The S&P 500 is down 9.4% month-to-date as of the close on Oct. 29, 2018, and is on pace to record its worst Oct. since 2008 and its sixth worst Oct. based on history since 1928. The other years when the S&P 500 that lost more in Oct. than in Oct. 2018 (so far) happened in 1987, 1929, 2008, 1932, 1937.

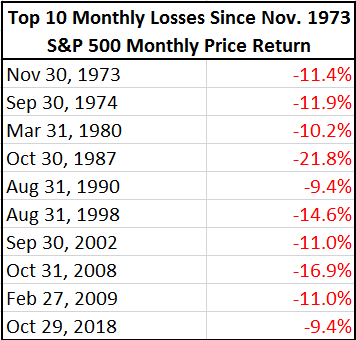

Also, month-to-date, the S&P 500 is having its 34th worst month on record and its worst month since Feb. 2009, when it lost 11.0%. The top ten worst months in S&P 500 history in chronological order date back to Nov. 1973, nearly 45 years ago, when the S&P 500 lost 11.4%, the most in 26 years, since Nov. 1948, when it lost 10.8%.

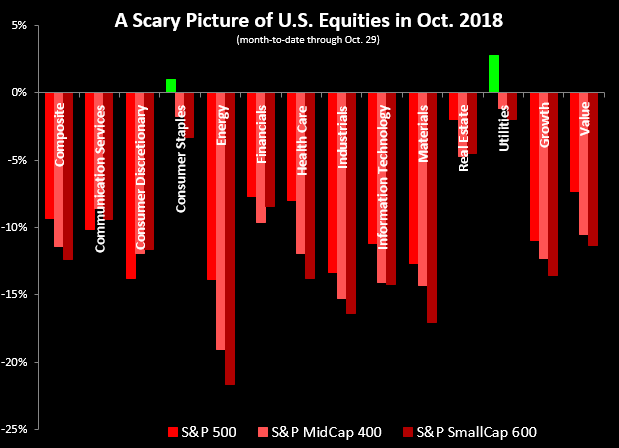

Not only is the S&P 500 having a historically bad month but almost all slices of U.S. equities by size, sector and style are losing big too. Month-to-date, of every style, size and sector, only large cap consumer staples and utilities are positive, up 1.0% and 2.8%, respectively. Energy was the worst performing sector across the sizes, losing 13.8%, 19.1% and 21.7% in large-, mid-, and small-caps, respectively, as the S&P GSCI (WTI) Crude Oil lost 8.5% month-to-date (through Oct. 29, 2018).

The losses are historically big when evaluating the sectors, sizes and styles as well. This is the 3rd worst month in history for S&P 500 Consumer Discretionary, S&P 500 Energy, S&P 500 Industrials and S&P 600 Industrials, losing a respective -13.8%, -13.8%, -13.3% and -16.4% (month-to-date through Oct. 29, 2018,) all on pace to post their 2nd worst Oct. in history. Additionally, there are a total 30 of 42 slices by the composites, sectors, sizes and styles that are on track to post their 2nd worst Oct., and all of them are having one of their top 20 worst months ever – with 13 indices on pace to have their 5th, 4th or 3rd worst ranked months ever.

In the past, the S&P 500 lost in all the Nov. months following the most losing Oct.’s. The Nov. returns of the S&P 500 in 1987, 1929, 2008, 1932, 1937 were -8.5%, -13.4%, -7.5%, -5.9% and -10.1%, respectively. However, in Dec. of each of these years, the S&P 500 was positive except for in 1937 when the index lost an additional 5.0% before bouncing back in Jan. 1938.

There have been some concerns about signs of economic weakness recently including lower than expected inflation, soft housing, flat auto sales, plus a slightly decelerating GDP and growing concerns over trade tensions, so analysts may be watching these factors as well as how the Fed raises rates – or not. Many may be looking for value opportunities as stocks have fallen and value is outperforming growth by the most since Nov. 2016 in large- and mid-caps, and the most since Mar. 2016 in small-caps with respective value premiums of 3.6%, 1.7% and 2.3%.

.

The posts on this blog are opinions, not advice. Please read our Disclaimers.