High beta, value factors among the star performers, while low volatility lags amid heightened appetite for risk

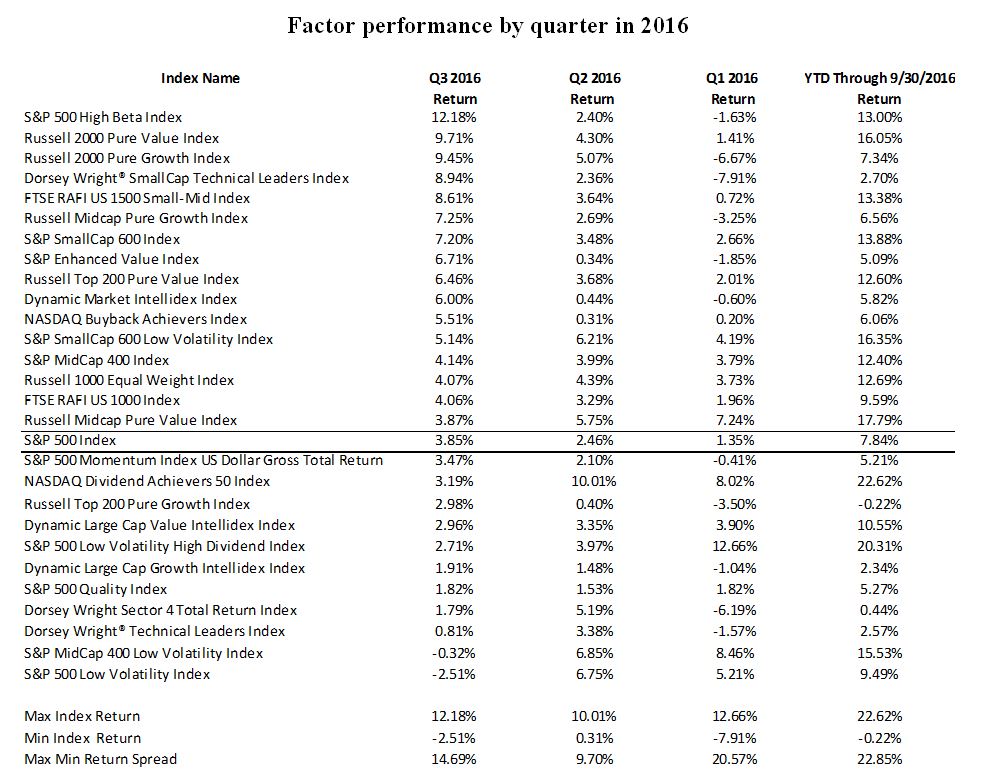

The high beta, value and size factors outperformed the broad-market S&P 500 Index by a sizeable margin during the third quarter, with the S&P 500 High Beta Index gaining 12.18% during the three-month period – outpacing all other factor indexes. The S&P 500 Index rose a healthy 3.85%, but 14 smart beta strategies and two smaller-cap indices – the S&P SmallCap 600 Index and S&P MidCap 400 Index – all outperformed the broader market.

There was a nearly 14.70% total return gap between the best-performing factor (high beta) and the poorest-performing factor (low volatility) during the third quarter. This dispersion was greater than the second quarter’s performance gap, but less than that of the first quarter, which saw significant market volatility. Year-to-date, there has been an even wider performance chasm from top to bottom, with the Nasdaq Dividend Achievers 50 Index up 22.6% and the Russell Top 200 Pure Growth Index down 0.22%. This dispersion underscores the differentiated return streams of factor-based strategies.

As you can see from the performance table above, some of the worst performers in the first quarter of the year turned out to be the best performers in the third quarter. Conversely, some of the best performers in the first quarter lagged in the third quarter. This is not unusual and again speaks to the diversification potential of factor-based strategies.

During the third quarter, the high beta factor benefited from heavy exposure to financials and energy stocks and limited exposure to utilities and consumer staples. Value-based strategies, represented by the Russell 2000 Pure Value Index and the Russell Top 200 Pure Value Index, also had significant exposure to financial and energy stocks, which boosted their returns.

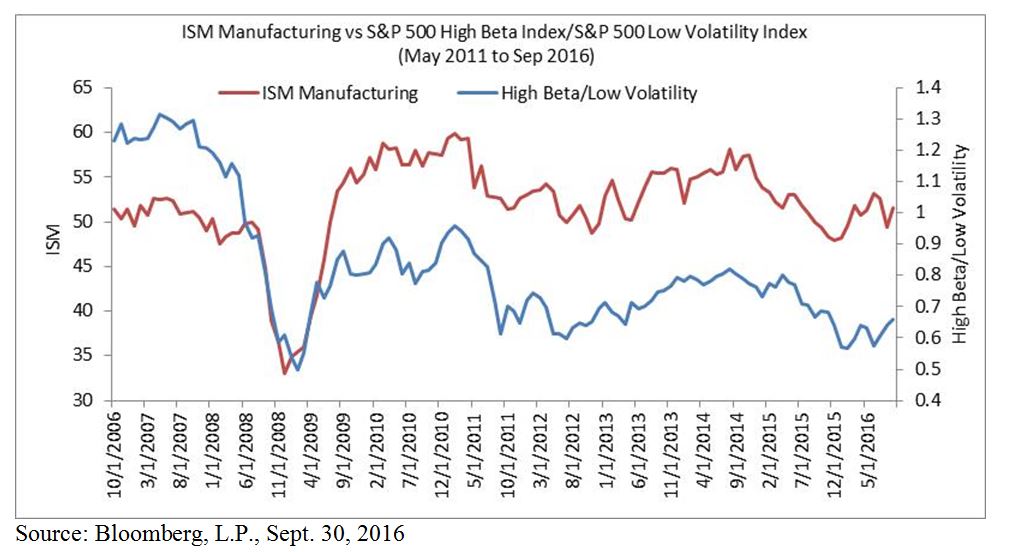

High beta and value strategies were also buoyed by an improved economic backdrop. The ISM Index, considered a barometer of US industrial activity, jumped from 52.7 in May to 56.1 in June – its highest level since October 2015. Moreover, non-farm payrolls rose by more by than 270,000 in both June and July.

