2014 was an extraordinarily difficult year for active equity managers, especially in the U.S. market; our year-end SPIVA report, e.g., showed that 86% of large-cap equity funds underperformed the S&P 500. This observation is hardly unique, nor original to us. What’s unusual about 2014’s results is that the rate of failure was extraordinarily high — between 2000 and 2013, on average “only” 58% of large-cap managers underperformed, as against 2014’s 86%.

Why was 2014 so difficult? Imagine that a genie gives you a form of perfect foresight: from the constituents of an index, you can always pick the stock whose performance is one standard deviation above average. How much is your foresight worth? Well — if the index is up 10%, and your stock pick is up 20%, it’s worth quite a bit. What happens if the distribution of returns is tighter, so that your stock pick is up only 11% in a 10% market? Then your skill, which is the same in absolute terms, is much less valuable — perhaps not even valuable enough to justify the costs of trading.

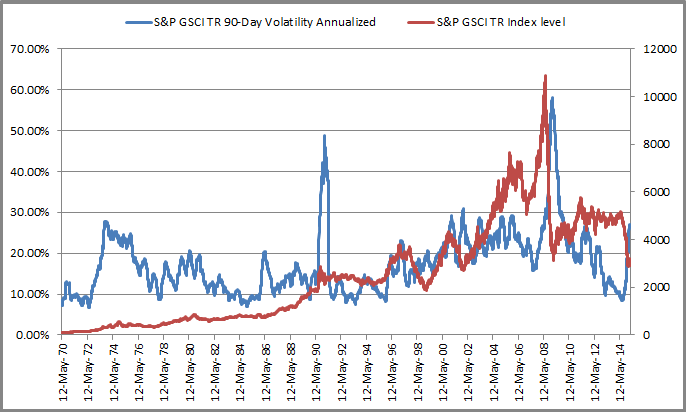

Dispersion measures the spread in returns among the components of an index (conveniently scaled in standard deviation terms, as was the genie’s gift), and dispersion has proven to be a valuable tool in forecasting the success of active stock selection strategies. In 2014, the S&P 500’s dispersion reached record low levels — which goes a long way toward explaining why it was so difficult for most managers to outperform.

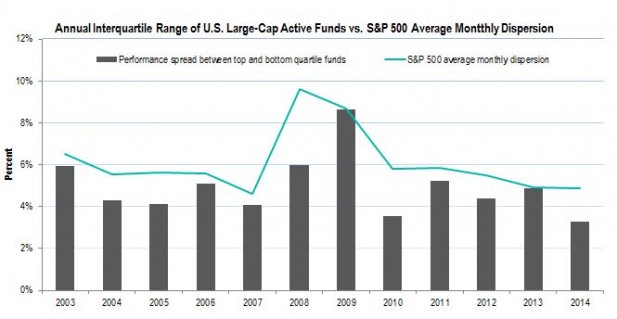

Dispersion also gives us an insight into the way in which active managers compare against one another. The bars in the chart below show the interquartile range of performance for large-cap active U.S. managers in our SPIVA database — the 25th percentile minus the 75th percentile, or, roughly speaking, the return of the “best” managers minus the return of the “worst” managers.

The line represents the average dispersion for the S&P 500 for the year in question. It’s not a perfect relationship, but it’s obvious that low dispersion reduces the spread between the best and worst managers.

The line represents the average dispersion for the S&P 500 for the year in question. It’s not a perfect relationship, but it’s obvious that low dispersion reduces the spread between the best and worst managers.

Whether measured relative to passive alternatives or within the active management universe, when dispersion is low, the value of stock selection skill declines.

The posts on this blog are opinions, not advice. Please read our Disclaimers.