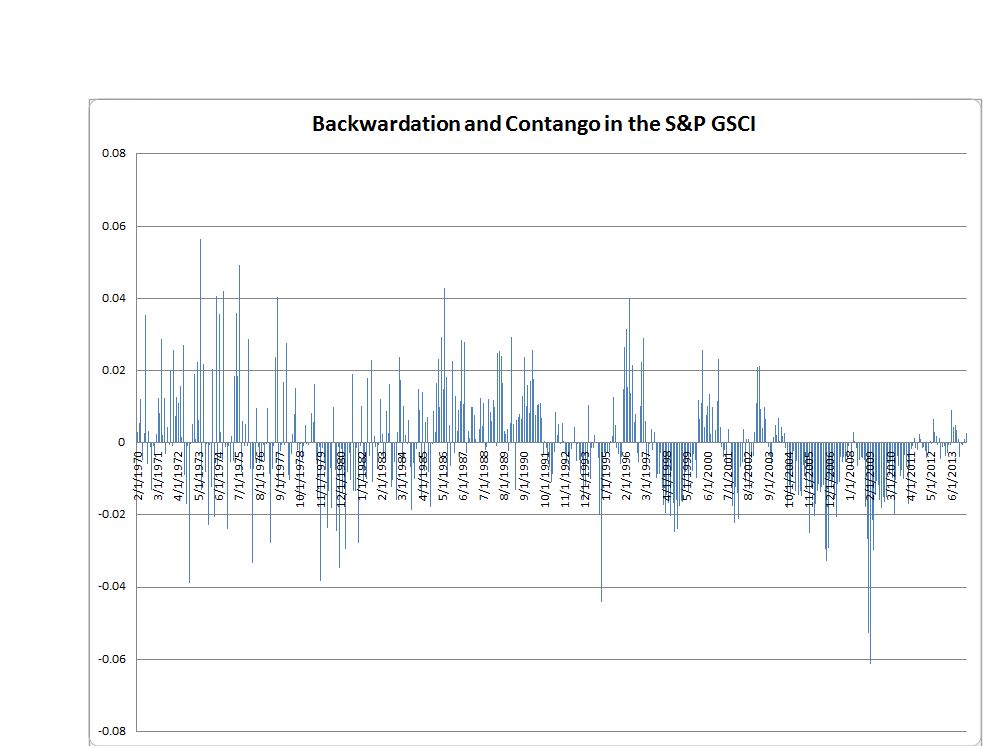

Commodities continue their comeback as supply shocks prevail over demand growth concerns from China. The backwardation (indicative of shortage), measured by roll yield or the excess return minus the spot return, has not only persisted from February into March but increased. March’s roll yield of 26 basis points more than doubled February’s roll yield of 10 basis points, bringing a MTD gain of 14 basis points to increase the S&P GSCI YTD return to 2.9%. While we have seen some backwardation in the past few summers, we have not seen it this early in the year since 2004 – the last year of low inventories until now. In 2004, the S&P GSCI returned 17.3%.

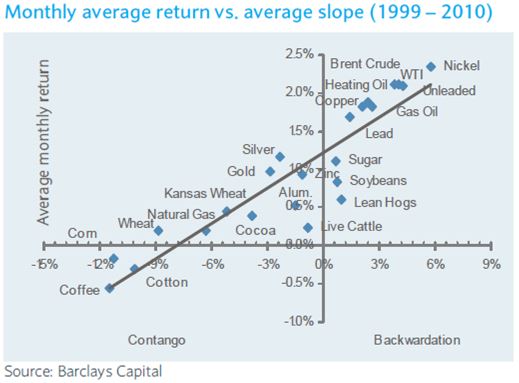

Don’t let the term structure fool you, though. There is a misperception that the term structure determines the total return. While the roll yield is a highly significant attribute to the total return, it is not the only driver. Price return and collateral yield are also included so that sometimes a positive return is realized despite contango. Although on average in this chart, there are no negative average monthly returns with backwardation, it does happen.

Currently we are experiencing shifts in the curves that are not big enough to overcome price changes. For example, the S&P GSCI Energy is in backwardation but is has a negative total return for the month of -1.2%. Also the S&P GSCI Copper is in backwardation for the 5th month straight but its March total return was -5.3%. It is hard to be a big copper bear with persistent backwardation like that unless a big supply comes to market. On the flip side, the S&P GSCI Agriculture & Livestock is up 6.4% in March but is still showing slight contango. The lean hogs, up 19.0% in March, had the fattest gain for the month, but is in contango (reflecting abundance and high storage costs), giving up 7.8% for a total return of 11.2%.

Earlier in the month, someone asked me if I had a food fetish after I had posted about coffee, cocoa, pork, cattle and corn. Given the S&P GSCI has 24 commodities and 10 are food related (if you don’t count edible gold leaf confections), I answered maybe a half of a food fetish, but that the weather is causing all sorts of problems in the supply chain for food commodities, spiking prices across the S&P GSCI Agriculture & Livestock. The weather is also putting some of these commodities into backwardation earlier than normal, which might be even more profitable for an index investor.

The posts on this blog are opinions, not advice. Please read our Disclaimers.