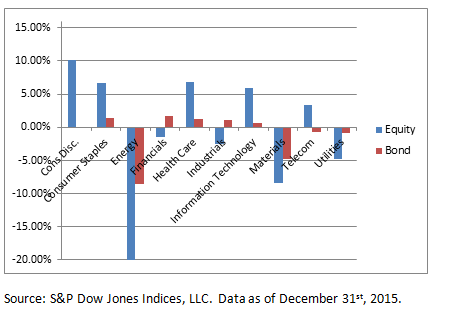

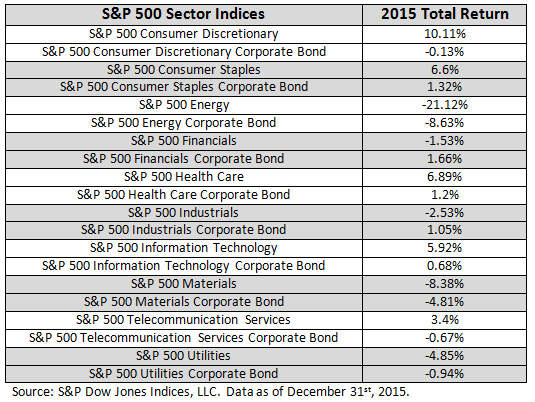

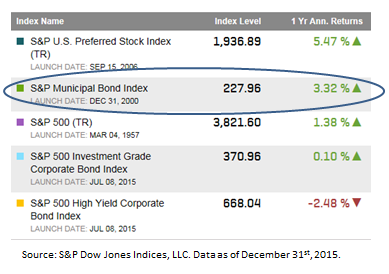

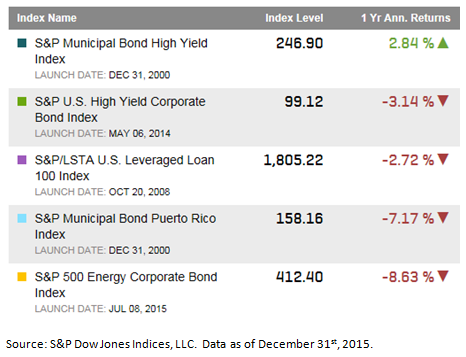

The S&P 500 Bond Index sectors creates the opportunity to examine sector performance on both the stock and bonds issued by the companies in the S&P 500 Index. The 2015 results: As expected corporate bonds were less volatile than their equity counterparts but they still suffered from the energy and materials onslaught.

Highlights (total returns used for comparability):

- Of the ten sectors sampled, five equity sectors saw positive returns in 2015.

- Bonds of the five sectors with negative performance did better than equities of those sectors.

- Energy was the biggest mover with equities down over 21% and bonds of those same companies down over 8.6%.

- Materials was also impacted hard in 2015 with equities down over 8.3% and bonds of those same companies down over 4.8%.

Chart 1: Selected S&P 500 sector indices for stocks and bonds

Table 1: Selected S&P 500 sector indices for stocks and bonds

The posts on this blog are opinions, not advice. Please read our Disclaimers.