Both the surprisingly strong 2013 US stock market performance and the surging rebound in US home prices are sparking fears of another round bursting bubbles among many investors and market pundits. While we don’t know the chances that either stocks or home prices will plunge in 2014, the collateral damage from either will be less than it was in 2008 because the underlying leverage in the economy is substantially smaller today than it was back then.

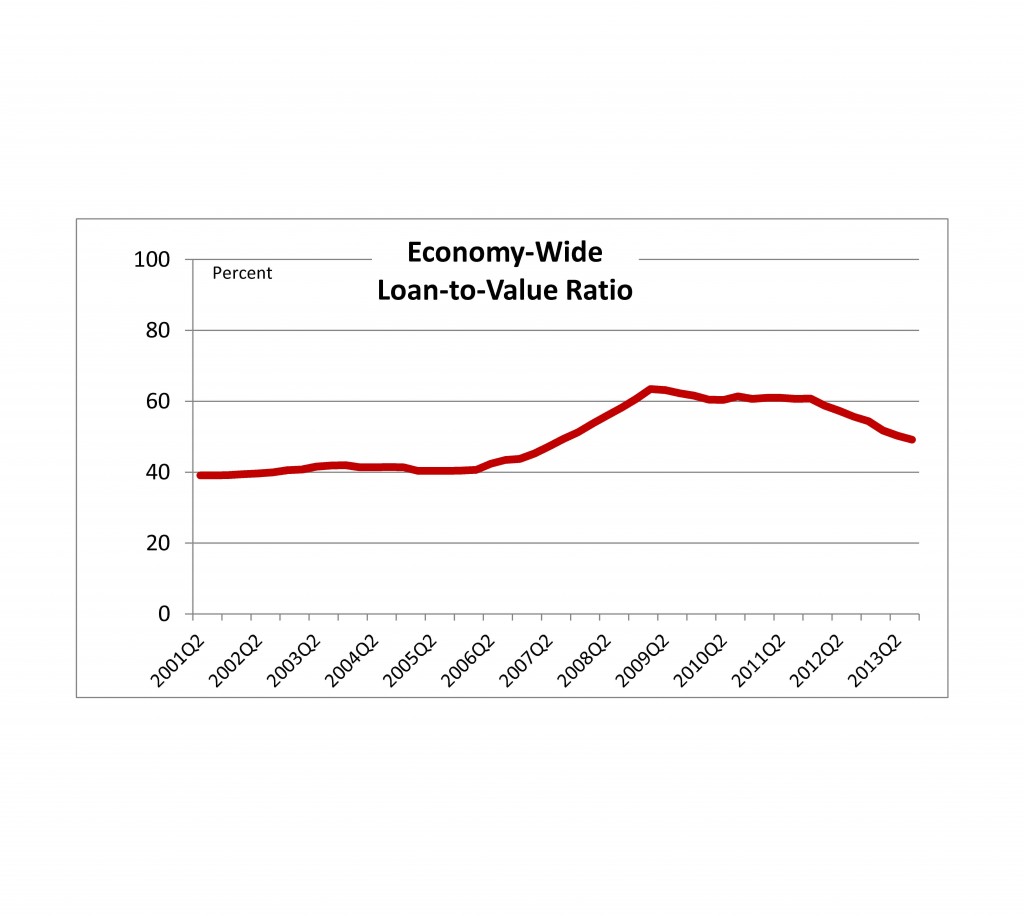

The financial crisis was a two-step (or double dive) event. First home prices collapsed, wiping out about a third of the value of American homes. Second, a lot of the mortgage debt collateralized by those homes failed creating a cascade of defaults, foreclosures and worse. The higher the loan to value ratio on a home with a mortgage, the smaller the price drop needed to put the mortgage under water. The chart shows the loan to value ratio for all owner-occupied housing in the United States, including homes owned without mortgages or with mortgages before the boom times of no money down mortgages. From about the beginning of 2006 to the beginning of 2009 it rose by half from 40% to 60%. When home prices plunged, homeowners and their mortgages were vulnerable. Today conditions are improved – the economy-wide loan to value ratio is down to 49%, not as comfortable as ten years ago, but better and safer for the economy than in the financial crisis.

This change did not just happen. Rather, the appetite for borrowing and debt is much less today than seven years ago. The total growth in mortgage debt in the 12 quarters ended with the 3rd quarter of 2013 was -7.2% — mortgage debt fell. Compare this to the increase in the 12 quarters ending with the 2007 4th quarter: 35.6%. The same story, with somewhat different numbers is true across most of the economy. Growth in debt outstanding in the last 12 quarters to 2013:3 for the entire economy was 12.7% versus 29.3% for the 12 quarters ended in 2007:4. The only sector where debt rose more quickly in the recent period was the Federal government, largely due to supporting the economy. Even with the federal government, debt is under more control with the deficit as a percentage of GDP down by more than half to 4.1% currently from 10% during the financial crisis.

The lower leverage and debt overhang will not prevent a bubble from bursting, doesn’t mean stock prices or home values can’t slide and doesn’t mean we shouldn’t be concerned that some markets may be over-valued. But, less debt and leverage means less damage if markets fall. That alone should ease some fears as we start a new year with higher prices on houses and stocks.

The posts on this blog are opinions, not advice. Please read our Disclaimers.