Why are gas prices so high? I know I’m not alone as “a commodity lady” wondering this as I pull out my credit card to pay at the pump. (Which is not often since I ride my bicycle to work most days)

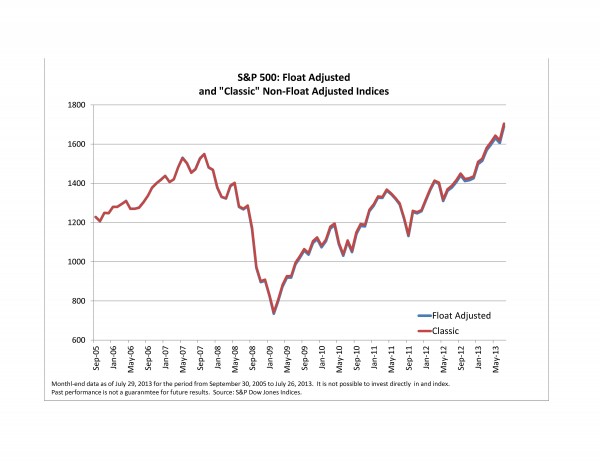

Gasoline prices typically rise in the summer because more people travel to take vacations. However, this July, the S&P GSCI Unleaded Gasoline gained 12.0%, which was the 4th highest increase in July in the history of the index (since 1988,) and the biggest rise in July since 2005 when the index increased 13.6%. The other years with big July increases were 1990, up 19.0%, and 2004, up 14.7%. While the index fell 11.1% in Aug 2004, it rose 17.6% in Sept that year. However, August 1990 and August 2005 subsequently jumped significantly, up 49.5% and 36.6%, respectively. It will be interesting to see where gas price go this August.

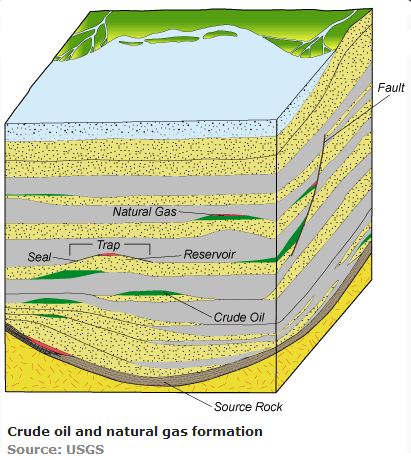

Why has this summer’s gas price increased so much? Finding and producing crude oil, the input to unleaded gasoline is difficult and expensive. Today, American oil reserves tend to lie in shale formations or in deposits under the ocean floor.

Since many easy-to-access oil reserves have already been tapped, more expensive technology is required to reach new reserves. The higher production costs drive higher gasoline prices as crude oil is the main substance in gasoline, which powers our transportation.

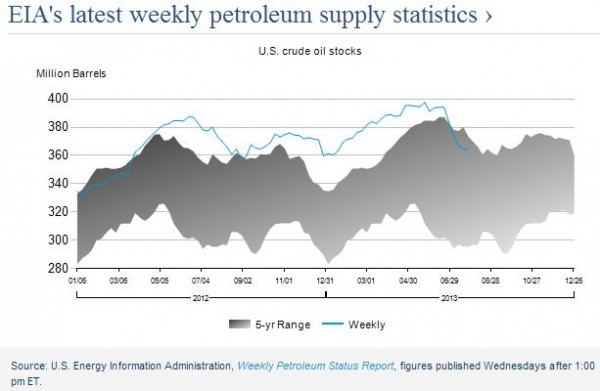

The S&P GSCI Crude Oil has a gained a total of 17.5% since May which is the most since Oct 2011. It gained 9.2% in July, the biggest monthly increase since Aug 2012 when it was also up 9.2%. This increase is from new infrastructure that has helped drain supplies and inventories from the U.S. benchmark supply point at Cushing, Oklahoma. The U.S. government data showed oil inventories at the Cushing, Oklahoma, delivery point fell for a fifth straight week to the lowest since April 2012. See the chart below from the U.S. EIA (Energy Information Administration)

Also BP Plc’s new 250,000 barrel per day crude distillation unit at its Whiting, Indiana, refinery started up at the end of June, increasing demand. This in conjunction with the U.S. Federal Reserve announcing plans to continue its $85 billion a month purchases of mortgage and Treasury securities to back the economy has supported oil prices. If the Fed eases up on the stimulus program, generally that might slow the economy and potentially drive down oil prices, then prices at the pump may come back down.

The posts on this blog are opinions, not advice. Please read our Disclaimers.