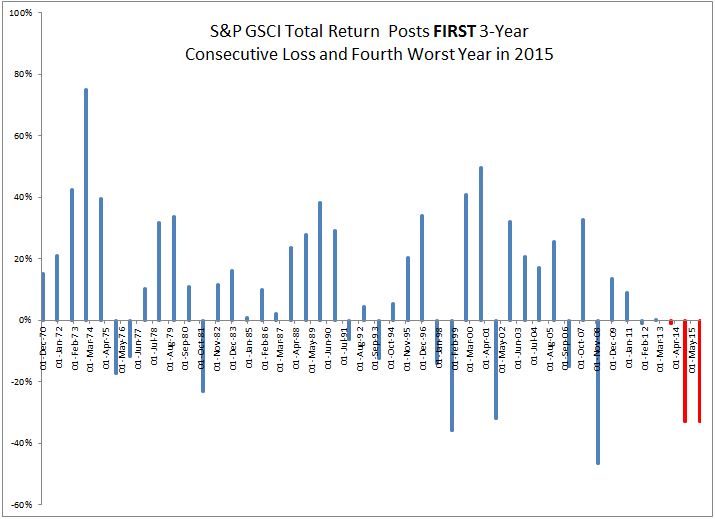

2015 will go down in history as one of the worst years ever for commodities. The S&P GSCI Total Return lost 32.9%, posting its 4th biggest annual loss in history since 1970, and the Dow Jones Commodity Index (DJCI) lost 25.3%. Below are some notable statistics about what happened inside the indices:

2015 ended the S&P GSCI’s first 3-year consecutive loss in its history, losing a total of 55.6% during this time. 2015’s loss of 32.9% followed a similar loss of 33.1% in 2014 and a small loss of 1.2% in 2013.

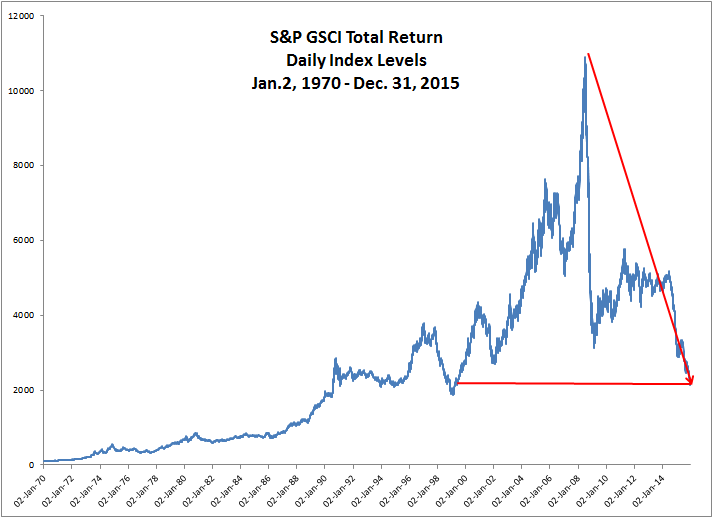

- On Dec. 22, 2015, the S&P GSCI Total Return recorded a new maximum drawdown of -80.5% from its peak on July 3, 2008. The index on Dec. 22, 2015 was the lowest in more than 16 years, since Mar. 24, 1999.

- 2015 ended the S&P GSCI’s biggest 2-year consecutive loss, down 55.1%, and is only the 4th ever back-to-back annual loss. Other consecutive losses happened in 1975-76 (-17.2%, -11.9%), 1997-98 (-14.1%, -35.8%) and 2013-14 (-1.2%, -33.1%).

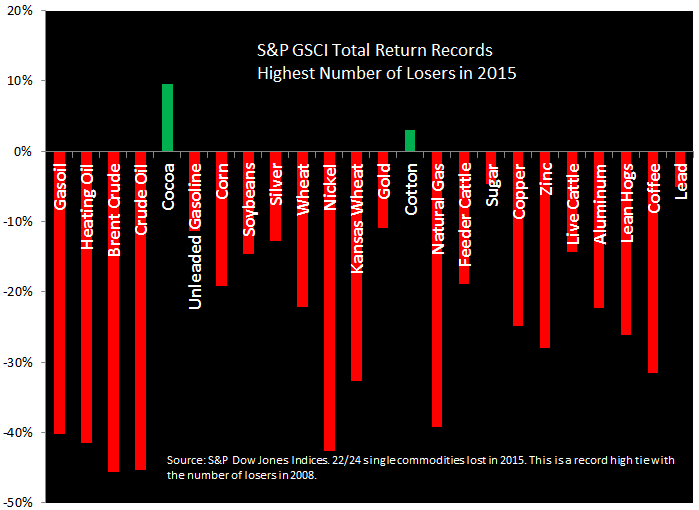

- 2015 tied 2008 for a record number of negative commodities with 22 of 24 down. 20 of the 22 lost more than 10%, 13 lost more than 20%, 8 lost more than 30% and 5 lost more than 40%.

