Despite global geopolitical tensions, Canadian equities, in contrast to U.S. equities, seem to be faring well. Since its rebalance on Dec. 17, 2021, the S&P/TSX Composite gained 5.7% (through March 17, 2022). It was no surprise that the S&P/TSX Composite Low Volatility Index lagged—what was surprising was that it lagged by 1.3%, rising 4.4% over the same period. This is a capture of 78% of the upside—significantly higher than the historical upside capture rate of 66%.

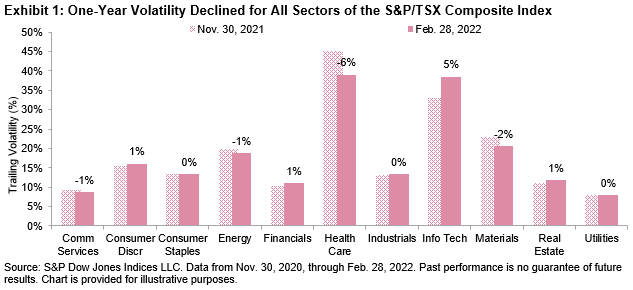

Volatility levels remained steady for the most part, with Health Care and Information Technology clocking in the greatest changes, down 6% and up 5%, respectively.

In the latest rebalance for the S&P/TSX Composite Low Volatility Index, effective at the close of trading on March 18, 2022, sector weight changes were minimal. The low volatility index shed what little weight it had in Consumer Discretionary and Information Technology entirely. The slack was mostly picked up by Energy and Real Estate, each adding 2% to its weight. Despite a 6% volatility decline in the sector overall, Health Care’s weight remained steady, pointing to pockets of volatility within the sector.