“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” – Milton Friedman

“If we do see what we believe is likely a transitory increase in inflation … I expect that we will be patient.” – Jerome Powell, March 4, 2021

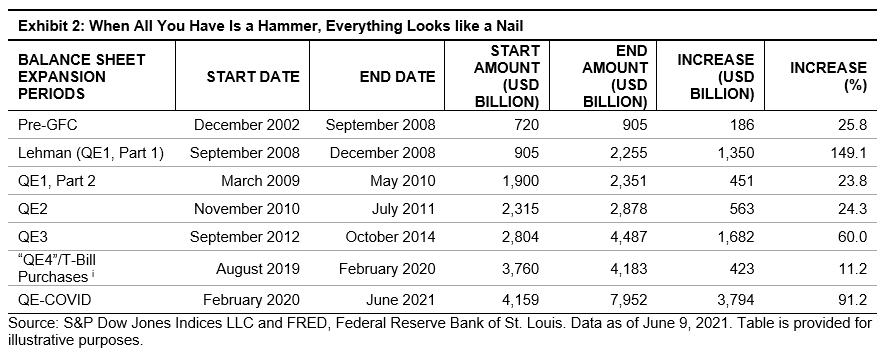

Since the Global Financial Crisis, the U.S. Federal Reserve has actively expanded its balance sheet in an effort to keep markets functioning smoothly and help offset economic downturns. While emergency measures may have been warranted at times, the Fed’s seemingly perpetual support (see Exhibits 1 and 2) has been controversial in many quarters.

The Fed’s go-to counter argument has been that inflation remained well under control, and, in fact, for many years was below their 2% target. While there may be some dislocations in capital allocation, in general, keeping interest rates low makes credit more accessible to individuals and businesses and the lack of inflation limits harm, making easy money policies a net positive.

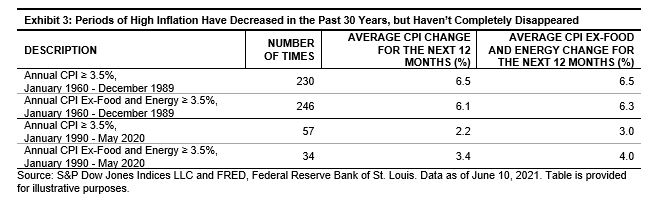

However, the most recent data showed a dramatic uptick in inflation, with a year-over-year Consumer Price Index (CPI) increase of 4.2% in April 2021 and 5.0% in May 2021—the highest reading since 2008. Even excluding the more volatile food and energy sectors, inflation over the previous year was 3.8% in May 2021, the highest since 1992. As previous periods of high inflation have tended to persist in the ensuing months as Exhibit 3 shows, the whispers that the Fed should begin rolling back their market interventions have become louder of late.ii

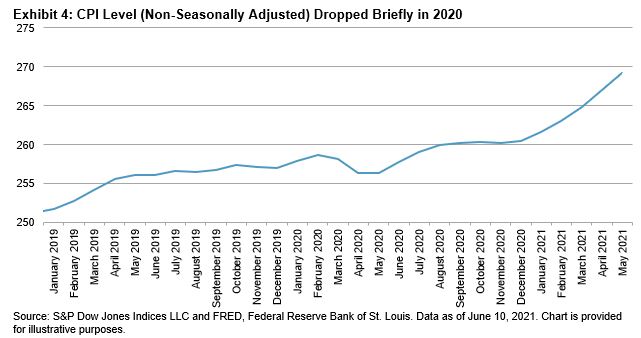

The high numbers from the past few releases were often dismissed as a “base effects” anomaly in the data. Since April 2020’s price level was artificially low due to the global shutdown at the beginning of the COVID-19 pandemic, it was merely a statistical artifact that calculating year-over-year inflation from that starting point would be so high.

While this is technically accurate, it overlooks the month-over-month (seasonally adjusted) changes. In the past three releases, the month-over-month changes have been 0.6%, 0.8%, and 0.6%. Excluding food and energy, prices have increased 0.3%, 0.9%, and 0.7%. In other words, if the inflation target remains at 2% per year, the Fed has basically used up its annual inflation “budget” within the past three months alone. Unlike the year-over-year series, the changes over the past three months can’t be ignored as coming from an artificially low starting point.

It remains to be seen whether an alternate explanation of “transitory” will hold and the inflation of the past few months is only due to the reopening of the economy and pent-up demand. The Fed’s USD 7 trillion buying binge may yet finally overcome the disinflationary pressures of technological development, demographic changes, and globalization over the past 30 years.

i The Fed vehemently insists this was not actually quantitative easing. The purchase of short-term Treasuries every month was to offset technical dysfunctions in lending markets and not a change in monetary policy. Nonetheless, the “expand the balance sheet” solution hammer applied.

ii The Fed’s 2% target applies to a different measure of inflation, known as the Personal Consumption Expenditure (PCE). The Fed looks at headline PCE inflation over the long-term but tends to focus on core inflation (excluding food and energy) in the short-term. However, in recent years the Fed has talked up the “trimmed mean PCE inflation rate”, which excludes large movements (both positive and negative). The methodological differences between CPI and PCE do not significantly affect the macro issues presented in this post.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

With many of the 24 commodity constituents of the S&P GSCI in backwardation in 2021, a positive catalyst in the form of a positive roll yield is one of the current reasons to look at commodity exposure. After years of negative roll yields, investors are being rewarded for holding commodity exposure. The S&P GSCI Dynamic Roll is designed to benefit from backwardation by holding positions at the front of the futures curve.

With many of the 24 commodity constituents of the S&P GSCI in backwardation in 2021, a positive catalyst in the form of a positive roll yield is one of the current reasons to look at commodity exposure. After years of negative roll yields, investors are being rewarded for holding commodity exposure. The S&P GSCI Dynamic Roll is designed to benefit from backwardation by holding positions at the front of the futures curve.