Something unusual happened in August in commodities where energy was the only sector that rose. Despite the negative non-energy performance, supply shocks created pockets of opportunity for some individual commodities within industrial metals and agriculture.

Now, oil has turned negative again from record high inventories despite U.S. production cuts, because OPEC producers have more than filled the gap and demand growth is faltering. Not only is emerging demand from China and India more unstable from slowed expansion and weak infrastructure demand, but developed market demand is also slowing as the stimulus from low oil prices is running out of fuel. As oil has become a major macro economic factor in GDP growth estimates, its low price seems like more of a liability than an asset as the horizon for a balanced market seems further away.

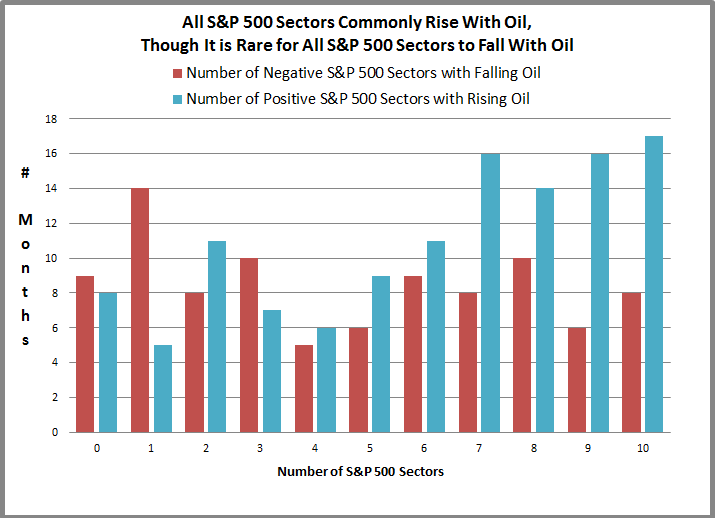

Upon inspection of the equity sectors, there is equally as rare and gloomy of a picture as in the commodities market. History shows that like with all commodities that rise with oil, rising oil supports the majority of equity sectors most of the time. In 120 positive oil months, 6 or more sectors were positive in 74 of those months or 62% of the time. In fact, there were 17 months where all ten sectors were positive with rising oil, which was the most common scenario with rising oil. On the other hand, when oil fell, the impacts on sectors were mixed with all 10 only simultaneously falling with oil in 8 months of 93 negative oil months and a total of 213 month in the time period since Jan. 1999.

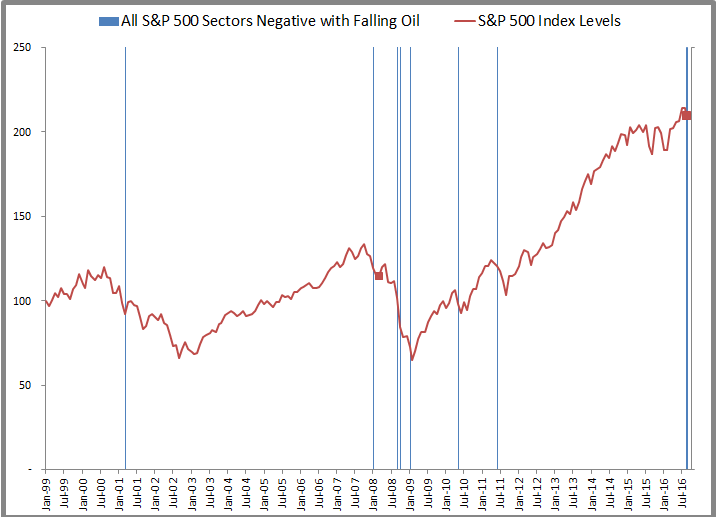

Month-to-date as of Sep. 14, 2016, oil is down and all the equity sectors are down with it. The last time this happened was over five years ago in Jun. 2011. Back then, the S&P 500 lost 14.0% in the following three months. However, the last time the unusual lonely rise of energy in the commodity spectrum happened in Mar. 2008, it took place near the same time as the as the unusual simultaneous equity sector drop back in Jan. 2008, right after the peak before the global financial crisis.

It may be coincidental timing or it may be related to the demand crisis in oil that might be hurting the economy enough for negative sector performance across the board, even if there is a rogue month of a bear market rally in oil alone.

Additionally, the sector risk premiums, a measure of the sentiment showing where investors are excited to participate in the upside of the stocks versus hide in the safety of the bonds, show 8 of 10 sectors with discounts. This is the most since Sep. 2015, when the Chinese stock volatility was rippling through the market. Now just technology and utilities are still positive but the technology risk premium has fallen to just 1.3% from 6.6% just two months ago.

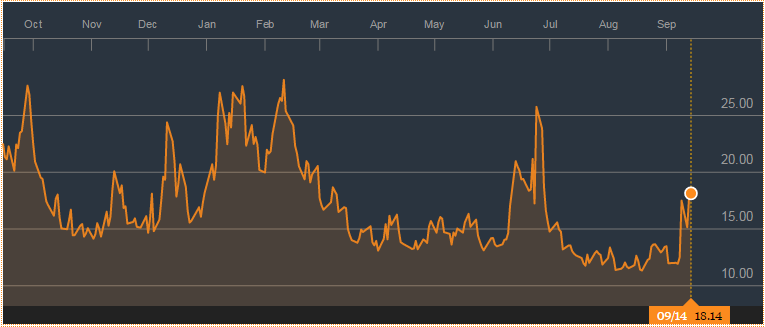

One last possible reflection that market participants are feeling the fear is evidenced by a spike in VIX, at its highest levels since the end of June.

The posts on this blog are opinions, not advice. Please read our Disclaimers.