Inflation is one of the most significant risks to investment returns over the long term. Core equities and conventional bonds tend to deliver below-average returns in rising inflation environments, which can encourage investors to seek out inflation-sensitive assets, such as commodities, inflation-linked bonds, REITs, natural resource stocks, and gold, to protect their portfolios from inflation shocks.

Currently, the risk of inflation centers on whether the post-pandemic recovery will be merely reflationary or truly inflationary. It may be difficult for market participants to assign a probability to a sustained period of inflation and to adapt portfolio construction, should the probability be sufficiently high.

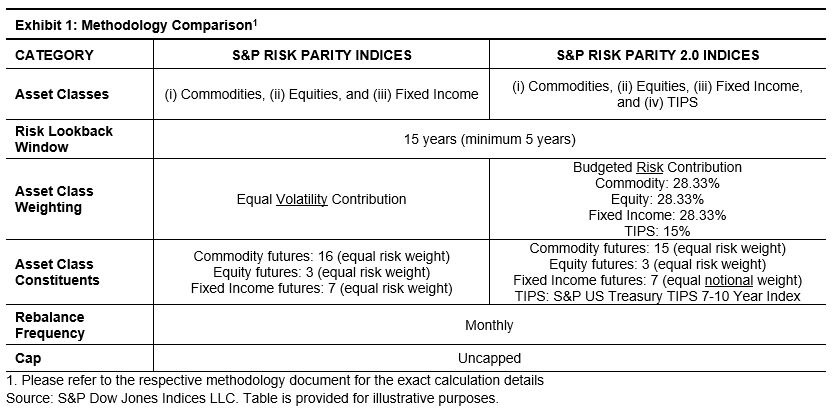

For an investor seeking protection against rising or high inflation, there is no “one-size-fits-all” solution—the portfolio must dynamically adjust to changes in the market environment, and this is exactly what the S&P Multi-Asset Dynamic Inflation Strategy Index is designed to do. The S&P Multi-Asset Dynamic Inflation Strategy Index seeks to measure the performance of a dynamic rotational strategy across a series of subindices designed to reflect the most appropriate response to the prevailing inflation regime in the U.S., as measured by the U.S. CPI. The index switches between three multi-asset strategies that have historically performed well in either a low, medium, or high inflation regime. The component indices within each multi-asset strategy are weighted based on dynamic weighting allocations (see Exhibit 1).

Component indices included in the S&P Multi-Asset Dynamic Inflation Strategy Index include those representing U.S. equities, commodity futures, U.S. sovereign bonds, U.S. inflation-linked bonds, and U.S. REITS.

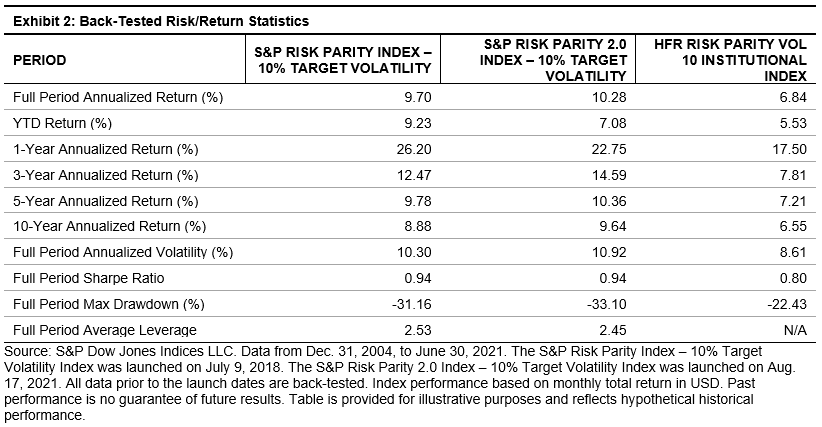

The inflation regime is identified based on cutoffs for specific levels of inflation, as illustrated in Exhibit 2. For each inflation regime, a suitable strategy is identified based on inflation sensitivity, historical performance, and economic justification. Each month, the inflation regime is determined using the realized U.S. CPI (YoY), and the appropriate allocation is chosen based on the strategy identified for that regime.

The index demonstrated strong inflation beta in the high inflation regime and is relatively easy to implement and manage. The back-tests (though limited in terms of history) show that its performance and turnover were both reasonable. In a low inflation environment, equities tend to perform well, and a traditional 60/40 allocation that is overweight in equities can be expected to provide reasonable returns. During periods of medium inflation, fixed income assets tend to yield better risk-adjusted returns, so the volatility-weighted strategy that overweights them is a reasonable choice. In a high inflation regime, it makes sense to switch to the pro inflation beta strategy, which overweights commodities and real assets, since those asset classes have better inflation-hedging properties.

Exhibit 3 demonstrates that the dynamic index generally outperformed the component strategies on a risk-adjusted basis, and its drawdowns were not as severe. It is also worth noting that it had consistently higher inflation sensitivity than the 60/40 or volatility weighted strategies.

For more information, please visit the index webpage and read the thought leadership research paper.

The posts on this blog are opinions, not advice. Please read our Disclaimers.