Academic arguments may well have “proven” the theoretical advantages of passive investing. But theory is nothing without experiment; a comprehensive and impartial assessment of where and when active managers have delivered the promised “alpha” – or not – is a necessary and critical component of the debate.

Our S&P Index Versus Active scorecard and associated Persistence reports have – for twelve years – quantitatively examined the performance of active mutual funds in the U.S. versus their relevant benchmarks. Yet many questions regarding the global picture have so far been left unanswered, and the publication last week of the first SPIVA® scorecard dedicated to the performance of the European fund industry is accordingly of great interest.1

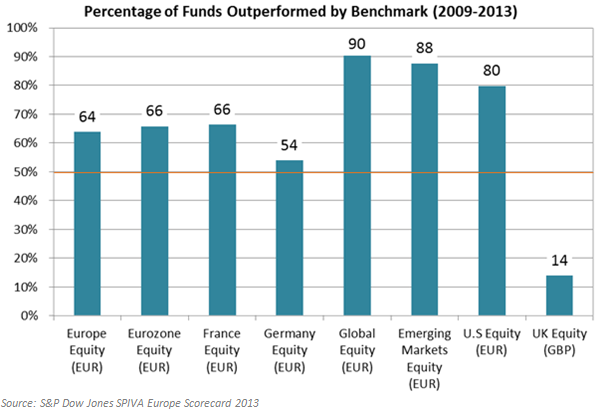

The overall conclusion for Europe is entirely familiar: broadly speaking, the majority of funds fail to beat their benchmarks. However, the conclusion is more nuanced at the more granular level of country and currency fund categories; and there are certainly a few surprises:

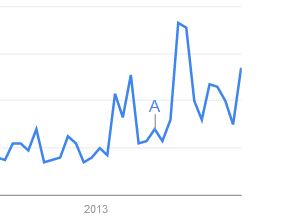

Throughout the report –which contains analysis for multiple further categories and time periods, as well as statistics on fund survival rates – interesting themes emerge above and beyond the headline numbers. Two conclusions of particular note are evidenced in the chart above:

- There are pockets (time periods and markets) where active managers as a group have conclusively delivered excess returns. In this case – nearly 7 out of 8 managers providing sterling-denominated exposure to U.K equities outperformed.

- Such pockets may be found in surprising places. Who amongst us would have anticipated such praise-worthy performance within the highly liquid, well-studied and notoriously efficient U.K. markets? It is particularly remarkable in contrast to the lamentable performance of emerging market equity managers, operating in the more volatile and idiosyncratic waters that supposedly mark the domains of active preeminence.

Of course, it is tempting to speculate as to what drivers might be accountable for the curious performance of active managers in the U.K. (indeed, we’re not immune to that temptation). However, what shouldn’t be lost is the critical observation that, at a fine enough degree of granularity and across enough time periods, one will almost certainly find places and times where active management delivered.

Moreover, such anomalies raise important further questions, which include:

- Can we (analytically or otherwise) identify periods or markets where active management is likely to have succeeded?

- If a benchmark is beaten with such apparent ease, is it right to query whether managers are being judged against the right benchmarks?

This is an area of ongoing research for us, and one that we consider to be deeply important. As such, we hope you join us in welcoming the Europe SPIVA report to an increasingly lively and global debate.

1) With the issuance of the most recent European report, there are now five regions covered including the U.S., Europe, Canada, India and Australia. The reports can be found here.

The posts on this blog are opinions, not advice. Please read our Disclaimers.