Currencies and equities across various countries classified as “emerging” have come under increased scrutiny in the past few weeks, with more excitable commentators seeing signs of a crisis. Should broad-based index followers be worried? Perhaps not.

On the one hand, the tapering of U.S. quantitative easing has triggered flights of “hot money” from countries (like Turkey) that were deemed overly dependent on U.S. largesse, those subject to political instability (Brazil) and those with potentially systemic local risks (a real-estate bubble and financial liquidity crunch in China).

On the other hand, this is not 1997. Except for Turkey, the majority of emerging markets have not piled on foreign currency debt, and years of relative underperformance has given rise to attractive valuations compared to the developed world. Russia – for example* – is trading at a price-to-book ratio of 0.77 and a dividend yield of over 4%.

Considering all such “emerging” markets as equivalent is convenient, but misleading. Recent sell-offs have been highly discriminatory and selective. The dispersion among stocks and countries within emerging markets is greater than for developed market equities.

One might think it therefore matters which countries you invest in. That’s certainly true. But it also means that there is a strong diversification effect, captured by broad-based indices. If the risks within emerging markets are particular to each country, the effect of aggregating those risks is highly dilutive. If you hold a concentrated position in any one country, you might be wise to worry. If you hold a diversified position across multiple countries, maybe not so much.

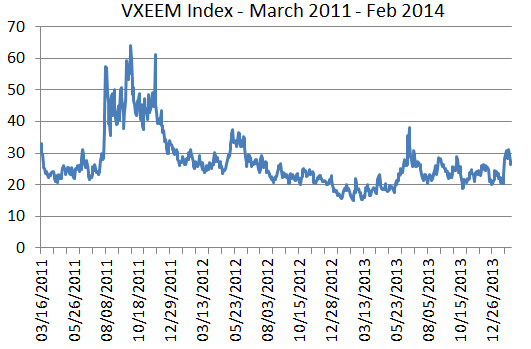

The volatility markets provide a current confirmation. Recently, the CBOE began publishing implied volatility levels for emerging markets. Like the VIX® (to which it is related) the VXEEM Index uses the prices of options to estimate how much volatility is predicted by the market – in this case for a broad-based emerging market ETF:

Source: CBOE, as of February 7th, 2014

Friday’s close of 26.5 is higher than current levels of the VIX; that should be no surprise – emerging markets are usually more volatile than developed markets. But it is fairly low on a historical basis: implied volatility is just below its three-year average. The options market is not overly worried about broad-based emerging market exposure: in an environment where the flows of flighty capital can prove decisive, this is useful information. The balance between fear and greed is not as tilted towards fear as the headlines might suggest.

_______________________________________________________

* Based on previous 12 month dividends and FY0 book value for S&P Russian Federation BMI. For purposes of comparison, the S&P United States BMI has a dividend yield of 1.8%, and price-to-book ratio of 2.61, as of 31st January, 2014.

The posts on this blog are opinions, not advice. Please read our Disclaimers.