Narrowing credit spreads hint at increased risk tolerance

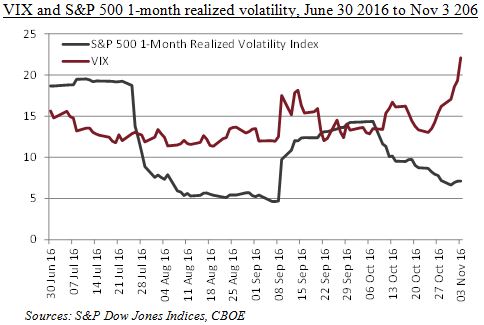

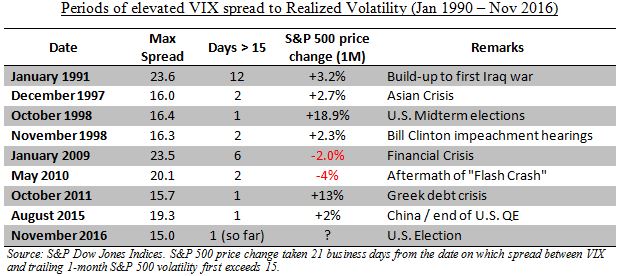

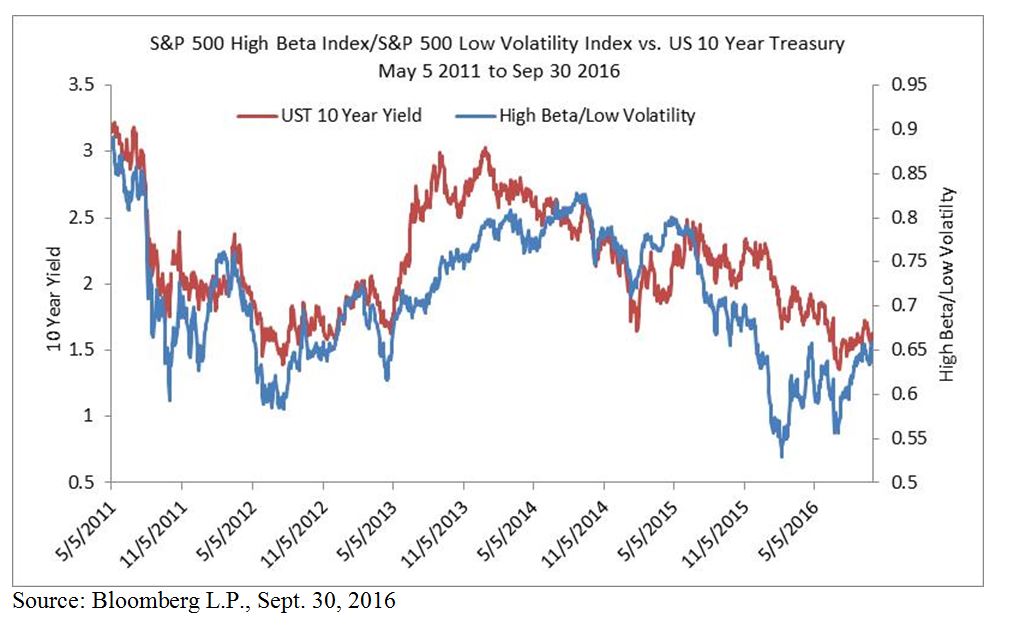

The improved outlook for economic growth led to a drop in high yield credit spreads during the quarter. The BarCap U.S. Corporate High Yield-to-Worst 10-year Treasury spread fell from 5.81 to 4.58, while the US 10-year Treasury yield bottomed out at 1.32% on July 6.1 Volatility, in the form of VIX, eased during the third quarter, falling from 15.63 to 13.20.1 Although the economy appeared less vibrant in September, a bias toward higher interest rates, a downward slant in high yield spreads and benign volatility were all favorable for investor risk taking.

Macro factors may not completely explain the favorable impact of energy exposure on value stocks and high beta based indices; stock selection was also important to energy sector returns. The 12-month Bloomberg Nymex Crude Oil Strip 12-Month Strip Futures Price Index finished the quarter at $50.46 – down marginally from Q2, but still above $50 for the second consecutive quarter. The rebound in oil prices coincided with OPEC’s decision to cut production in late September.1

Year-to-date, the Nasdaq Dividend Achievers Index has been the strongest performer – driven by energy and utilities and solid stock selection in financials, staples and industrials. The combination of dividend growth and yield was positive during the first half of 2016, and led to only slight underperformance in the third quarter.

What’s behind the performance of high beta stocks?

The strong quarterly performance of high beta stocks makes sense when you consider that high beta can outpace low volatility during periods of rising 10-year Treasury yields and stronger economic growth, when investor demand for defensive stocks may ease. The charts below depict this relationship.

The posts on this blog are opinions, not advice. Please read our Disclaimers.