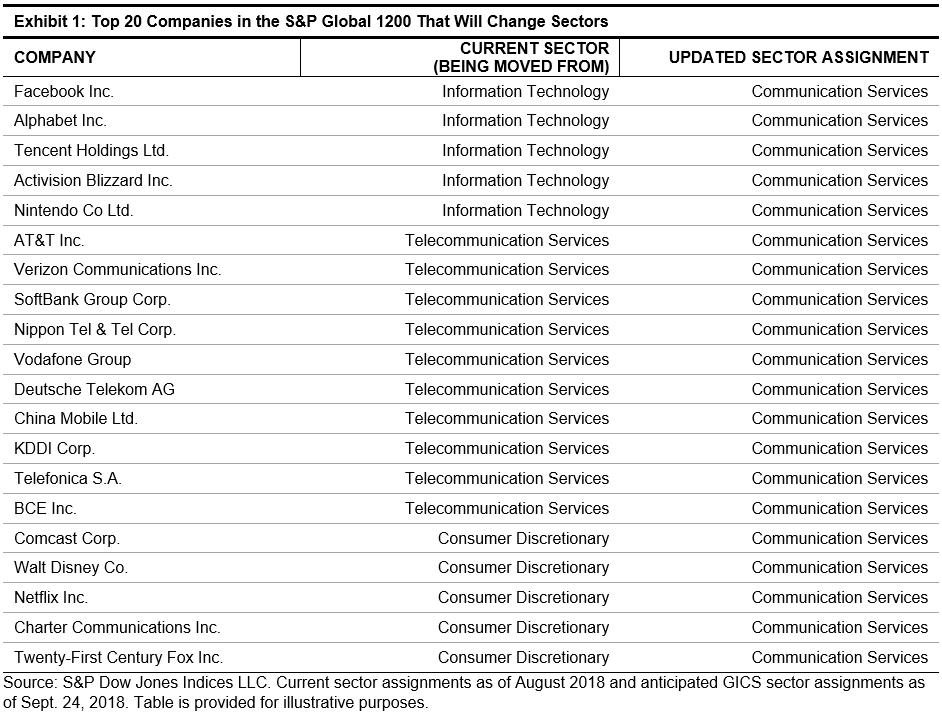

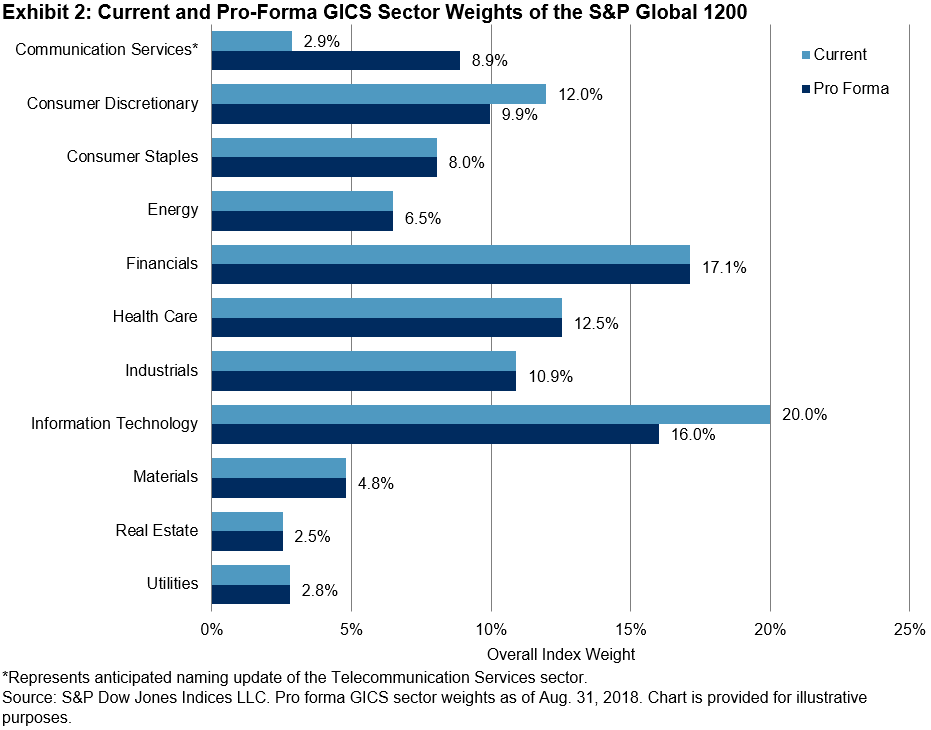

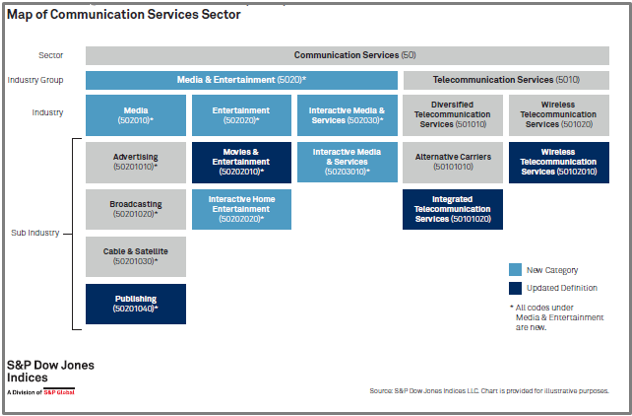

On Monday, Sep. 24th, 2018, the biggest GICS change in history will take place. It will impact, the biggest sector, information technology, as well as the consumer discretionary and telecommunication services sectors. This is a result of market feedback confirming the ways in which people communicate and seek information have transformed. Integration between telecommunications, media, and internet companies in terms of both infrastructure and content have advanced the communication industry into a much broader field as evidenced by the convergence between telecom and cable companies. Many internet companies have become synonymous with social communication and information, while the Internet Software & Services Sub-Industry has become too diverse, evolving to include new business models using internet technology to cater to a variety of end users and industries. Most now regard the internet as simply a medium for delivery of a company’s products & services. The impact on the GICS classification is depicted below to show the expansion of telecommunication services into the communication services sector with new definitions described here.

In the next part of this post, more details of the results will be shown including major stocks moving, market caps, growth/value characteristics, fundamentals and proforma performance.

Special thank you to my colleague, Louis Bellucci, for his contribution to this post.

The posts on this blog are opinions, not advice. Please read our Disclaimers.