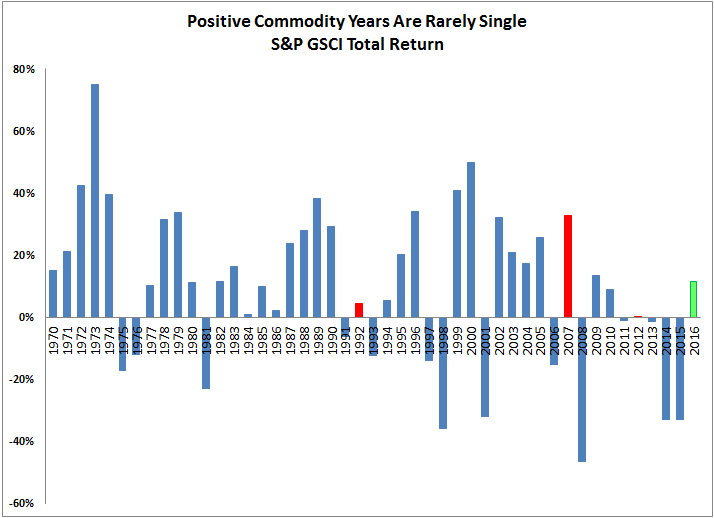

Commodities ended 2016 by posting the first positive returns in 4 years. The S&P GSCI Total Return gained 11.4% and the DJCI (Dow Jones Commodity Index) gained 13.3%. Energy was the best performing sector gaining 18.1% in the S&P GSCI, and livestock performed worst, losing 7.3%. Agriculture, industrial metals and precious metals returned -4.2%, 17.6%, and 8.4%, respectively. It was the energy sector’s best year since 2007, when it gained 41.9%. It was also the industrial metal’s best year since 2009, when it gained 82.4%. The comeback in these two sectors together is meaningful since they are the most economically sensitive. The last time these two sectors were up this much together after two consecutive negative years was in 1999, that led commodities to return roughly 360% through 2007. Through history since 1970, the average number of consecutive positive years is 3.5 years with rarely a single positive year.

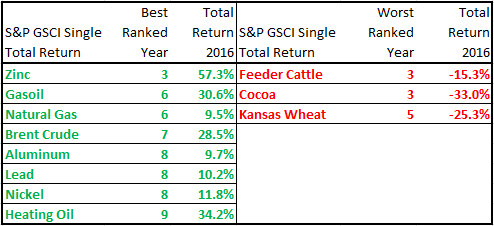

In 2016, there were 17 positive commodities of 24 total, that is the most since 2010 when 21 were positive. It is also the greatest comeback (from only 2 positive commodities last year, namely cocoa and cotton) since the 2009 improvement when 18 were positive after only 2 gained in 2008 – cocoa and gold. This year, cocoa was the worst performing commodity, losing 33.0%, while zinc performed best, gaining 57.4%. For cocoa, 2016 was the 3rd worst on record but it was the 3rd best year for zinc. Despite some relatively high and low rankings, the overall index performance rank fell exactly in the middle of its historical performance ranking both its 24th best and 24th worst year. Also, although many commodities of energy and industrial metals did well, the sectors’ returns only ranked as their 14th (energy) and 12th (industrial metals) best years.

One potential concern is there were only six commodities (cocoa, cotton, feeder cattle, natural gas, sugar and wheat) in backwardation in December which is just below the average number of 6.8 for this time of year, which means there still needs to be more inventory drawn down before there are persistent shortages.

However, while the S&P 500 beat the S&P GSCI in 2016, by 59 basis points, extending the commodity consecutive annual under-performance to a new record of nine years, the gap is closing that could indicate a turning point in the cycle for commodities.

The three most powerful influences on commodities in 2017 are OPEC’s ability to manage oil production in the face of US competition, Trump’s impact on inflation and growth, and a potential weakening dollar.

- OPEC’s decision gave energy a huge bump up in the last month, its biggest gain since April, but the upside can be capped depending on three things: 1. Whether all the participants follow through on the agreement.

- How the US producers respond – since US inventories need to be low for OPEC’s decision to matter.

- Whether China might slow buying as prices rise – or even worse, start exporting their stockpiles which are somewhat unknown. (China could also put a stop on the metals rally from exporting stockpiles – like it did on the nickel rally in 2014).

- Historically Republican presidencies are favorable for grains and gas which are key to rising inflation. Moreover, copper, lead and nickel have had their best performance with Republicans. That in itself does not promise growth since rising inflation from commodity prices can cause stagflation – BUT stagflation is less likely if Trump builds infrastructure and jobs growth which may propel GDP and help the metals.

- Industrials have outperformed as much as 15% annualized on average of industrial metals during Republican (over Democratic) rule.

- Also, industrial metals outperformed precious metals last month by the most in 26 years. This is considered extremely bullish. The bullish sentiment is also showing itself in the falling correlation between the metals, meaning investors are specifically seeking growth in industrial metals instead of hiding in the safe haven of gold.

- Although the dollar theoretically should rally from rising rates, that relationship hasn’t held. So, even if rates rise more, there is a chance the dollar will revert after continually hitting new recent highs – that can lift commodities substantially. In fact, every single one of the 24 commodities we track rises from a falling dollar, especially industrial metals which can rise as much as 7% for every 1% the dollar falls.

The posts on this blog are opinions, not advice. Please read our Disclaimers.