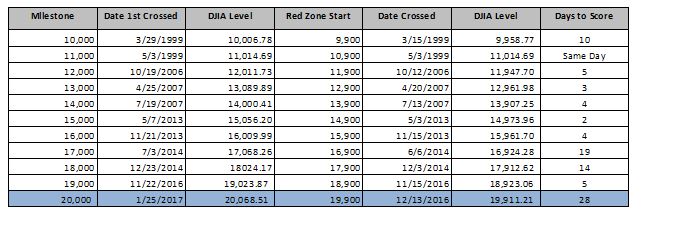

Since the U.S. presidential election on Nov. 8, 2016, the S&P/BMV Sovereign UDIBONOS Bond Index, which seeks to track inflation-protected Mexican government bonds, outperformed its nominal counterpart, the S&P/BMV Sovereign MBONOS Bond Index (see Exhibit 1). What was the driver behind this outperformance, and can we expect it to persist?

Exhibit 1: S&P Mexico Sovereign Bond Indices Performance

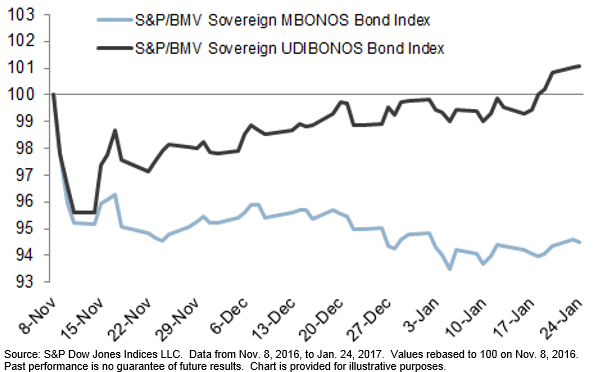

One way to analyze the relative value of inflation-linked bonds versus nominal bonds is to compare the implied break-evens priced between the two against near-term inflation expectations. Since November 2016, break-even points have widened out substantially; December 2017 bonds are wider by 2.4%, at 5.9%, and June 2022 bonds are wider by 1.7%, at 4.7%. In other words, for a market participant to see more value in the June 2022 UDIBono inflation-linked bond than in the nominal version, they must believe that inflation will surpass 4.7% over the investment horizon.

Exhibit 2: December 2017 and June 2022 Nominal Versus Real Bond Break-Evens

Can forward-looking inflation deliver the returns priced in UDIBonos?

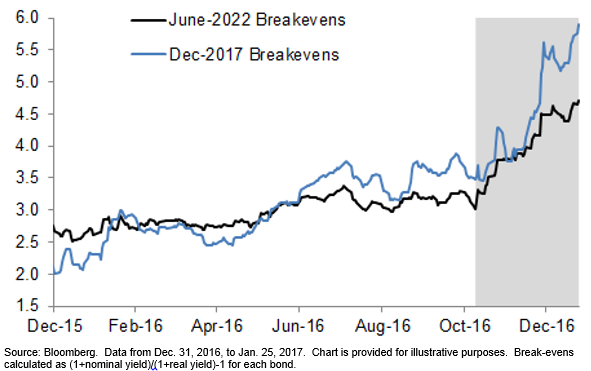

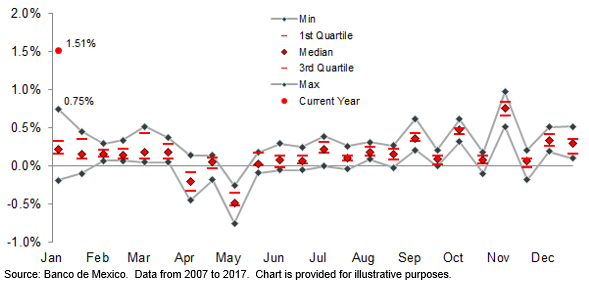

Anticipating seasonal patterns as well as identifying the near-term drivers and associated risks to assumptions are key in the decision-making process. Over the past decade, monthly consumer price inflation in Mexico has tended to reach a peak in November, slowing through the first quarter to a trough in May (see Exhibit 3).

Exhibit 3: Distribution of Monthly Inflation in Mexico

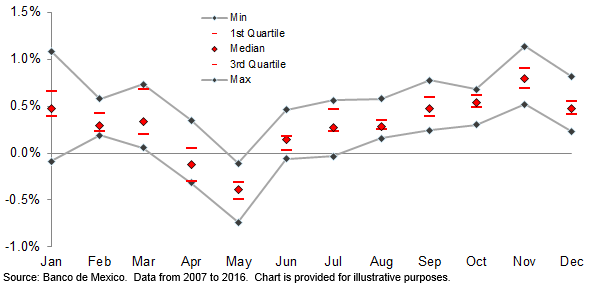

In late December 2016, Mexican authorities announced plans to liberalize domestic gasoline prices starting in January 2017. The effects of the decision can already be seen in the first bi-weekly inflation print of the year. The CPI of 1.51% for the first two weeks of 2017 surprised economists—a Bloomberg survey found that economists’ CPI expectations for this period ranged from 0.53% to 1.46% (see Exhibit 4). As a result of the record high print and unfavorable base effects, the year-over-year bi-weekly CPI for Jan. 15, 2017, jumped to 4.78% from 3.24% print on Dec. 31, 2017. The central bank’s target range is 3% ±1%.

Exhibit 4: Mexico Bi-Weekly Inflation History

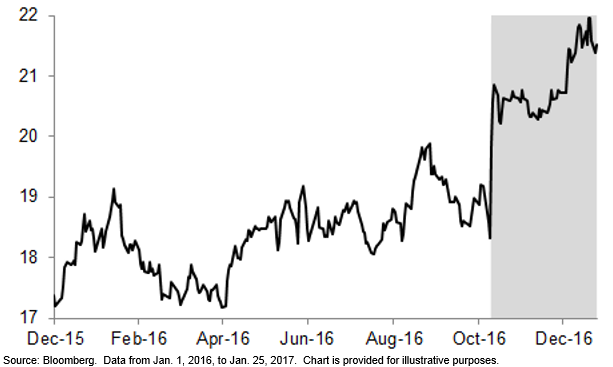

In addition to higher domestic gasoline prices, pass-through from the sharp exchange rate devaluation since the U.S. presidential election on Nov. 8, 2016, will likely continue to pressure the index in the coming months. The MXN slipped nearly 14.9% between the Nov. 8, 2016, close and the Jan. 25, 2017, close (see Exhibit 5).

Exhibit 5: Movement in Value of the Mexican Peso

Although we are now entering a low seasonal period with historically high break-even points, the balance of risks seems to be to the upside. With the record-breaking first bi-weekly print behind us, it shouldn’t take much more than the historical median (see Exhibit 4) to buoy the UDIBonos.

The posts on this blog are opinions, not advice. Please read our Disclaimers.