- Brent Crude lost 45.7% in 2015, the most of any single commodity. Other big losers were (WTI) Crude Oil (-45.3%), Nickel (-42.6%), Heating Oil (-41.4%) and Gasoil (-40.2%).

- Cocoa and Cotton were the only winners in 2015, gaining 9.6% and 3.0%, respectively. Cocoa is the only commodity to have been positive in each of the past 3 years, gaining a total return of 37.5%. Interestingly, cocoa was also up in 2008, gaining 27.0% that year. Further, cocoa has only ever been down three times together with the overall index in 1991, 1998 and 2011.

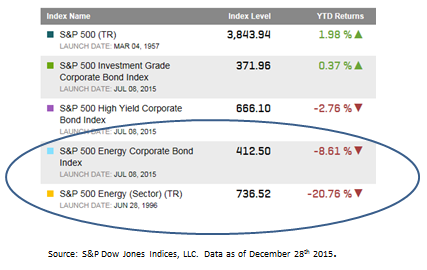

- 2015 is only the second time all five commodity sectors lost in a year. (1998 was the first.) Not only did every sector lose, but they all posted double-digit losses. Agriculture (-16.9%), Energy (-41.5%), Industrial Metals (-24.5%), Livestock (-18.3%) and Precious Metals (-11.1%). Over the past three years, their losses have been significant with about 2/3 shaved off energy, 40% each in metals and agriculture, and 10% off of livestock.

- The S&P GSCI term structure in 2015 was the worst since 2010 and the 12th worst in history. Brent Crude posted its 4th worst roll yield, losing an additional 10.4% from contango. Natural gas lost 20.1% and (WTI) Crude Oil lost 14.9% from contango that are both severe but compared to their own histories, not as bad as brent crude’s loss.

- For the year, six commodities contributed positive roll yield to the total return: copper, feeder cattle, lean hogs, live cattle, soybeans and unleaded gasoline.

- Equities (S&P 500) have now outperformed commodities (S&P GSCI) for eight consecutive years that is a new record. Following the last time equities outperformed commodities for near as long in 1980-86, seven consecutive years, commodities returned almost 300% through 1990 as measured by the S&P GSCI Total Return index.

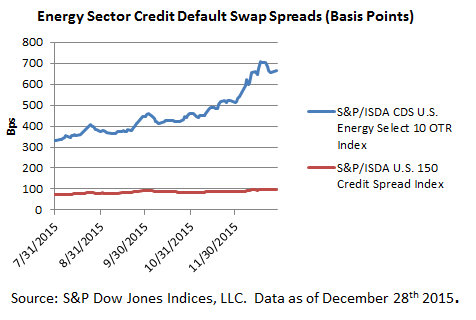

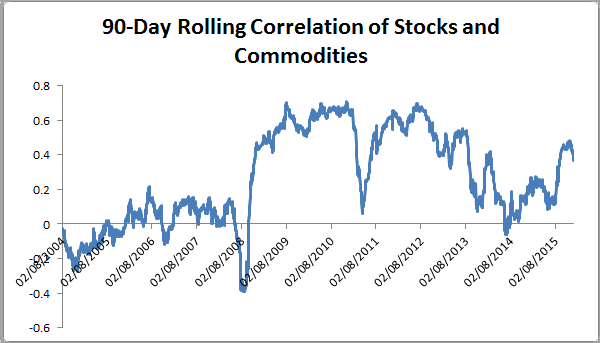

One area of concern is that recent correlation between equities and commodities has spiked, more than quadrupling since July.

Together with the VIX (fear gauge) spike, investors may feel there is too much risk on the table and pull out of risky assets. If this happens, diversification benefits can be ruined like in the financial crisis – just when diversification was needed most.

Despite these overwhelmingly negative statistics, there have been some improvements in commodities recently that may be the start of a turnaround. In Dec., 2015, almost half of the commodities (11/24) were positive and eight were in backwardation that included feeder cattle, copper, cocoa, corn, cotton, Kansas wheat, wheat and live cattle. Also, the equity risk premium in energy signaled a bottom in Oct., 2015, El Nino and interest rates may help commodities, and again, the cycle between equities and commodities may switch. All of these may be positive for commodities going forward.

However, OPEC supply continues to be a headwind, though at some point, the demand from investors and consumers will likely pull back enough to hinder non-OPEC suppliers that may stabilize the market. Slowing Chinese demand growth and the strong dollar also haven’t helped commodities but it doesn’t seem to have impacted commodities across the board since each commodity has behaved differently and China stockpiled many commodities at cheap prices to fill reserves. The policy combined with weather make the future for commodities difficult to predict.

The posts on this blog are opinions, not advice. Please read our Disclaimers.