After much economic activity this week, the Fed announced inflation moved “somewhat closer” to the objective and is showing signs of firming after running below its 2% target for the past two years. In the last June report from the United States Department of Labor, food prices continued to increase although at a slower pace and unleaded gasoline prices had the biggest increase since March 2013.

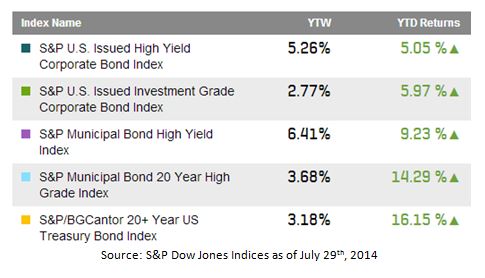

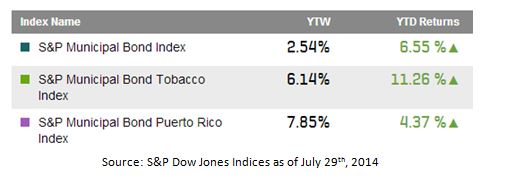

The Commerce Department reported earlier Wednesday the economy grew at a 4% annual rate in the second quarter, bouncing back after a 2.1% first quarter contraction driven by bad weather. The combination of a growing economy and bad weather was great news for commodities in the first half of the year as evidenced by the 5.7% increase in the S&P GSCI through June. That all changed in July.

July 2014 was the worst month for commodities since May 2012. The S&P GSCI lost 5.3%, giving up almost its entire gain for the year, now positive only 11 basis points YTD. The DJCI also had a big loss of 4.9% that pushed it into negative territory for the year, down 39 basis points.

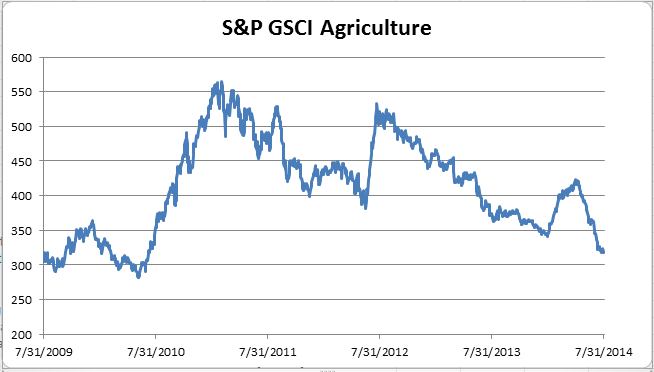

While this is not good news for commodity investors, this might be the relief consumers need to keep their wallets from shrinking. Energy and Agriculture were the two worst performing sectors in July, down 5.8% and 8.7%, respectively in the S&P GSCI. Energy was down even more, losing 6.7%, in the DJCI from its heavier weight in natural gas that lost 13.7%, the most since March 2012. However, agriculture fared slightly better in the DJCI than in the S&P GSCI losing 7.2% from its bigger weight in soybeans, which lost 6.5%, less than wheat and corn – plus coffee was up another 11.4%, bringing its YTD total up to 68.9%.

Although not the biggest loser in the index or the most heavily weighted, one of the most important commodities that we all care about is unleaded gasoline. Prices at the pump have been brutal, as I mentioned above that the government reported the biggest price increase since March 2013. If the S&P GSCI or DJCI Unleaded Gasoline is any indication of prices we may see, the -8.1% spot return was the 5th worst July on record since 1988 and may provide some indication of price relief at the pump. It is also the worst July since July 2008, when after the index drop, the CPI data showed a drop in price increase from 4.090 in July 2008 to 1.689 by Dec 2008.

Further we have been discussing the impact of climate change (and potentially el nino) on food prices, where food processors have been running out of choices (substitution and buying ahead) to keep food prices down for everyday consumers like you and me. The result has been higher prices at the grocery store. This happened from the destruction of the agriculture and livestock chain from the freezing weather in Q1. Now after the decline in July from perfect weather that brought down the grains, the agriculture is priced the lowest since July of 2010.

This may open a window of opportunity for food processors to purchase cheap ingredients ahead of further price spikes that may happen from an el nino and climate change. Then, we may see lower prices again at the grocery store.

The posts on this blog are opinions, not advice. Please read our Disclaimers.