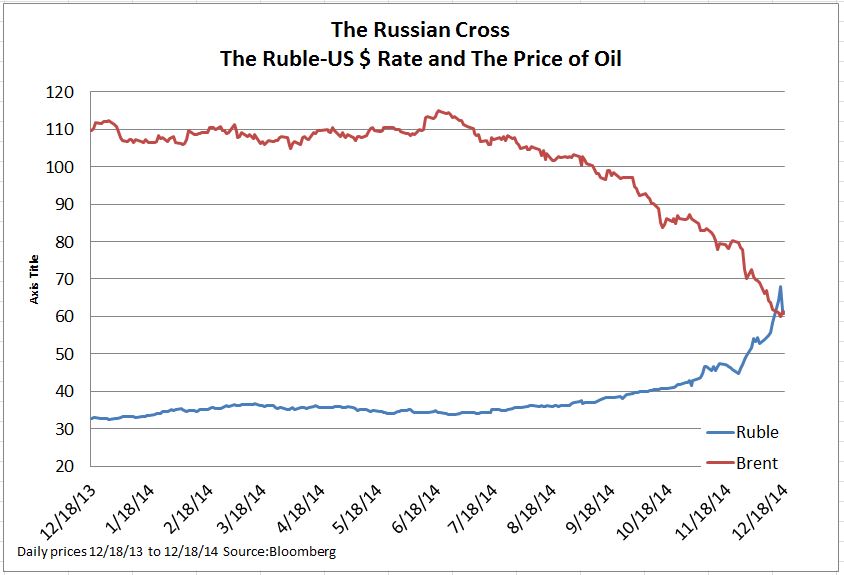

After sliding slowly down for most of the year, The Russian ruble dropped 20% in the last ten days. The slide began with the weakening Russian economy, sanctions imposed by the US and the EU last summer and falling oil prices. All these factors were present for many weeks and none explain the sharp move seen at the right hand end of the chart where the ruble/dollar rate jumps.

There were two immediate causes. The first, and less important, was a bill passed by Congress authorizing additional sanctions. While the President signed the bill, no instant action on more sanctions was expected. Second, at the end of last week Rosneft, the Russian oil company, offered a large ruble-denominated bond and the Russian central bank added the new issue to the list of securities it will accept as collateral for loans to local banks. Further, Russian banks were rumored to be the principal purchasers of the Rosneft bonds. Since Rosneft needs to refinance a large US dollar denominated loan from western banks, the markets assumed that, one way or another, the ruble proceeds from the bond issue or rubles from banks using the bonds as collateral with the central bank, would find their way into the foreign exchange markets and put downward pressure on the currency. These fears sparked the run on the ruble this week.

So far this has played out according to the usual process: gradual economic weakening, rising inflation, large hard currency debts and external pressures on trade (cheap oil) creates nervousness and worry. Then some seemingly minor event like the Rosneft bond issue raises the fear level and leads to a run.

The response also followed the usual script except that for the moment it seems to be successful. First, the Russian central bank raised interest rates by 6.5 percentage points to 17%. Then it followed two days later by intervening in the foreign exchange market and buying rubles. The amount bought isn’t known but Russian foreign exchange reserves, estimated at $200 to $400 billion, don’t appear to be exhausted. Since Wednesday afternoon New York time, the ruble has traded near 60 to the US dollar without any large dips. Brent crude oil, the principal global oil benchmark, is also showing some signs of stability. It rebounded from under $59 yesterday to above $60. For the moment the combination of relief from collapsing oil prices, the higher interest rates and the forex intervention may be stabilizing the ruble.

If the ruble can remain close to 60, the crisis will be over for the time being and the result will be far better than most past currency crises. However, no one should assume everything is resolved. Interest rates at 17% and imports 50% more expensive than a year ago (see chart) impose huge stresses on the economy. Add to that the sanctions and the reluctance of European and American businesses to invest in Russian projects, and another currency crisis cannot be ruled out.

Tim Edwards, in an earlier post on this blog, noted that the trailing PE ratio on the S&P Russian BMI is four times, a deliciously low number. It is either too early or too late: If the ruble holds near 60 or strengthens somewhat it may be too late to speculate in Russia; if the next move takes the Ruble close to 100, it is too early. Unfortunately there is no way to know.

The posts on this blog are opinions, not advice. Please read our Disclaimers.