Aficionados of our SPIVA reports will recognize that most active managers underperform passive benchmarks most of the time. For example, between 2000 and 2014, a majority of large-cap U.S. managers beat the S&P 500 in only three calendar years. The records of mid-cap managers against the S&P MidCap 400 and small-cap managers against the S&P SmallCap 600 are equally undistinguished.

Since they’re relatively uncommon, years when the majority of managers do outperform naturally attract our attention. For example, in 2013, two-thirds of all Canadian equity managers beat the S&P/TSX Composite, a dramatic improvement from results in 2012 and prior years. What was special about 2013? Perhaps it was that the S&P/TSX Composite was up 13%, while the S&P 500 rose by better than 32%. Given the difference in Canadian and U.S. returns, a Canadian manager who made a tactical foray south of the border in 2013 might have been very well rewarded for doing so. (In 2014, when Canadian and U.S. returns were much closer, only 26% of Canadian managers outperformed.)

Similarly, for four consecutive years between 2007-2010, the majority of U.S. large-cap value managers outperformed the S&P 500 Value Index. Of course, those years straddled the global financial crisis, during which time the S&P 500 Value Index declined by a cumulative -13.5%. Meanwhile, the S&P 500 Growth Index rose by a cumulative 7.5%. Perhaps value managers as a group were aided by an ability to tilt toward higher-growth issues.

What these examples illustrate is that there are at least two ways to skin the active management cat. We can call them, broadly, selection and allocation, and we’ve been looking at examples of successful allocation calls — from Canada into the U.S., e.g., or from value into growth. Selection, on the other hand, denotes the process of overweighting and underweighting issues within a manager’s benchmark index. Managers can add (or lose) value by both selection and allocation, but the likely magnitude of their success is conditioned by different things:

- Stock selection is most valuable in periods of high dispersion. Dispersion is a formal measure of the degree to which the best performers in an index are outperforming the worst. The higher a market’s dispersion, the higher the value of a manager’s stock selection skill.

- Allocation strategies — be they among countries or within segments of a single equity market — likewise are potentially most profitable when the dispersion among component returns is high.

What does this tell us about 2015’s likely results for active U.S. equity managers?

- Selection strategies face significant headwinds. Although U.S. dispersion will probably finish 2015 slightly ahead of 2014’s record low, it remains well below its long-term historical average.

- In 2015, the selection odds are against you. In most years, the S&P 500 Equal Weight Index, which tells us the return of the average stock, outperforms the S&P 500. When this happens, the implication is that most randomly-chosen portfolios would outperform the (cap-weighted) market average. But through December 9, 2015, equal weight is lagging cap weight — the S&P 500’s total return is 1.44%, versus -2.23% for the S&P 500 Equal Weight. The concentration of performance in larger-cap names exacerbates the challenges posed by low dispersion.

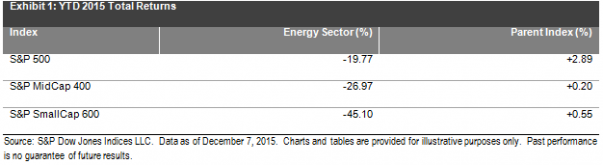

- Allocation strategies along the capitalization scale won’t help. In some years there are substantial differences in performance between, say, the S&P 500 and the S&P MidCap 400. In such times, managers benchmarked against the worse performer can benefit by tilting in the direction of the better performer. Through December 9, total returns were 1.44% for the S&P 500, -1.65% for the S&P MidCap 400, and -1.24% for the S&P SmallCap 600. So large-cap managers can’t hide by moving down the cap scale.

- On a more cheerful note, value managers have a better chance of outperforming than do growth managers. Through December 9, the S&P 500 Value Index had declined -3.53%, while the S&P 500 Growth Index had risen 6.04%. A value manager who makes an allocation toward growth may well benefit; not so the growth manager who goes in the opposite direction.

In 2014, 86% of large-cap managers lagged the S&P 500. 2015’s results may be somewhat better, but conditions for active managers should continue to be difficult.

The posts on this blog are opinions, not advice. Please read our Disclaimers.