What strategies will be the most profitable over the next 12 months? Which spread will have the greatest opportunity? These are just a few questions we asked the audience at our S&P Dow Jones Indices 7th Annual Commodities Seminar, and we thought you may be interested in their answers.

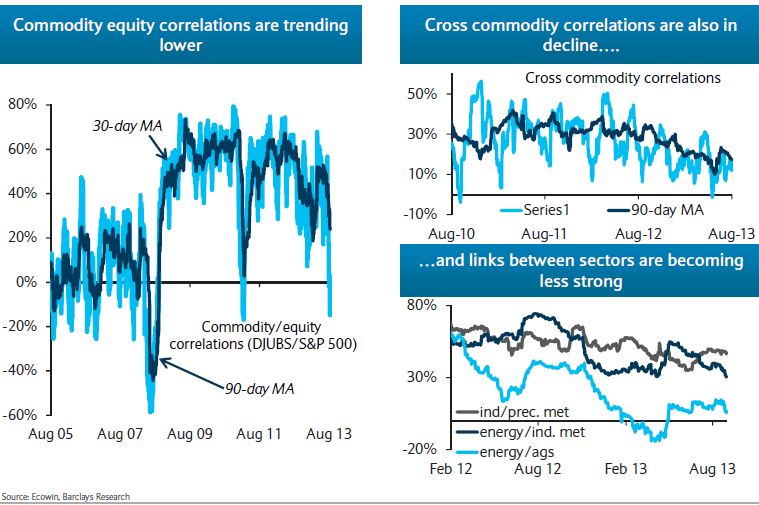

As I mentioned in a recent CNBC interview, the three main factors influencing commodities currently are quantitative easing, Chinese demand growth and geopolitical tensions. This backdrop has been characterized by more frequent backwardation and lower correlations.

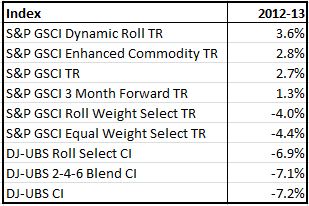

Given the more frequent backwardation in 2012 and 2013, the performance of more flexible strategies like the S&P GSCI Roll Weight Select and S&P GSCI Dynamic Roll have outperformed their static counterparts. See the table below:

Also, below are two research papers on the fundamentals of why this is the case:

- Identifying Return Opportunities In A Demand-Driven World Economy

- What’s Price Got to do with Term Structure?

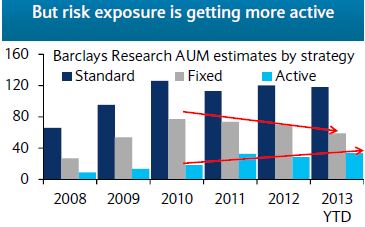

Research by Barclays shows investors are taking notice and assets are flowing into more active strategies.

Will this continue? We asked our audience, “Which index strategy do you believe will be most profitable over the next 12 months?”

Below are their answers, which match the trend of flows into active indexing but buck the trend that flows of fixed are declining compared to standard.

13.0% Front month

26.1% 3-Month Forward

30.4% Dynamic Roll

30.4% Long-Short Trend Following

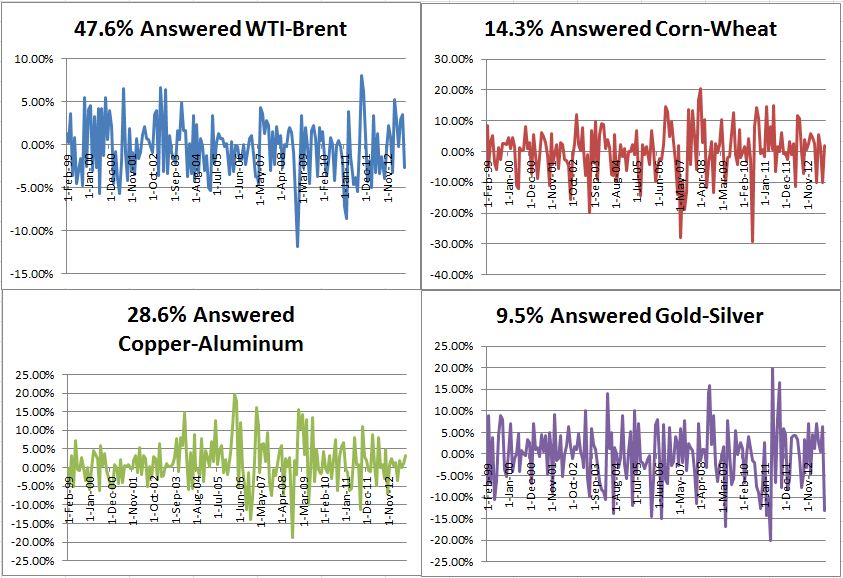

Another question we asked was regarding in which spread is the greatest opportunity?

See the answers from the audience in the charts below:

What are your predictions? We’d love to hear!

The posts on this blog are opinions, not advice. Please read our Disclaimers.