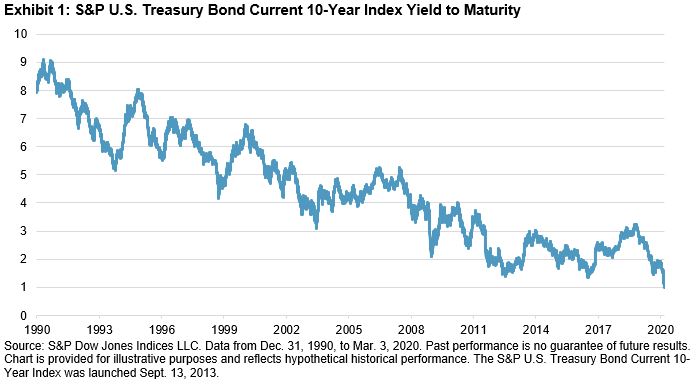

For those wondering what role fixed income would have in their portfolio at record-low yields, they had to wait just one week. On Friday, Feb. 21, 2020, we hit a record-low yield for the 30-year Treasury, as the S&P U.S. Treasury Bond Current 30-Year Index yield fell to 1.92%. The next week, the Dow Jones Industrial Average proceeded to shed over 3,500 points and Treasuries maintained their safe haven status. Following an emergency 50 bps rate cut by the Fed, the 10-year set an all-time low, falling below 1% for the first time. The double digit returns in bonds YTD continue to buffer losses in investors’ portfolios.

The continual downward march in yields has created large shifts in the fixed income market structure, affecting investors who benchmark their portfolios to indices. Borrowers, for the most part, have taken advantage of lower rates to issue debt at lower levels, which lowers the potential return for investors. The coupon rates for fixed income indices have fallen 1%-2% over the past decade (see Exhibit 2). Ten years ago, investment-grade issuers were paying an average coupon of around 6%, while that is closer to what high-yield issuers pay today. While coupons have fallen, the interest rate risk has risen, as measured by modified duration. Borrowers have issued longer dated debt, increasing the index average by nearly 30% and 40% for investment grade and Treasury indices, respectively (see Exhibit 3). While interest rate risk has gone up, credit risk, as measured by the average credit rating of investment-grade issuers, has also increased (see Exhibit 4). BBB-rated securities account for 54% of the investment-grade market, up from 21% in 2000.

Futures markets seem to point to higher potential volatility in 2020 as we near the November 2020 general election. VIX® futures price a premium leading into the November 2020 election and current delegate counts show a stark contrast in political policy to challenge the incumbent. With stocks coming off record highs and markets pricing for increased volatility around Election Day, there still appears to be a place for bonds in your portfolio.

Market participants today are living in a stressful environment, which includes rising interest rate risk, credit risk, and volatility risk. The potential diversification benefit of bonds in a portfolio context should be considered.

The posts on this blog are opinions, not advice. Please read our Disclaimers.